Question

Meredith Furman is reviewing the quarterly performance report shown below that she just received from her accountant, Josh Moore. Actual Static Budget Variance Sales volume

Meredith Furman is reviewing the quarterly performance report shown below that she just received from her accountant, Josh Moore.

| Actual | Static Budget | Variance | ||

| Sales volume | 80,000 | 82,000 | (2,000) | U |

| Sales revenue | $1,196,800 | $1,230,000 | $(33,200) | U |

| Direct materials | 324,690 | 328,000 | (3,310) | F |

| Direct labor | 359,560 | 369,000 | (9,440) | F |

| Variable MOH | 95,200 | 94,300 | 900 | U |

| Fixed MOH | 130,000 | 134,460 | (4,460) | F |

| Cost of goods sold | 909,450 | 925,760 | (16,310) | F |

| Gross margin | 287,350 | 304,240 | (16,890) | U |

| Sales salaries expense | 130,000 | 136,500 | (6,500) | F |

| Bad debt expense | 23,936 | 24,600 | (664) | F |

| Advertising expense | 3,000 | 3,000 | ||

| Management salaries expense | 30,000 | 30,000 | ||

| Depreciation expense | 30,000 | 30,000 | ||

| Miscellaneous expense | 1,300 | 1,500 | (200) | F |

| Total selling & administrative expenses | 218,236 | 225,600 | (7,364) | F |

| Operating income | $ 69,114 | $ 78,640 | $ (9,526) | U |

She is a bit confused how most of the expenses are showing a favorable variance for the quarter. After some new employees burned several of batches of caramel popcorn during their training, she had expected the direct materials variance to be unfavorable. And given that these new employees were slow in picking up their processing speeds she had expected the direct labor variance to be unfavorable as well. To make things even more confusing, she doesnt understand how all the favorable expense variables led to the unfavorable operating income variance. She has asked Josh to help her better understand the report and the companys performance.

After doing additional investigation, Josh uncovered the data below for the quarter that he believes will help him develop more useful information to share with Meredith. The standard cost card for a bag of caramel corn is as follows:

| Standard Quantity | Standard Price | Product Cost | |

| Direct materials | 10 ounces | $ 0.40 | $ 4.00 |

| Direct labor | 0.25 DLH | $18.00 | 4.50 |

| Variable overhead | 0.25 DLH | $ 4.60 | 1.15 |

| Fixed overhead | 0.25 DLH | $ 5.40 | 1.35 |

| Total cost | $11.00 |

The company purchased 830,000 ounces of popcorn during the month at a total cost of $327,850. It used 822,000 ounces in producing the 80,000 bags of caramel corn.

Given the low raw materials inventory the company maintains to ensure product freshness, the company had to make a rush order of popcorn from a new vendor after new workers burned several batches of caramel corn while completing their training and first several days on the job. The new vendor, who was anxious to get Paladin Popcorns future business, offered a substantial discount for this first order.

The company worked 20,200 direct labor hours and had a total quarterly direct labor payroll of $359,560.

The company spent $130,000 on fixed overhead costs during the quarter.

ROUND YOUR ANSWERS TO WHOLE DOLLARS. DO NOT INCLUDE A $ WITH YOUR ANSWER. DO NOT INCLUDE ANY INDICATION OF A NEGATIVE NUMBER IN YOUR ANSWER (F/U WILL ACCOMPLISH THAT).

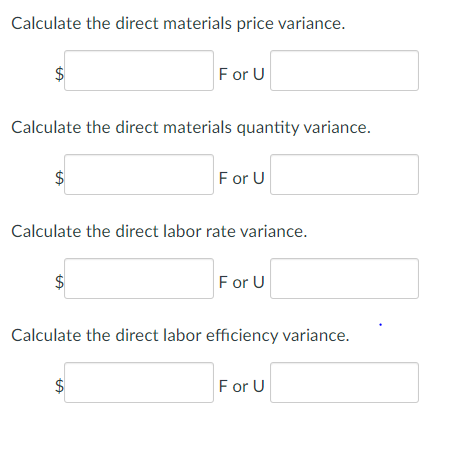

Calculate the direct materials price variance.

Please help!

Calculate the direct materials price variance. $ For U Calculate the direct materials quantity variance. $ For U Calculate the direct labor rate variance. $ For U Calculate the direct labor efficiency variance. $ For UStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started