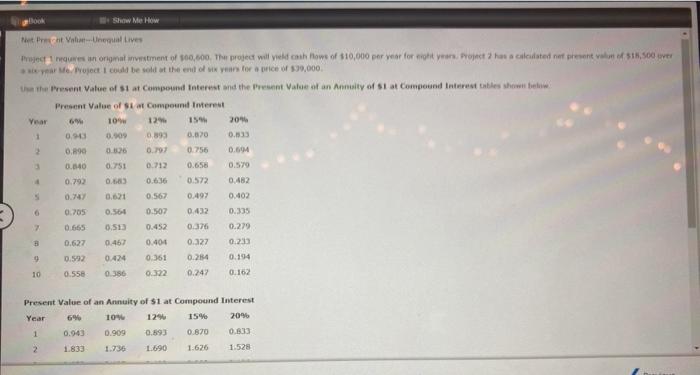

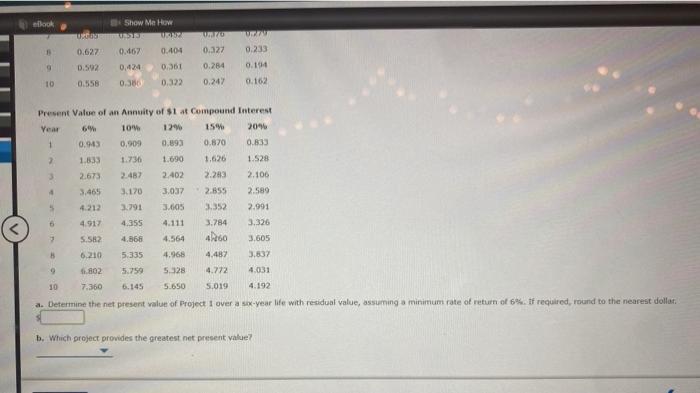

Met Print Une Lives Project I reques un organisment of $60,000. The project will ich rows of $10,000 per year for eight years to credited not present om of $15.500 ver are Project I could be sold at the end of years for a price of $99.000 U the Present Value of 1 at Compound interest and the Present Value of an Annuity of Stat Compound interest the show Present Value of Staf Compound Interest Year 6 104 12 19 205 0.943 0.009 0.89 0.020 0.833 2 0.89 0.006 0.79 0.756 0.64 0.640 0.751 0.712 0.658 0.579 0.792 0.600 0.636 0.572 0.482 0.72 0.61 0.567 0.497 0.402 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 3 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0:361 0.254 0.194 10 0.558 0.356 0322 0.24% 0.162 Present Value of an Annuity of S1 at Compound Interest Year 6 109 12 15% 20 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 Show Me How urg 0.627 0.327 0.233 0.167 0.424 9 0.404 0.361 0.322 0.592 0.556 0.14 0.284 0.247 10 0.300 0.162 Present Value of an Annuity of $1 at Compound Interest Year 104 129 15 2016 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 2.673 2.482 2.402 2.283 2.100 3,465 3.170 3.037 2.855 2.589 4.212 2.791 3.605 3.352 2.991 6 4.917 4.355 3.784 3.326 2 5.582 4.868 4.564 460 3.605 6,210 5.335 4.965 4.487 3,837 9 802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. Determine the net present value of Project 1 over a six-year life with residual value, assuming a minimum rate of return of 6%. If required, round to the nearest dollar b. Which project provides the greatest net present value? Met Print Une Lives Project I reques un organisment of $60,000. The project will ich rows of $10,000 per year for eight years to credited not present om of $15.500 ver are Project I could be sold at the end of years for a price of $99.000 U the Present Value of 1 at Compound interest and the Present Value of an Annuity of Stat Compound interest the show Present Value of Staf Compound Interest Year 6 104 12 19 205 0.943 0.009 0.89 0.020 0.833 2 0.89 0.006 0.79 0.756 0.64 0.640 0.751 0.712 0.658 0.579 0.792 0.600 0.636 0.572 0.482 0.72 0.61 0.567 0.497 0.402 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 3 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0:361 0.254 0.194 10 0.558 0.356 0322 0.24% 0.162 Present Value of an Annuity of S1 at Compound Interest Year 6 109 12 15% 20 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 Show Me How urg 0.627 0.327 0.233 0.167 0.424 9 0.404 0.361 0.322 0.592 0.556 0.14 0.284 0.247 10 0.300 0.162 Present Value of an Annuity of $1 at Compound Interest Year 104 129 15 2016 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 2.673 2.482 2.402 2.283 2.100 3,465 3.170 3.037 2.855 2.589 4.212 2.791 3.605 3.352 2.991 6 4.917 4.355 3.784 3.326 2 5.582 4.868 4.564 460 3.605 6,210 5.335 4.965 4.487 3,837 9 802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. Determine the net present value of Project 1 over a six-year life with residual value, assuming a minimum rate of return of 6%. If required, round to the nearest dollar b. Which project provides the greatest net present value