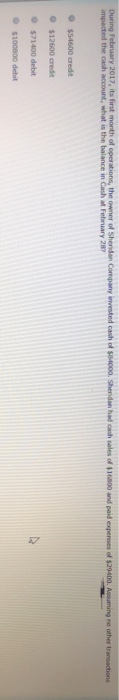

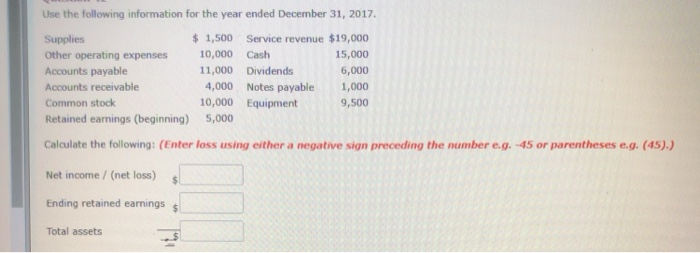

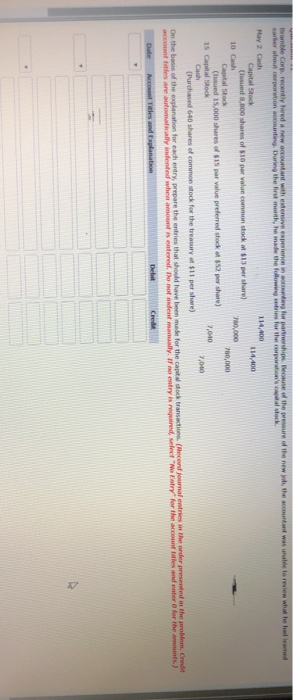

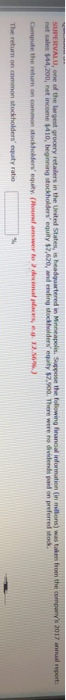

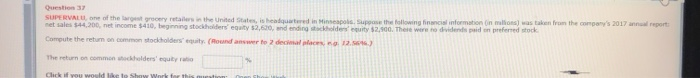

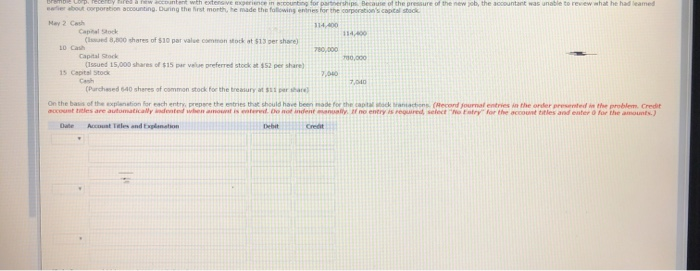

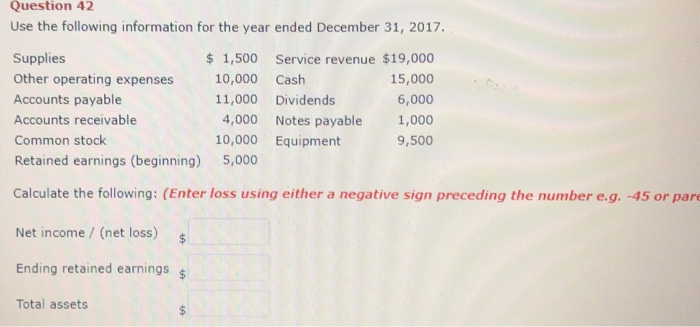

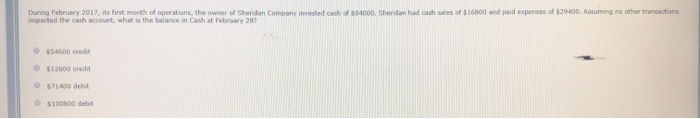

During February 2017, its first month of operations, the owner of Sheridan Company invested cash of $84000, Sherdan had cash sales of $16800 and paid expenses of $29400. Ausuming no other transactions impacted the cash account, what is the balance in Cash at February 287 O$54600 credit $12600 credt $71400 debit $100800 debit Use the following information for the year ended December 31, 2017. 1,500 Service revenue $19,000 Supplies Other operating expenses Accounts payable 10,000 Cash 15,000 11,000 Dividends 6,000 Notes payable 10,000 Equipment 4,000 Accounts receivable 1,000 9,500 Common stock Retained earnings (beginning) 5,000 Calculate the following: (Enter loss using either a negative sign preceding the number e.g.-45 or parentheses e.g. (45).) Net income / (net loss) Ending retained earnings Total assets Bramble Cop recently hired a new acountant with extensive experience in acounting for partnerships Because of the pressure of the new job, the accountant was unable to review what he had learned earker about corporation accounting. During the first month, he made the followig nris for the corpration's capital stock May 2 Cash 114,400 Capital Stock (Issued 8,800 shares of $10 par value common stock at $13 per share) 114,400 10 Cash 780,000 Capital 5tock 780,000 (Issued 15,000 shares of $15 par value predeerred stock at $52 per share) 15 Capital Stock 2,040 Cash 7,040 (Purchased 640 shares of common stock for the treasury at $11 per share) On the basis of the explanation for each entry, prepare the entries that should have been made for the capital stock transactions (Recond journal entries in the order presented in the problem, Credit account titles are automatically indented when amount is entered. Do not indent manaally. If no entry is required, select "No Eatry" or the account titles and enter 0 for the amounts.) Date Accont Titles and Explanation Debit Credit U RRIE SUPERVALU, one of the largest grocery retalers in the United States, is headquartered in Minneapolis. Suppose the following finanoal indormation (in millons) was taken from the compeny's 2017 annual report: net sales $44,200, net income $410, beginning stockholders' equity $2,620, and ending stockholders eqaty $7,900 There were no dividends paid on preferred stock Compute the return on common stockholders' equity. (Round answer fo 2 decimal places, eg. 12.569) The return on common stockholders equty rabo Question 37 eof the largest grocery retailers in the United States, is headquartered in Minseacols. Supgose the following financial nformation (in mlions) was taken from the company's 2017 annual report SUPERVALU net sales $44,200, net income $410, begnning stockholders eqaity $2,620, and ending tckholdes equity $2,900. There wore ho dividends pid on prefered stock Compute the retum on common stockholders equity. (Round answer to 2 decimal places, . 12.s The return on common stockholders' equity raio Cick if you ould lke to Show Work for this muestion: ier ab opshion accountagDue n extersivE Experience in 8counting for partnershipS Becaue of the pressure of the new ob, the acountant was unable te revewwhat he had leamed irst morth, he made the following entnes for the corporstion's capital stodk May 2 Cash 114,400 Capital Stocks (lsmaed 8.800 shares of $10 par value common sMock at $13 per share) 14400 10 Cash 780,000 Caoital Stock 0.000 (Issued 15.000 shares of $15 par velue preferred stock at $52 per share) 15 Capital Stock 7,040 Canh 7,040 (Parchased 640 sheres of common stock for the treasury at $11 per share On the basis of the explanation for each prepere the entries that should have been made for the capital stock branactons (Recond journal entries in the order presented in the problem. Credit account teles are automatically indeated when amowat is eatered Do not indent anually if no entry is required, select "No Entry" for the account tles aad enter for the amounts.) Date Accoust Ttles and Explanation Cret Debit Question 42 Use the following information for the year ended December 31, 2017. $ 1,500 Service revenue $19,000 Supplies Other operating expenses 10,000 Cash 15,000 Accounts payable 11,000 Dividends 6,000 Accounts receivable 4,000 Notes payable 1,000 10,000 Equipment Common stock 9,500 Retained earnings (beginning) 5,000 Calculate the following: (Enter loss using either a negative sign preceding the number e.g. -45 or pare Net income / (net loss) Ending retained earnings Total assets During February 2017, its first month of operations, the owner of Sheridan Company invested cash of s34000. Shendan had cash sales of $16800 and paid expenses of $29400. Assuming no other transactions impacted the cash account, what is the balance in Cash at February 287 $54600 ored $12600 credt $71400 debit $100800 debit