Question

Mentone Global Corporation (MGC) is attempting to evaluate two alternative capital structures X and Y. The following table shows the two structures along with relevant

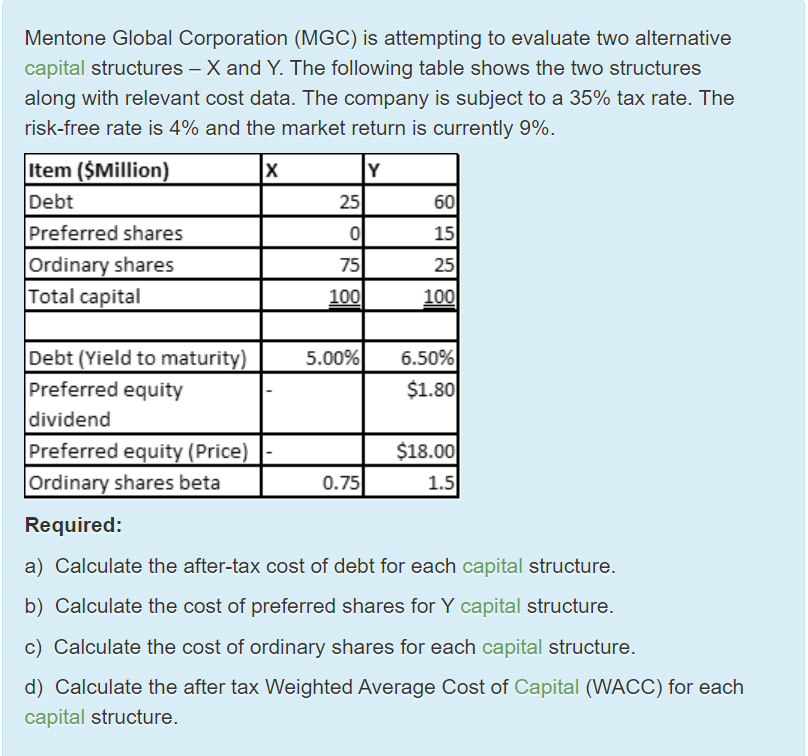

Mentone Global Corporation (MGC) is attempting to evaluate two alternative capital structures X and Y. The following table shows the two structures along with relevant cost data. The company is subject to a 35% tax rate. The risk-free rate is 4% and the market return is currently 9%.

Mentone Global Corporation (MGC) is attempting to evaluate two alternative capital structures X and Y. The following table shows the two structures along with relevant cost data. The company is subject to a 35% tax rate. The risk-free rate is 4% and the market return is currently 9%.

Required: a) Calculate the after-tax cost of debt for each capital structure.

b) Calculate the cost of preferred shares for Y capital structure.

c) Calculate the cost of ordinary shares for each capital structure.

d) Calculate the after tax Weighted Average Cost of Capital (WACC) for each capital structure.

Mentone Global Corporation (MGC) is attempting to evaluate two alternative capital structures X and Y. The following table shows the two structures along with relevant cost data. The company is subject to a 35% tax rate. The risk-free rate is 4% and the market return is currently 9%. Item ($Million) X Y Debt 25 60 Preferred shares 0 15 Ordinary shares 75 25 Total capital 1000 100 5.00% 6.50% $1.800 Debt (Yield to maturity) Preferred equity dividend Preferred equity (Price) Ordinary shares beta Required: $18.001 1.5 0.75 a) Calculate the after-tax cost of debt for each capital structure. b) Calculate the cost of preferred shares for Y capital structure. c) Calculate the cost of ordinary shares for each capital structure. d) Calculate the after tax Weighted Average Cost of Capital (WACC) for each capital structureStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started