Answered step by step

Verified Expert Solution

Question

1 Approved Answer

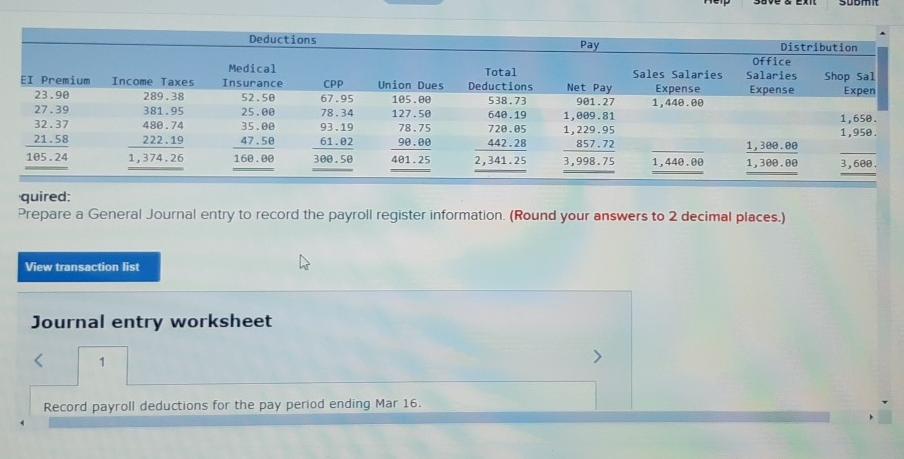

MI Deductions Pay Sales Salaries Expense 1,440.80 Distribution Office Salaries Shop Sal Expense Expen EI Premium 23.90 27.39 32.37 21.58 185.24 Income Taxes 289.38 381.95

MI Deductions Pay Sales Salaries Expense 1,440.80 Distribution Office Salaries Shop Sal Expense Expen EI Premium 23.90 27.39 32.37 21.58 185.24 Income Taxes 289.38 381.95 488.74 222.19 1,374.26 Medical Insurance 52.50 25.00 35.ee 47.50 160.ee CPP 67.95 78.34 93.19 61.02 308.50 Union Dues 105.ee 127.50 78.75 99.00 401.25 Total Deductions 538.73 640.19 720.05 442.28 2,341.25 Net Pay 901.27 1,089.81 1,229.95 857.72 3,998.75 1,650. 1,950. 1,380.ee 1,300.00 1,440.00 3,680 quired: Prepare a General Journal entry to record the payroll register information (Round your answers to 2 decimal places.) View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started