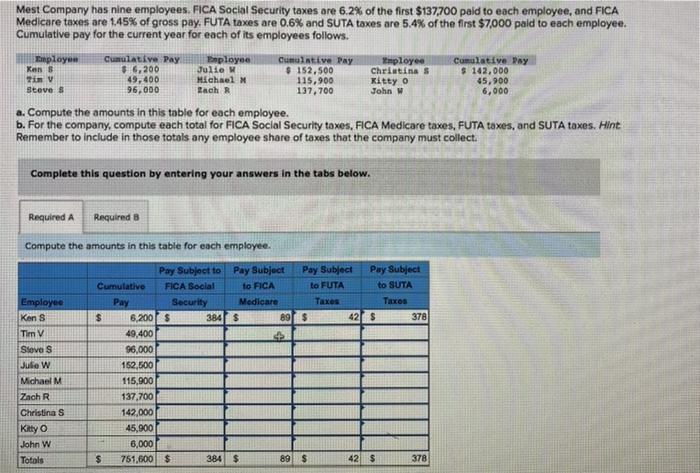

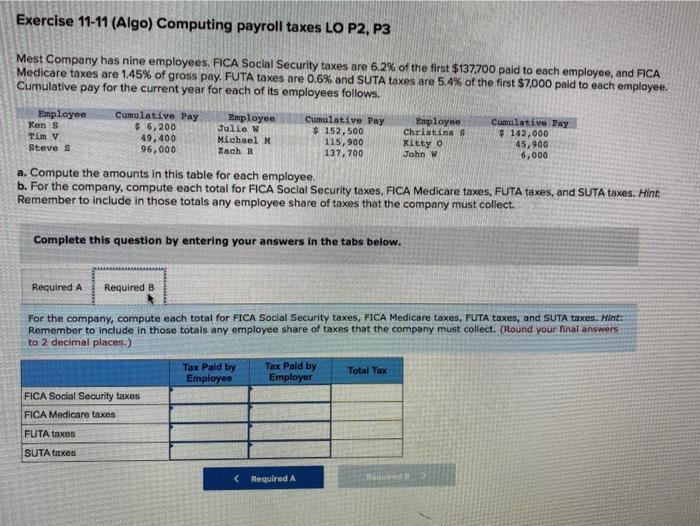

Mest Company has nine employees. FICA Social Security taxes are 6.2% of the first $137,700 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay, FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to each employee. Cumulative pay for the current year for each of its employees follows. Employee Cumulative Pay Employee Cumulative Pay Imployee Cumulative Ray Ken 8 56,200 Julie W $ 152,500 Christina S S 142.000 in V 49.400 Michael M 115,900 Kitty o 45,900 Steve S 96,000 Lach R 137,700 John W 6,000 a. Compute the amounts in this table for each employee. b. For the company, compute each total for FICA Social Security toxes, FICA Medicare taxes, FUTA taxes, and SUTA taxes. Hint Remember to include in those totals any employee share of taxes that the company must collect Complete this question by entering your answers in the tabs below. Required A Required B Compute the amounts in this table for each employee. Employee Kons Tim V Steve S Julie W Michael M Zach R Christina S Kitty John W Totals Pay Subject to Pay Subject Pay Subject Pay Subject Cumulative FICA Social to FICA to FUTA to SUTA Pay Security Medicare Taxes Taxos $ 6.2005 3845 89 $ 42 s 378 49,400 96,000 152,500 115,900 137,700 142,000 45.900 6,000 $ 751,600 $ 384 $ 89 $ 42 $ 378 Exercise 11-11 (Algo) Computing payroll taxes LO P2, P3 Mest Company has nine employees. FICA Social Security taxes are 6.2% of the first $137,700 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay, FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 pald to each employee. Cumulative pay for the current year for each of its employees follows. Employee Cumulative Pay Employee Cumulative Pay Employee Cumulative Tay Ken 9 $ 6,200 Julie W $ 152,500 Christina s $142.000 Tim v 49,400 Michael M 115,900 kitty o 45,900 Steve S 96,000 Zach R 137,700 John W 6,000 a. Compute the amounts in this table for each employee b. For the company, compute each total for FICA Social Security taxes, FICA Medicare taxes, FUTA taxes, and SUTA taxes. Hint Remember to include in those totals any employee share of taxes that the company must collect. Complete this question by entering your answers in the tabs below. Required A Required B For the company, compute each total for FICA Social Security taxes, FICA Medicare taxes, FUTA taxes, and SUTA taxes. Hint: Remember to include in those totals any employee share of taxes that the company must collect. (Round your final answers to 2 decimal places.) Tax Pald by Tax Paid by Total Tax Employee Employer FICA Social Security taxes FICA Medicare taxes FUTA taxes SUTA taxes