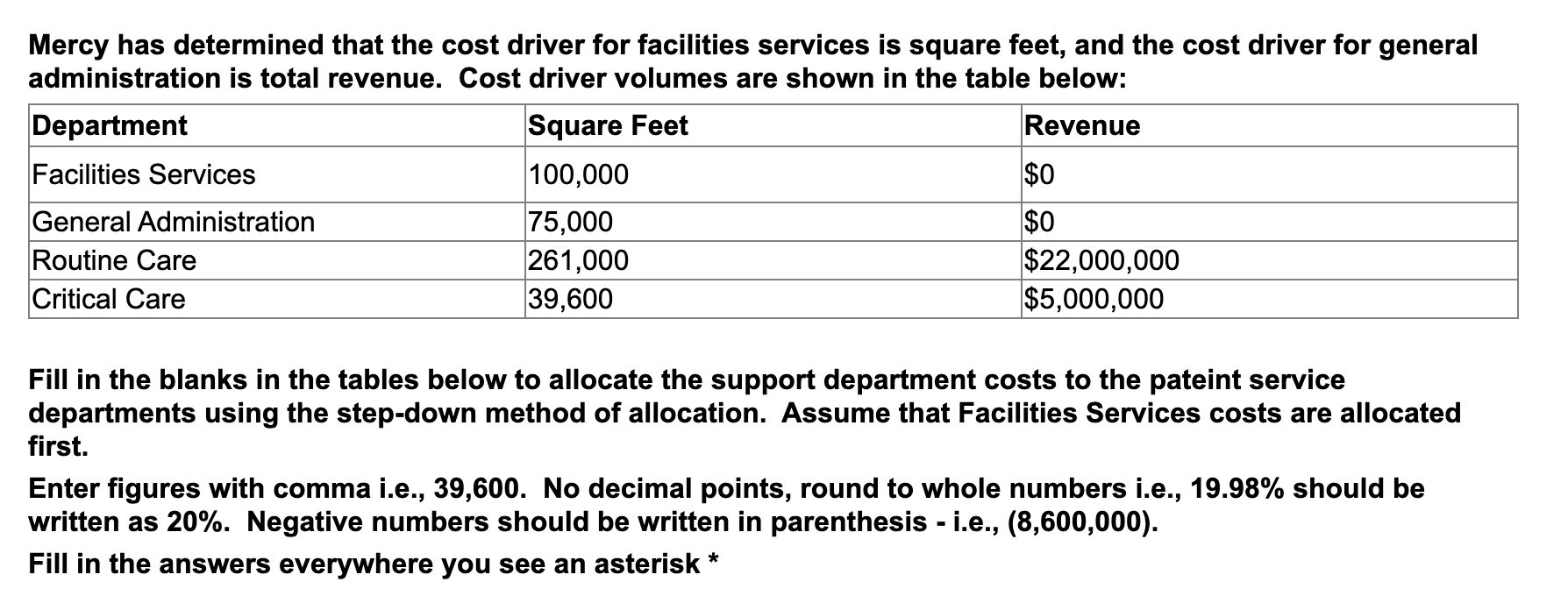

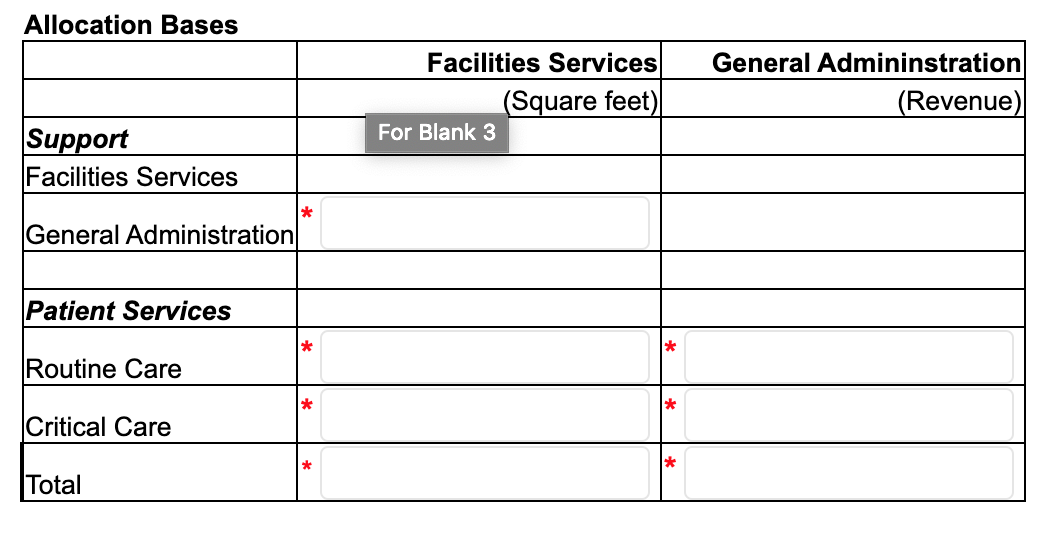

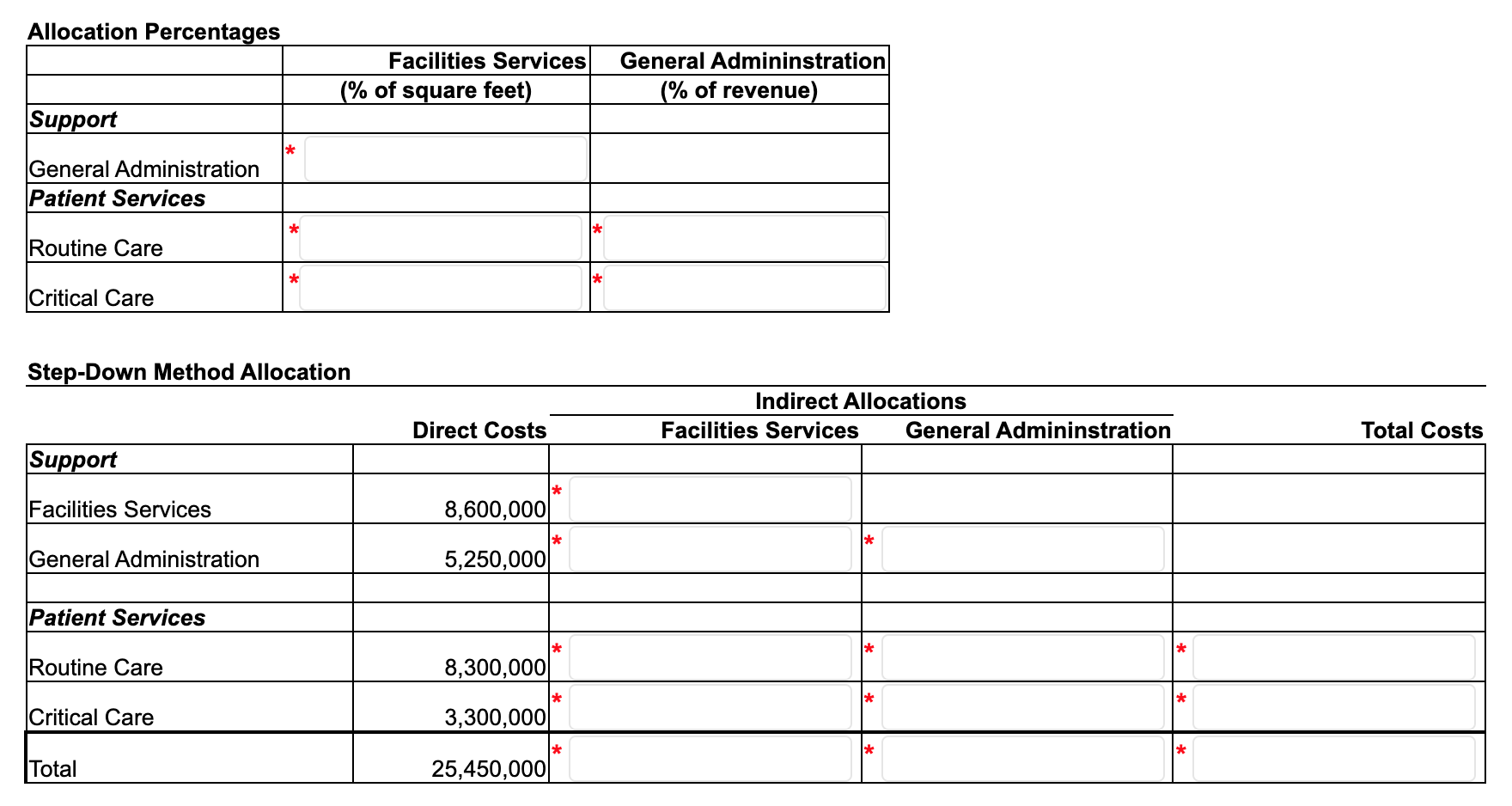

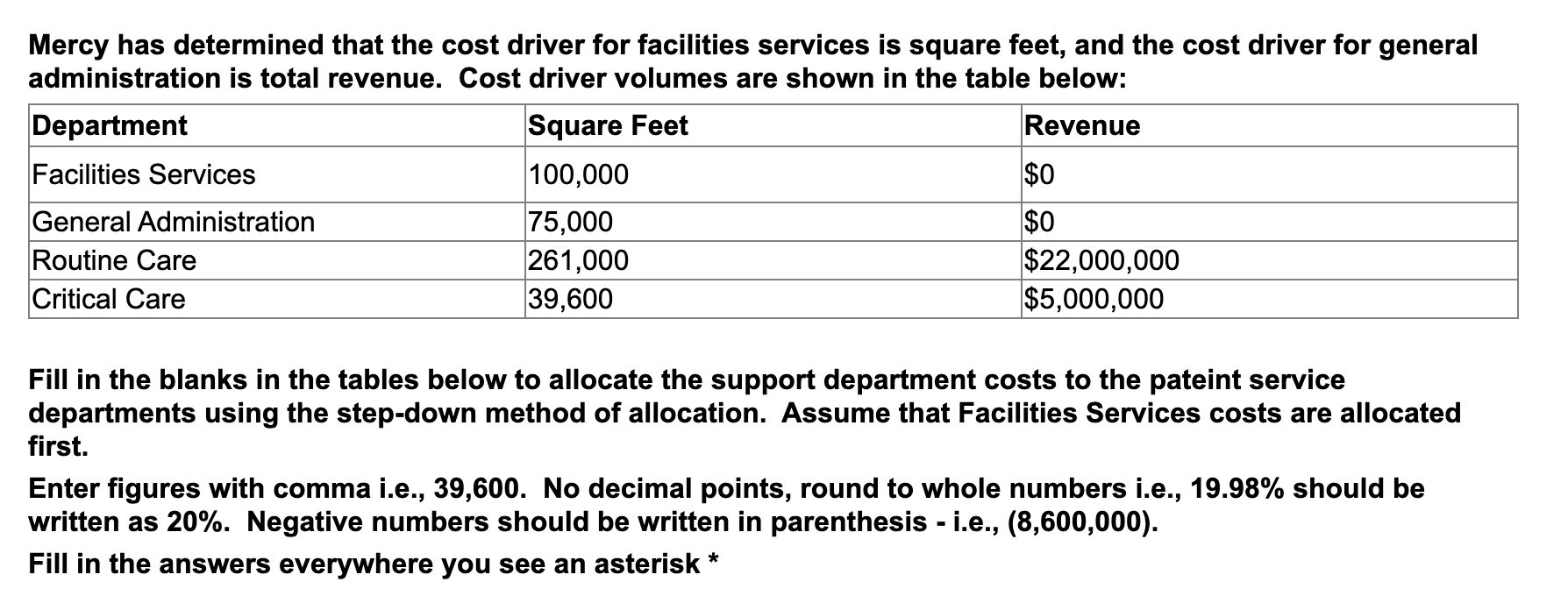

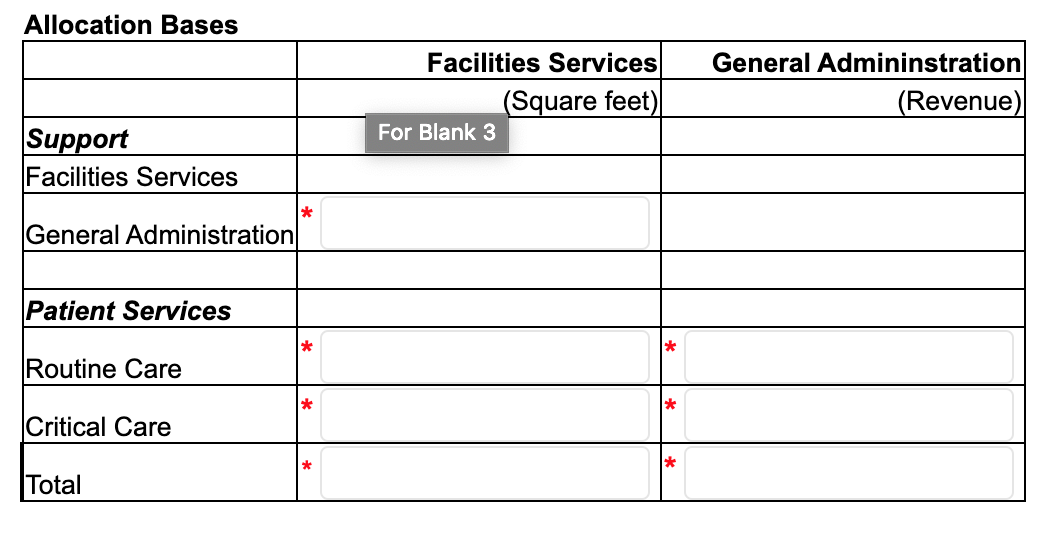

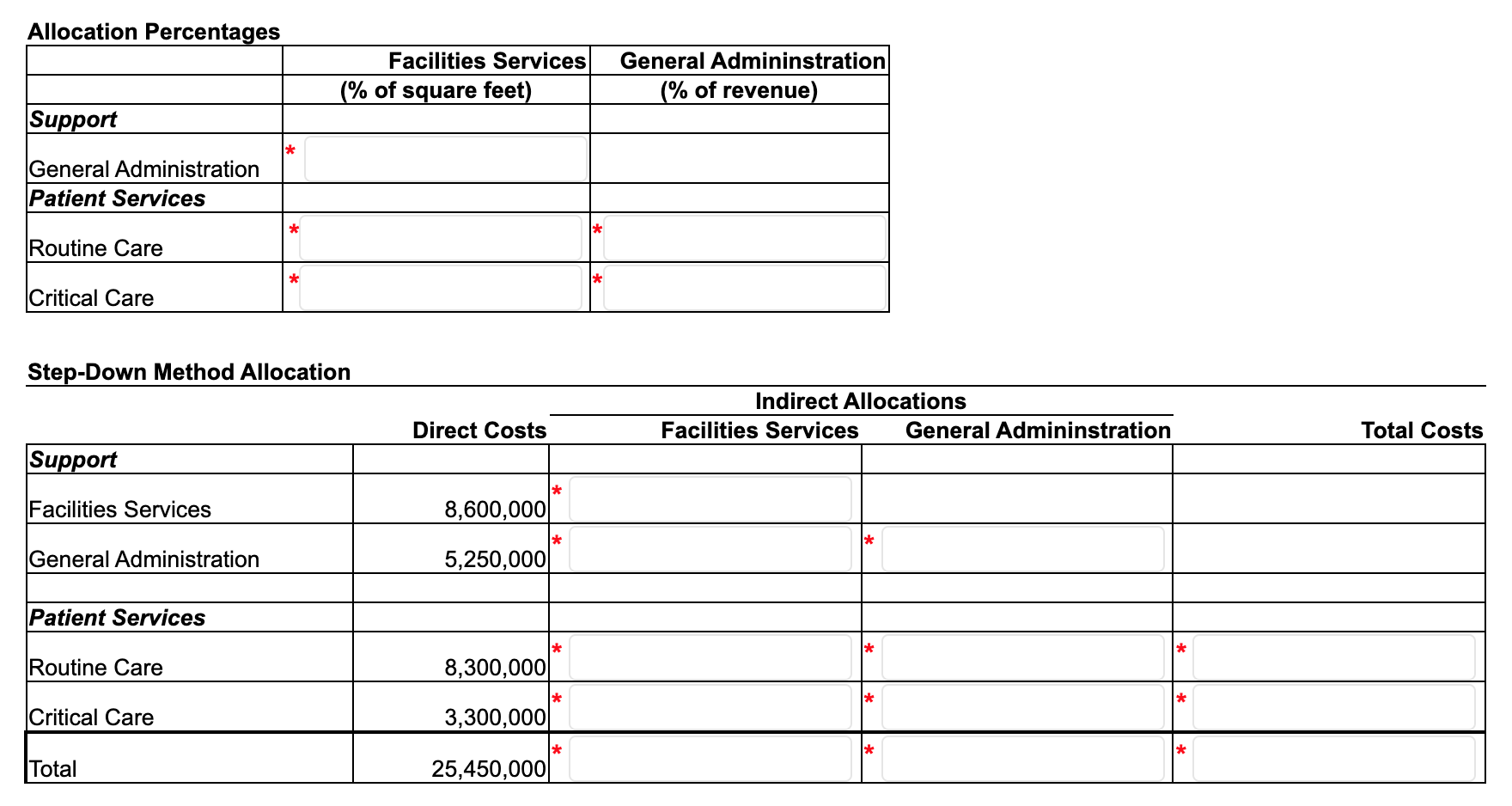

Mercy has determined that the cost driver for facilities services is square feet, and the cost driver for general administration is total revenue. Cost driver volumes are shown in the table below: Department Square Feet Revenue Facilities Services 100,000 $0 General Administration 75,000 $0 Routine Care 261,000 $22,000,000 Critical Care 39,600 $5,000,000 Fill in the blanks in the tables below to allocate the support department costs to the pateint service departments using the step-down method of allocation. Assume that Facilities Services costs are allocated first. Enter figures with comma i.e., 39,600. No decimal points, round to whole numbers i.e., 19.98% should be written as 20%. Negative numbers should be written in parenthesis - i.e., (8,600,000). Fill in the answers everywhere you see an asterisk * Allocation Bases Facilities Services (Square feet) For Blank 3 General Admininstration (Revenue) Support Facilities Services * General Administration Patient Services * Routine Care * * Critical Care Total Allocation Percentages Facilities Services (% of square feet) General Admininstration (% of revenue) Support * General Administration Patient Services * * Routine Care * * Critical Care Step-Down Method Allocation Indirect Allocations Facilities Services General Admininstration Direct Costs Total Costs Support * Facilities Services 8,600,000 * General Administration 5,250,000 Patient Services * * * Routine Care 8,300,000 * * * Critical Care 3,300,000 * * * Total 25,450,000 Mercy has determined that the cost driver for facilities services is square feet, and the cost driver for general administration is total revenue. Cost driver volumes are shown in the table below: Department Square Feet Revenue Facilities Services 100,000 $0 General Administration 75,000 $0 Routine Care 261,000 $22,000,000 Critical Care 39,600 $5,000,000 Fill in the blanks in the tables below to allocate the support department costs to the pateint service departments using the step-down method of allocation. Assume that Facilities Services costs are allocated first. Enter figures with comma i.e., 39,600. No decimal points, round to whole numbers i.e., 19.98% should be written as 20%. Negative numbers should be written in parenthesis - i.e., (8,600,000). Fill in the answers everywhere you see an asterisk * Allocation Bases Facilities Services (Square feet) For Blank 3 General Admininstration (Revenue) Support Facilities Services * General Administration Patient Services * Routine Care * * Critical Care Total Allocation Percentages Facilities Services (% of square feet) General Admininstration (% of revenue) Support * General Administration Patient Services * * Routine Care * * Critical Care Step-Down Method Allocation Indirect Allocations Facilities Services General Admininstration Direct Costs Total Costs Support * Facilities Services 8,600,000 * General Administration 5,250,000 Patient Services * * * Routine Care 8,300,000 * * * Critical Care 3,300,000 * * * Total 25,450,000