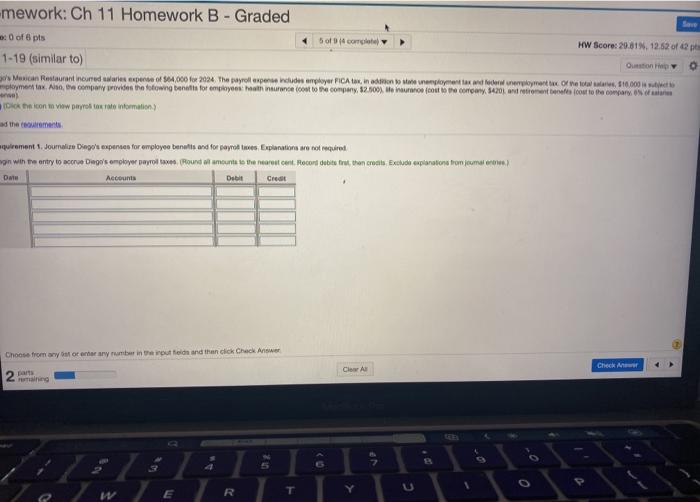

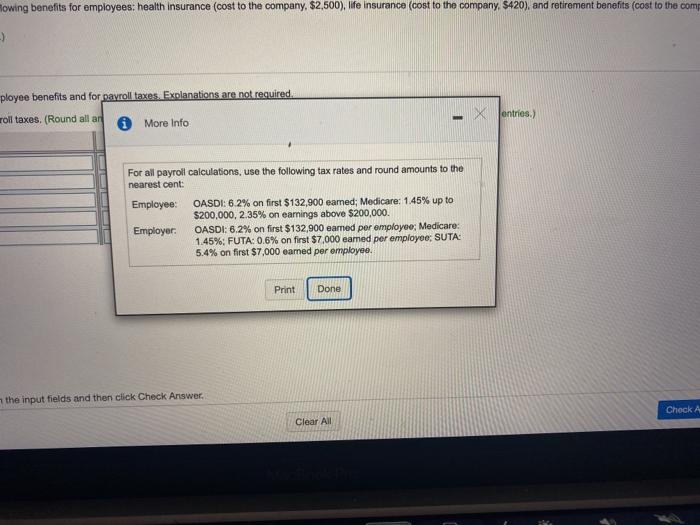

-mework: Ch 11 Homework B - Graded Sowe : 0 of 6 pts 5 of com HW Score: 29.01. 12.52 of 2 1-19 (similar to) Oston Sol Musican Restaurant und war es expert of 4,000 for 2024. The payroll expense nude amplayer ICA in no te nemen der er mere etos, 10.000 me tax. Also, the company rides the folowng benefits for employees at turence to the company. 12.509) How to the corny 54701 Petronenfes foot to the companys lok the icon to view dayro totale information quirement 1. Journalie Dingo's poses for employee benefits and for payroles Explanations are not required on with the entry to Diego's omployer payroll Round of mount to the nearest cent Recon dubito frut then credits Exclude explanation from man Date Accounts Debit Cred Choose from any rere any number in the routed and then click Check Answer Check Clow 2 E R Howing benefits for employees: health insurance (cost to the company, $2,500), life insurance (cost to the company, $420), and retirement benefits (cost to the comp -> ployee benefits and for payroll taxes. Explanations are not required X entries.) coll taxes. (Round all an i More Info For all payroll calculations, use the following tax rates and round amounts to the nearest cent: Employee: Employer: OASDI: 6.2% on first $132,900 eamed; Medicare: 1.45% up to $200,000, 2.35% on earnings above $200,000. OASDI: 6.2% on first $132,900 eamed per employee; Medicare: 1.45%: FUTA: 0.6% on first $7,000 eamed per employee; SUTA: 5.4% on first $7,000 eamed per employee Print Done the input fields and then click Check Answer. Check A Clear All Homework: Ch 11 Homework B - Graded Score: 0 of 6 pts HW Score 29.87N, 12:52 EF11-19 (similar to) Diego's Mexican Restaurant incurred stare expense of 564,000 to 2024. The payroll expenses employer PICA, Interest to deterre. unemployment as to the company provides the following benefits for employees at a cost to the company. 12.50 in the compared to ) Clate toon to view payroll taxe Wormation) Read the Requirement 1. Journals Diego's expers for employee pardon se retro Begin with the cry in accrue Diego's moyer payroon doit, edhe Account DR C Chocolate and then the CA MacBook Pro 9 ese 8 X 5 6 7 4 P 2 3 Y U T ER Q W J tab G H F C