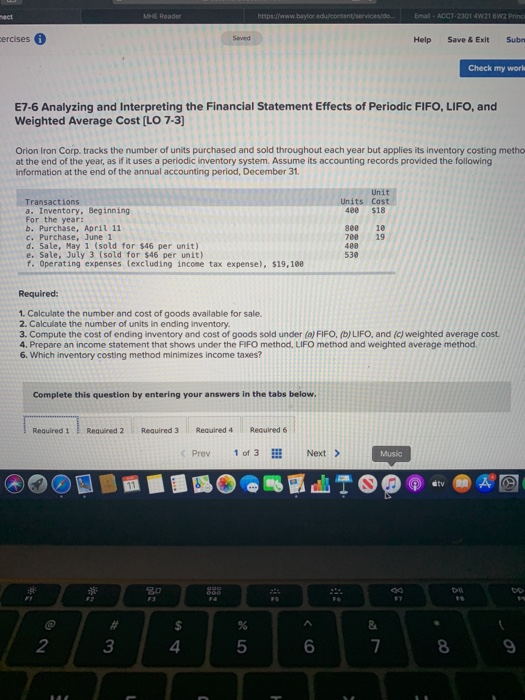

met MHE Reader Mttps://www.baylor edu/content/service/do Email - ACCT-2301 421 6W2 Princi ercises Saved Help Save & Exit Sub Check my world E7-6 Analyzing and Interpreting the Financial Statement Effects of Periodic FIFO, LIFO, and Weighted Average Cost [LO 7-3] Orion Iron Corp. tracks the number of units purchased and sold throughout each year but applies its inventory costing metho at the end of the year, as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31. Unit Units Cost 400 $18 Transactions a. Inventory, Beginning For the year: b. Purchase, April 11 c. Purchase, June 1 d. Sale, May 1 (sold for $46 per unit) e. Sale, July 3 (sold for $46 per unit) f. Operating expenses (excluding income tax expense), $19, 108 le 19 800 700 400 530 Required: 1. Calculate the number and cost of goods available for sale. 2. Calculate the number of units in ending inventory. 3. Compute the cost of ending inventory and cost of goods sold under (a) FIFO. (b) LIFO, and (c) weighted average cost. 4. Prepare an income statement that shows under the FIFO method, LIFO method and weighted average method. 6. Which inventory costing method minimizes income taxes? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 6 Prev 1 of 3 Next > Music tv A 80 90 FS A & 2 $ 4 3 5 6 7 8 9 met MHE Reader Mttps://www.baylor edu/content/service/do Email - ACCT-2301 421 6W2 Princi ercises Saved Help Save & Exit Sub Check my world E7-6 Analyzing and Interpreting the Financial Statement Effects of Periodic FIFO, LIFO, and Weighted Average Cost [LO 7-3] Orion Iron Corp. tracks the number of units purchased and sold throughout each year but applies its inventory costing metho at the end of the year, as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31. Unit Units Cost 400 $18 Transactions a. Inventory, Beginning For the year: b. Purchase, April 11 c. Purchase, June 1 d. Sale, May 1 (sold for $46 per unit) e. Sale, July 3 (sold for $46 per unit) f. Operating expenses (excluding income tax expense), $19, 108 le 19 800 700 400 530 Required: 1. Calculate the number and cost of goods available for sale. 2. Calculate the number of units in ending inventory. 3. Compute the cost of ending inventory and cost of goods sold under (a) FIFO. (b) LIFO, and (c) weighted average cost. 4. Prepare an income statement that shows under the FIFO method, LIFO method and weighted average method. 6. Which inventory costing method minimizes income taxes? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 6 Prev 1 of 3 Next > Music tv A 80 90 FS A & 2 $ 4 3 5 6 7 8 9