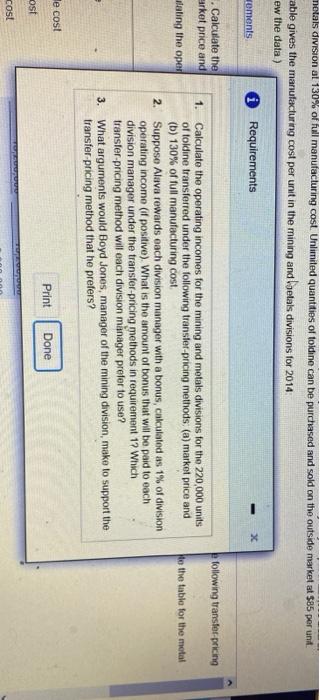

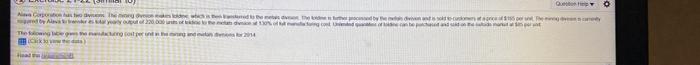

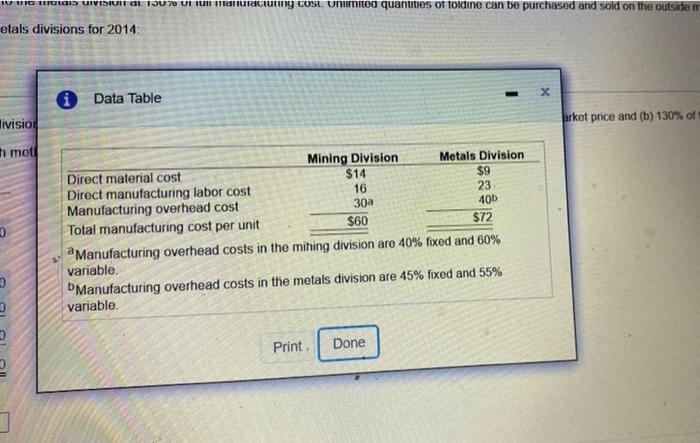

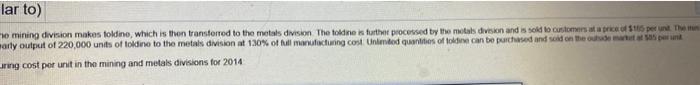

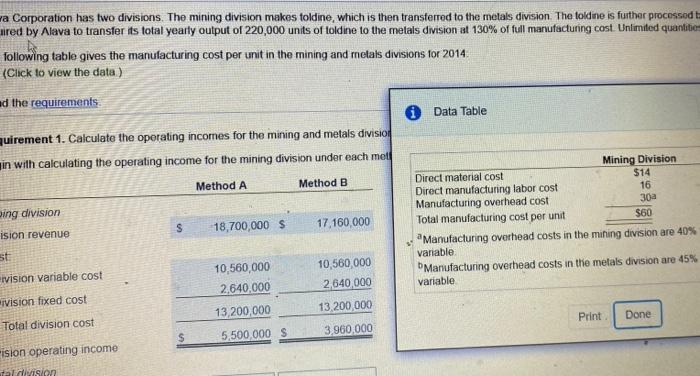

metals division at 130% of full manufacturing cost. Unlimited quantities of toldine can be purchased and sold on the outside market at $85 per unit. able gives the manufacturing cost per unit in the mining and loetals divisions for 2014 ew the data) - A Requirements sements x . Calculate the arket price and following transfer pricing dating the oper to the table for the metal 1. Calculate the operating incomes for the mining and motals divisions for the 220,000 units of foldine transferred under the following transfer pricing methods, (a) market price and (b) 130% of full manufacturing cost 2. Suppose Aluva rewards each division manager with a bonus, calculated as 1% of division operating income (if positive) What is the amount of bonus that will be paid to each division manager under the transfer pricing methods in requirement 1? Which transfer pricing method will each division manager prefer to use? 3. What arguments would Boyd Jones, manager of the mining division, make to support the transfer pricing method that he prefers? le cost Print Done ost cost Q O Com th condid The open HR WIG HO VIVIRIL TOU70 VIRUM COSE Unumited quantities of toldine can be purchased and sold on the outside etals divisions for 2014 Data Table Hivisior arket price and (b) 130% of h mot 0 Mining Division Metals Division Direct material cost $14 $9 Direct manufacturing labor cost 16 23 Manufacturing overhead cost 30a 400 Total manufacturing cost per unit $60 $72 a Manufacturing overhead costs in the mining division are 40% fixed and 60% variable. Manufacturing overhead costs in the metals division are 45% fixed and 55% variable. 3 Print Done lar to) o mining division makes foldino, which is then transferred to the metal division The toldne is further processed by the metas division and is sold to customers are of 116 perut The arly output of 220,000 units of one to the metals division at 130% of ill manufacturing cost United quantities of old can be purchased and sold on the order as per und uring cost per unit in the mining and metals divisions for 2014 s sold to customers at a price of $165 per unit. The mining division is currently ed and sold on the outside market at $85 per unit. arket price and (b) 130% of full manufacturing cost. wa Corporation has two divisions. The mining division makes toldine, which is then transferred to the metals division. The foldine is further processo uired by Alava to transfer its total yearly output of 220,000 units of toldine to the metals division at 130% of full manufacturing cost. Unlimited quantities following table gives the manufacturing cost per unit in the mining and metals divisions for 2014 (Click to view the data) ad the requirements Data Table quirement 1. Calculate the operating incomes for the mining and metals division in with calculating the operating income for the mining division under each met Method A Method B ing division 17,160,000 S 18,700,000 $ Mining Division Direct material cost $14 Direct manufacturing labor cost 16 Manufacturing overhead cost 30a Total manufacturing cost per unit $60 Manufacturing overhead costs in the mining division are 40% variable Manufacturing overhead costs in the metals division are 45% variable ision revenue st ivision variable cost 10,560,000 2.640.000 10,560,000 2640 000 ivision fixed cost 13,200,000 13,200,000 Print Done Total division cost 3,960,000 s 5,500,000 $ ision operating income Mision