Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Menu eecda284-34f7-42f9-b7d... X + Create All tools Edit Convert Sign John Bratton works for a medium sized company trading on the Toronto Stock Exchange

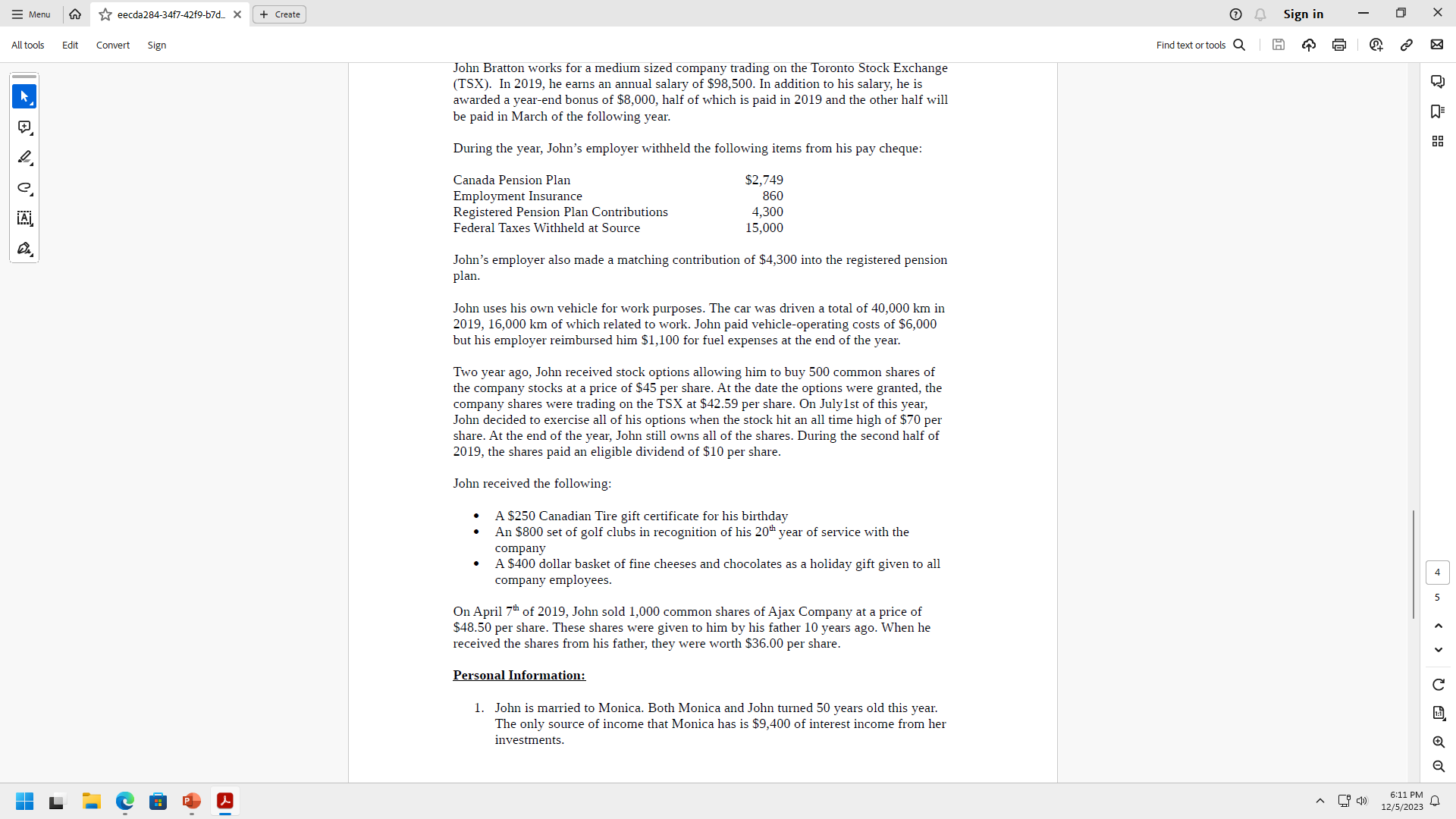

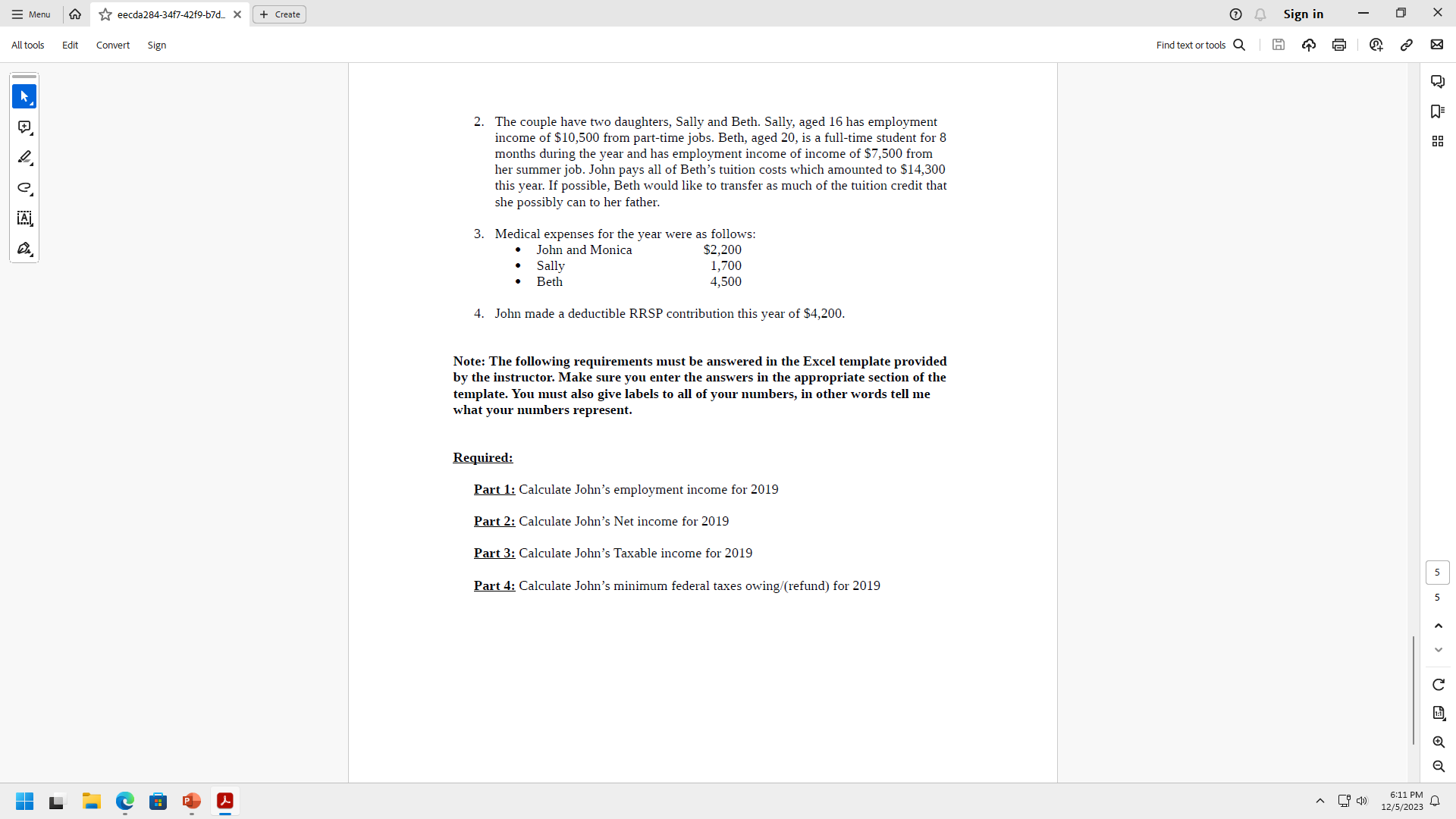

Menu eecda284-34f7-42f9-b7d... X + Create All tools Edit Convert Sign John Bratton works for a medium sized company trading on the Toronto Stock Exchange (TSX). In 2019, he earns an annual salary of $98,500. In addition to his salary, he is awarded a year-end bonus of $8,000, half of which is paid in 2019 and the other half will be paid in March of the following year. During the year, John's employer withheld the following items from his pay cheque: Canada Pension Plan Employment Insurance Registered Pension Plan Contributions Federal Taxes Withheld at Source $2,749 860 4,300 15,000 John's employer also made a matching contribution of $4,300 into the registered pension plan. John uses his own vehicle for work purposes. The car was driven a total of 40,000 km in 2019, 16,000 km of which related to work. John paid vehicle-operating costs of $6,000 but his employer reimbursed him $1,100 for fuel expenses at the end of the year. Two year ago, John received stock options allowing him to buy 500 common shares of the company stocks at a price of $45 per share. At the date the options were granted, the company shares were trading on the TSX at $42.59 per share. On July1st of this year, John decided to exercise all of his options when the stock hit an all time high of $70 per share. At the end of the year, John still owns all of the shares. During the second half of 2019, the shares paid an eligible dividend of $10 per share. John received the following: A $250 Canadian Tire gift certificate for his birthday An $800 set of golf clubs in recognition of his 20th year of service with the company A $400 dollar basket of fine cheeses and chocolates as a holiday gift given to all company employees. On April 7th of 2019, John sold 1,000 common shares of Ajax Company at a price of $48.50 per share. These shares were given to him by his father 10 years ago. When he received the shares from his father, they were worth $36.00 per share. Personal Information: 1. John is married to Monica. Both Monica and John turned 50 years old this year. The only source of income that Monica has is $9,400 of interest income from her investments. Find text or tools Q Sign in H af i C+ 6:11 PM 12/5/2023 XX Q 88 U o D Menu eecda284-34f7-42f9-b7d... X + Create All tools Edit Convert Sign 2. The couple have two daughters, Sally and Beth. Sally, aged 16 has employment income of $10,500 from part-time jobs. Beth, aged 20, is a full-time student for 8 months during the year and has employment income of income of $7,500 from her summer job. John pays all of Beth's tuition costs which amounted to $14,300 this year. If possible, Beth would like to transfer as much of the tuition credit that she possibly can to her father. 3. Medical expenses for the year were as follows: John and Monica $2,200 1,700 4,500 Sally Beth 4. John made a deductible RRSP contribution this year of $4,200. Note: The following requirements must be answered in the Excel template provided by the instructor. Make sure you enter the answers in the appropriate section of the template. You must also give labels to all of your numbers, in other words tell me what your numbers represent. Required: Part 1: Calculate John's employment income for 2019 Part 2: Calculate John's Net income for 2019 Part 3: Calculate John's Taxable income for 2019 Part 4: Calculate John's minimum federal taxes owing/(refund) for 2019 Find text or tools Q Sign in H af i C+ 6:11 PM 12/5/2023 XX Q 88 O D

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the calculations for Johns income tax scenario based on the information provided Part 1 Cal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started