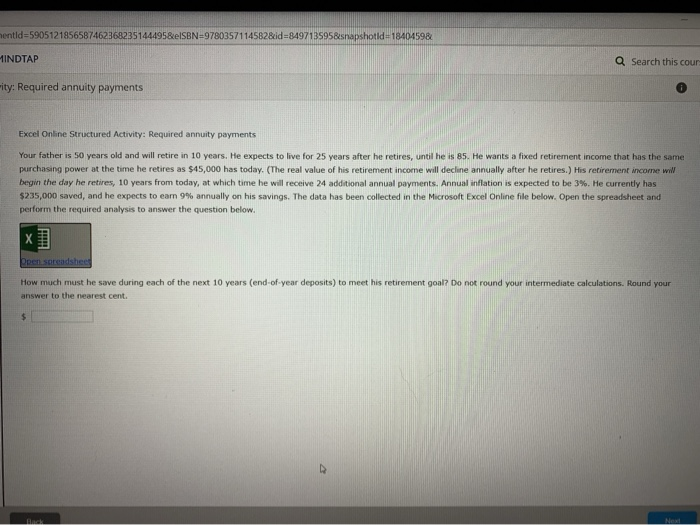

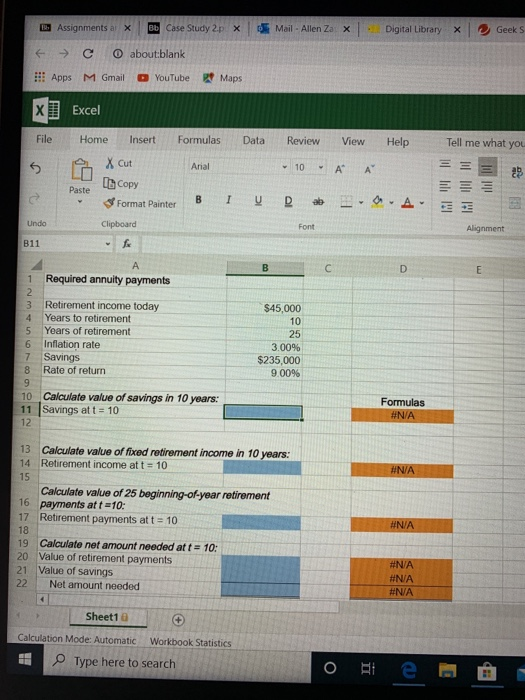

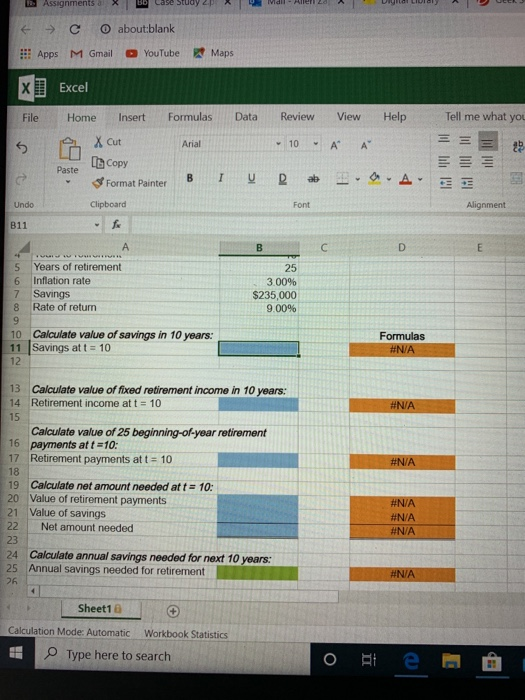

mentid=5905121856587462368235144495&ISBN=9780357114582&id=849713595&snapshotld 18404598 INDTAP Q Search this cour city: Required annuity payments Excel Online Structured Activity: Required annuity payments Your father is 50 years old and will retire in 10 years. He expects to live for 25 years after he retires, until he is 85. He wants a fixed retirement income that has the same purchasing power at the time he retires as $45,000 has today. (The real value of his retirement income will decline annually after he retires.) His retirement income will begin the day he retires, 10 years from today, at which time he will receive 24 additional annual payments. Annual inflation is expected to be 3%. He currently has $235,000 saved, and he expects to earn 9% annually on his savings. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. HH pensareadsheet How much must he save during each of the next 10 years (end-of-year deposits) to meet his retirement goal? Do not round your intermediate calculations. Round your answer to the nearest cent. $ ch NOR Assignments a X Bb Case Study 2.px Mail-Allen Zax Digital Library Geek S e about:blank Apps M Gmail O YouTube Maps X Excel File Home Insert Formulas Data Review View Help Tell me what you 5 X Cut Anal 10 A A 2 Paste 3 Format Painter lili B 1 U D ab A. Unda Clipboard Font Alignment B11 B D E Required annuity payments 2 3 Retirement income today 4 Years to retirement 5 Years of retirement 6 Inflation rate 7 Savings 8 Rate of return 9 10 Calculate value of savings in 10 years: 11 Savings at t = 10 12 $45,000 10 25 3.00% $235,000 9.00% Formulas #N/A #N/A #N/A 13 Calculate value of fixed retirement income in 10 years: 14 Retirement income at t = 10 15 Calculate value of 25 beginning-of-year retirement 16 payments at t=10: 17 Retirement payments at t = 10 18 19 Calculate net amount needed at t = 10: 20 Value of retirement payments 21 Value of savings 22 Net amount needed 4 Sheet1 #N/A #N/A #N/A Calculation Mode: Automatic Workbook Statistics Type here to search E Assignments Case Study - about:blank Apps M Gmail YouTube Maps X Excel File Home Insert Formulas Data Review View Help Tell me what you E X Cut 5 Arial 10 A A 25 ili ! [b Copy EE Paste B I Format Painter UR ab Undo Clipboard Font Alignment B11 B D 5 6 Years of retirement Inflation rate Savings Rate of return 25 3.00% $235,000 9.00% 8 9 10 Calculate value of savings in 10 years: 11 Savings at t = 10 12 Formulas #N/A #N/A #N/A 13 Calculate value of fixed retirement income in 10 years: 14 Retirement income att = 10 15 Calculate value of 25 beginning-of-year retirement 16 payments at t=10: 17 Retirement payments at t = 10 18 19 Calculate net amount needed at t = 10: 20 Value of retirement payments 21 Value of savings 22 Net amount needed 23 24 Calculate annual savings needed for next 10 years: 25 Annual savings needed for retirement 26 4 Sheet1 #N/A #N/A #N/A #N/A Calculation Mode: Automatic Workbook Statistics Type here to search mentid=5905121856587462368235144495&ISBN=9780357114582&id=849713595&snapshotld 18404598 INDTAP Q Search this cour city: Required annuity payments Excel Online Structured Activity: Required annuity payments Your father is 50 years old and will retire in 10 years. He expects to live for 25 years after he retires, until he is 85. He wants a fixed retirement income that has the same purchasing power at the time he retires as $45,000 has today. (The real value of his retirement income will decline annually after he retires.) His retirement income will begin the day he retires, 10 years from today, at which time he will receive 24 additional annual payments. Annual inflation is expected to be 3%. He currently has $235,000 saved, and he expects to earn 9% annually on his savings. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. HH pensareadsheet How much must he save during each of the next 10 years (end-of-year deposits) to meet his retirement goal? Do not round your intermediate calculations. Round your answer to the nearest cent. $ ch NOR Assignments a X Bb Case Study 2.px Mail-Allen Zax Digital Library Geek S e about:blank Apps M Gmail O YouTube Maps X Excel File Home Insert Formulas Data Review View Help Tell me what you 5 X Cut Anal 10 A A 2 Paste 3 Format Painter lili B 1 U D ab A. Unda Clipboard Font Alignment B11 B D E Required annuity payments 2 3 Retirement income today 4 Years to retirement 5 Years of retirement 6 Inflation rate 7 Savings 8 Rate of return 9 10 Calculate value of savings in 10 years: 11 Savings at t = 10 12 $45,000 10 25 3.00% $235,000 9.00% Formulas #N/A #N/A #N/A 13 Calculate value of fixed retirement income in 10 years: 14 Retirement income at t = 10 15 Calculate value of 25 beginning-of-year retirement 16 payments at t=10: 17 Retirement payments at t = 10 18 19 Calculate net amount needed at t = 10: 20 Value of retirement payments 21 Value of savings 22 Net amount needed 4 Sheet1 #N/A #N/A #N/A Calculation Mode: Automatic Workbook Statistics Type here to search E Assignments Case Study - about:blank Apps M Gmail YouTube Maps X Excel File Home Insert Formulas Data Review View Help Tell me what you E X Cut 5 Arial 10 A A 25 ili ! [b Copy EE Paste B I Format Painter UR ab Undo Clipboard Font Alignment B11 B D 5 6 Years of retirement Inflation rate Savings Rate of return 25 3.00% $235,000 9.00% 8 9 10 Calculate value of savings in 10 years: 11 Savings at t = 10 12 Formulas #N/A #N/A #N/A 13 Calculate value of fixed retirement income in 10 years: 14 Retirement income att = 10 15 Calculate value of 25 beginning-of-year retirement 16 payments at t=10: 17 Retirement payments at t = 10 18 19 Calculate net amount needed at t = 10: 20 Value of retirement payments 21 Value of savings 22 Net amount needed 23 24 Calculate annual savings needed for next 10 years: 25 Annual savings needed for retirement 26 4 Sheet1 #N/A #N/A #N/A #N/A Calculation Mode: Automatic Workbook Statistics Type here to search