Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Metha was employed by Safaricom _Plc at a basic salary of ksh 18 million per annum. The service level agreements sated that Metha was

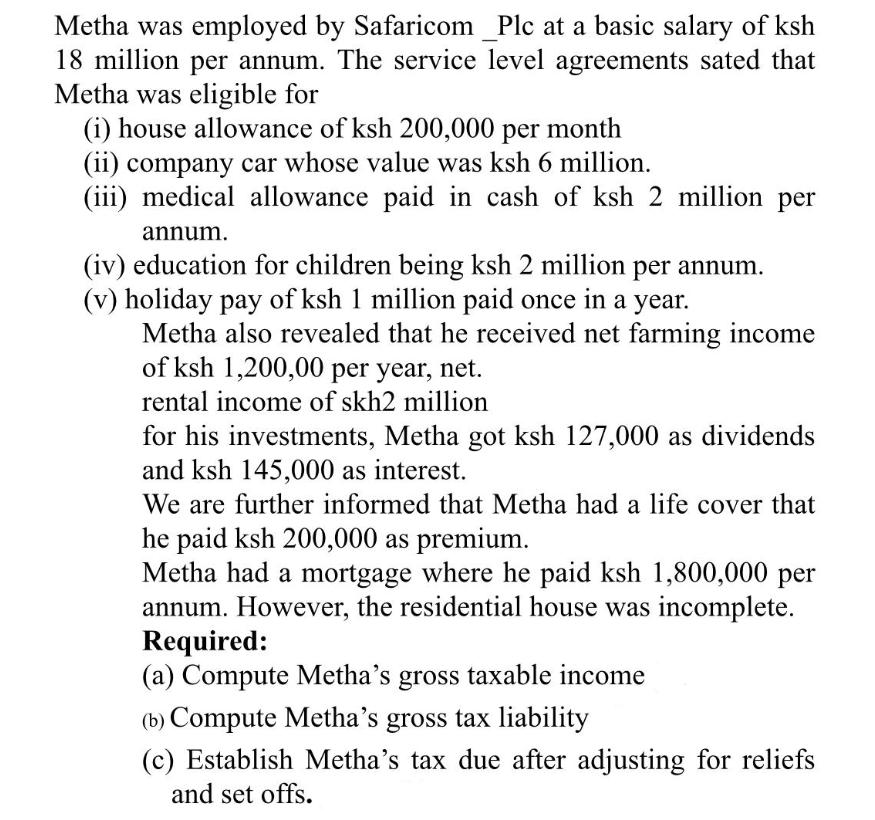

Metha was employed by Safaricom _Plc at a basic salary of ksh 18 million per annum. The service level agreements sated that Metha was eligible for (i) house allowance of ksh 200,000 per month (ii) company car whose value was ksh 6 million. (iii) medical allowance paid in cash of ksh 2 million per annum. (iv) education for children being ksh 2 million per annum. (v) holiday pay of ksh 1 million paid once in a year. Metha also revealed that he received net farming income of ksh 1,200,00 per year, net. rental income of skh2 million for his investments, Metha got ksh 127,000 as dividends and ksh 145,000 as interest. We are further informed that Metha had a life cover that he paid ksh 200,000 as premium. Metha had a mortgage where he paid ksh 1,800,000 per annum. However, the residential house was incomplete. Required: (a) Compute Metha's gross taxable income (b) Compute Metha's gross tax liability (c) Establish Metha's tax due after adjusting for reliefs and set offs.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute Methas gross taxable income gross tax liability and the tax due after adjusting for relie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started