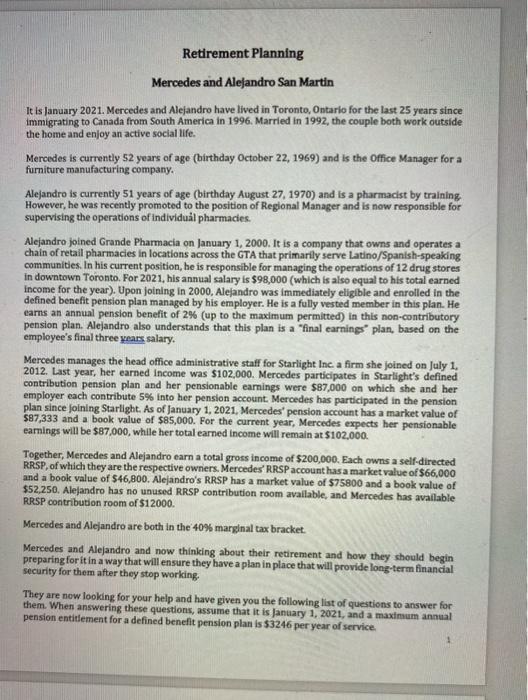

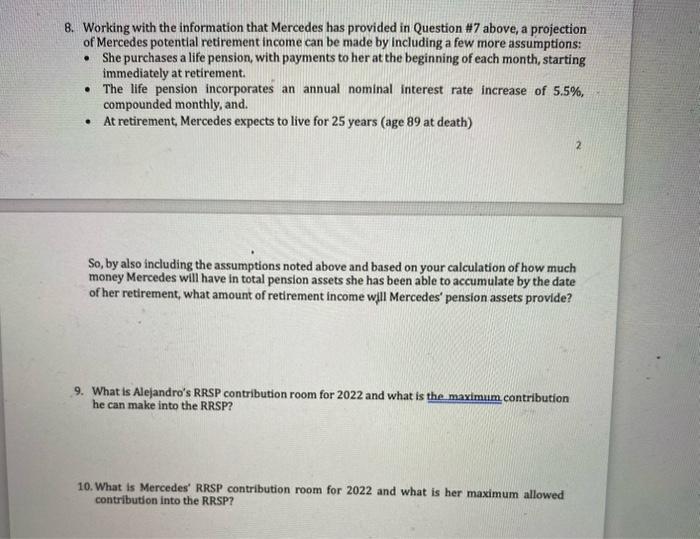

Mercedes and Alejandro San Martin It is January 2021. Mercedes and Alejandro have lived in Toronto, Ontario for the last 25 years since immigrating to Canada from South America in 1996. Married in 1992, the couple both work outside the home and enjoy an active social life. Mercedes is currently 52 years of age (birthday October 22, 1969) and is the Office Manager for a furniture manufacturing company. Alejandro is currently 51 years of age (birthday August 27, 1970) and is a pharmacist by training However, he was recently promoted to the position of Regional Manager and is now responsible for supervising the operations of individuall pharmades. Aejandro joined Grande Pharmacia on January 1, 2000. It is a company that owns and operates a chain of retail pharmacies in locations across the GTA that primarly serve Latino/Spanish-speaking communities. In his current position, he is responsible for managing the operations of 12 drug stores in downtown Toronto. For 2021, his annual salary is $98,000 (which is also equal to his total earned income for the year). Upon joining in 2000. Alejandro was immediately eligible and enrolled in the defined benefit pension plan managed by his employer. He is a fully vested member in this plan. He earns an annual pension benefit of 2% (up to the maximum permitted) in this non-contributory pension plan. Alejandro also understands that this plan is a "final earnings" plan, based on the employee's final three years salary. Mercedes manages the head office administrative staff for Starlight Inc. a firm she joined on July 1 , 2012. Last year, her earned income was $102,000. Mercedes participates in Starlight's defined contribution pension plan and her pensionable earnings were $87,000 on which she and her employer each contribute 5% into her pension account. Mercedes has participated in the pension plan since joining Starlight. As of January 1, 2021, Mercedes' pension account has a market value of $87,333 and a book value of $85,000. For the current year, Mercedes expects her pensionable eamings will be $87,000, while her total earned income will remain at $102,000. Together, Mercedes and Alejandro earn a total gross income of $200,000. Each owns a self-directed RRSP, of which they are the respective owners. Mercedes' RRSP account has a market value of $66,000 and a book value of $46,800. Alejandro's RRSP has a market value of $75800 and a book value of \$52,250, Alejandro has no unused RRSP contribution room avallable, and Mercedes has available RRSP contribution room of $12000. Mercedes and Alejandro are both in the 40% marglnal tax bracket. Mercedes and Alejandro and now thinking about their retirement and how they should begin preparing for it in a way that will ensure they have a plan in place that will provide long-term financial security for them after they stop working. They are now looking for your help and have given you the following list of questions to answer for them. When answering these questions, assume that it is January 1,2021 , and a maximum annual pension entitlement for a defined benefit pension plan is $3246 per year of service. 8. Working with the information that Mercedes has provided in Question #7 above, a projection of Mercedes potential retirement income can be made by including a few more assumptions: - She purchases a life pension, with payments to her at the beginning of each month, starting immediately at retirement. - The life pension incorporates an annual nominal interest rate increase of 5.5%, compounded monthly, and. - At retirement, Mercedes expects to live for 25 years (age 89 at death) So, by also including the assumptions noted above and based on your calculation of how much money Mercedes will have in total pension assets she has been able to accumulate by the date of her retirement, what amount of retirement income will Mercedes' pension assets provide? 9. What is Alejandro's RRSP contribution room for 2022 and what is the maximum contribution he can make into the RRSP? 10. What is Mercedes' RRSP contribution room for 2022 and what is her maximum allowed contribution into the RRSP? Mercedes and Alejandro San Martin It is January 2021. Mercedes and Alejandro have lived in Toronto, Ontario for the last 25 years since immigrating to Canada from South America in 1996. Married in 1992, the couple both work outside the home and enjoy an active social life. Mercedes is currently 52 years of age (birthday October 22, 1969) and is the Office Manager for a furniture manufacturing company. Alejandro is currently 51 years of age (birthday August 27, 1970) and is a pharmacist by training However, he was recently promoted to the position of Regional Manager and is now responsible for supervising the operations of individuall pharmades. Aejandro joined Grande Pharmacia on January 1, 2000. It is a company that owns and operates a chain of retail pharmacies in locations across the GTA that primarly serve Latino/Spanish-speaking communities. In his current position, he is responsible for managing the operations of 12 drug stores in downtown Toronto. For 2021, his annual salary is $98,000 (which is also equal to his total earned income for the year). Upon joining in 2000. Alejandro was immediately eligible and enrolled in the defined benefit pension plan managed by his employer. He is a fully vested member in this plan. He earns an annual pension benefit of 2% (up to the maximum permitted) in this non-contributory pension plan. Alejandro also understands that this plan is a "final earnings" plan, based on the employee's final three years salary. Mercedes manages the head office administrative staff for Starlight Inc. a firm she joined on July 1 , 2012. Last year, her earned income was $102,000. Mercedes participates in Starlight's defined contribution pension plan and her pensionable earnings were $87,000 on which she and her employer each contribute 5% into her pension account. Mercedes has participated in the pension plan since joining Starlight. As of January 1, 2021, Mercedes' pension account has a market value of $87,333 and a book value of $85,000. For the current year, Mercedes expects her pensionable eamings will be $87,000, while her total earned income will remain at $102,000. Together, Mercedes and Alejandro earn a total gross income of $200,000. Each owns a self-directed RRSP, of which they are the respective owners. Mercedes' RRSP account has a market value of $66,000 and a book value of $46,800. Alejandro's RRSP has a market value of $75800 and a book value of \$52,250, Alejandro has no unused RRSP contribution room avallable, and Mercedes has available RRSP contribution room of $12000. Mercedes and Alejandro are both in the 40% marglnal tax bracket. Mercedes and Alejandro and now thinking about their retirement and how they should begin preparing for it in a way that will ensure they have a plan in place that will provide long-term financial security for them after they stop working. They are now looking for your help and have given you the following list of questions to answer for them. When answering these questions, assume that it is January 1,2021 , and a maximum annual pension entitlement for a defined benefit pension plan is $3246 per year of service. 8. Working with the information that Mercedes has provided in Question #7 above, a projection of Mercedes potential retirement income can be made by including a few more assumptions: - She purchases a life pension, with payments to her at the beginning of each month, starting immediately at retirement. - The life pension incorporates an annual nominal interest rate increase of 5.5%, compounded monthly, and. - At retirement, Mercedes expects to live for 25 years (age 89 at death) So, by also including the assumptions noted above and based on your calculation of how much money Mercedes will have in total pension assets she has been able to accumulate by the date of her retirement, what amount of retirement income will Mercedes' pension assets provide? 9. What is Alejandro's RRSP contribution room for 2022 and what is the maximum contribution he can make into the RRSP? 10. What is Mercedes' RRSP contribution room for 2022 and what is her maximum allowed contribution into the RRSP