Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Michael, an international student from Ireland, has a W-2 that shows amounts withheld for Social Security and Medicare taxes. Michael is an F-1 nonresident alien

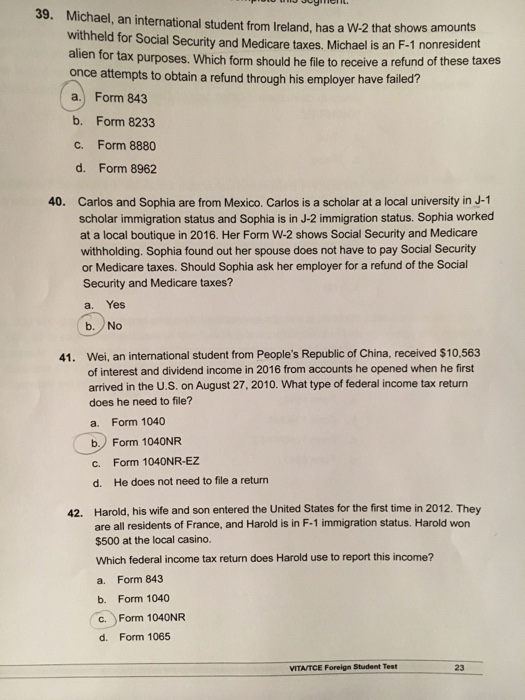

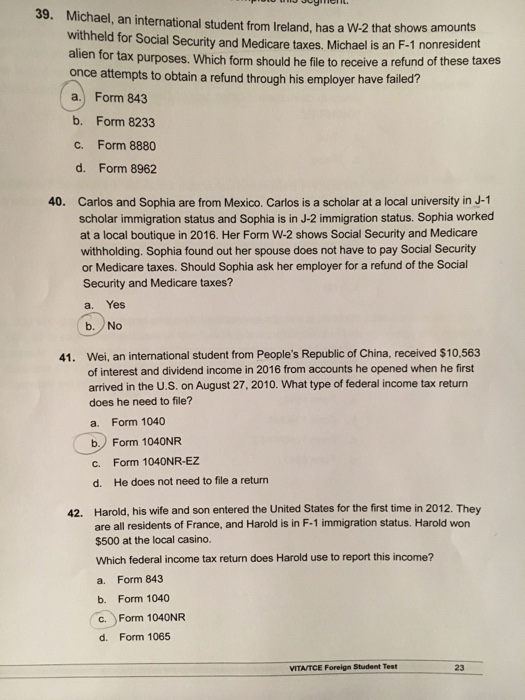

Michael, an international student from Ireland, has a W-2 that shows amounts withheld for Social Security and Medicare taxes. Michael is an F-1 nonresident alien for tax purposes. Which form should he file to receive a refund of these taxes once attempts to obtain a refund through his employer have failed? Form 843 Form 8233 Form 8880 Form 8962 Carlos and Sophia are from Mexico. Carlos is a scholar at a local university m J-1 scholar immigration status and Sophia is in J-2 immigration status. Sophia worked at a local boutique in 2016. Her Form W-2 shows Social Security and Medicare withholding. Sophia found out her spouse does not have to pay Social Security or Medicare taxes. Should Sophia ask her employer for a refund of the Social Security and Medicare taxes? Yes No. Wei, an international student from People's Republic of China, received $10, 563 of interest and dividend income in 2016 from accounts he opened when he first arrived in the U.S. on August 27. 2010. What type of federal income tax return does he need to file? Form 1040 Form 1040NR Form 1040NR-E2 He does not need to file a return Harold, his wife and son entered the United States for the first time in 2012. They are all residents of France, and Harold is in F-1 immigration status. Harold won $500 at the local casino Which federal income tax return does Harold use to report this income? Form 843 Form 1040 Form 1O40NR Form 1065

Michael, an international student from Ireland, has a W-2 that shows amounts withheld for Social Security and Medicare taxes. Michael is an F-1 nonresident alien for tax purposes. Which form should he file to receive a refund of these taxes once attempts to obtain a refund through his employer have failed? Form 843 Form 8233 Form 8880 Form 8962 Carlos and Sophia are from Mexico. Carlos is a scholar at a local university m J-1 scholar immigration status and Sophia is in J-2 immigration status. Sophia worked at a local boutique in 2016. Her Form W-2 shows Social Security and Medicare withholding. Sophia found out her spouse does not have to pay Social Security or Medicare taxes. Should Sophia ask her employer for a refund of the Social Security and Medicare taxes? Yes No. Wei, an international student from People's Republic of China, received $10, 563 of interest and dividend income in 2016 from accounts he opened when he first arrived in the U.S. on August 27. 2010. What type of federal income tax return does he need to file? Form 1040 Form 1040NR Form 1040NR-E2 He does not need to file a return Harold, his wife and son entered the United States for the first time in 2012. They are all residents of France, and Harold is in F-1 immigration status. Harold won $500 at the local casino Which federal income tax return does Harold use to report this income? Form 843 Form 1040 Form 1O40NR Form 1065

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started