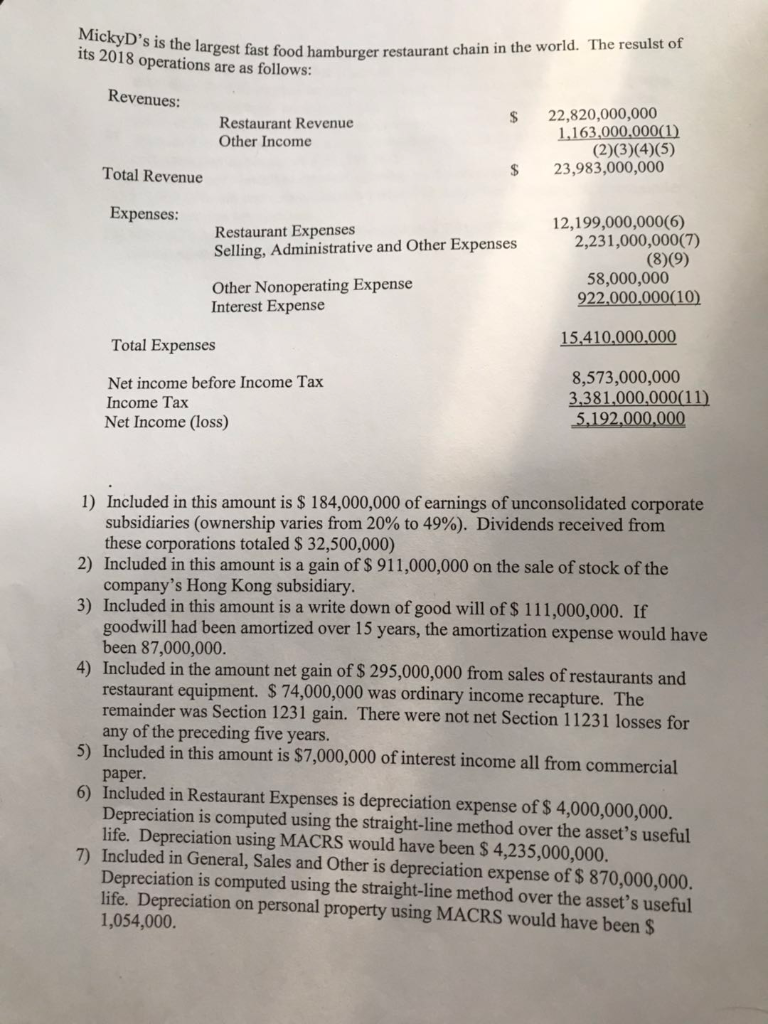

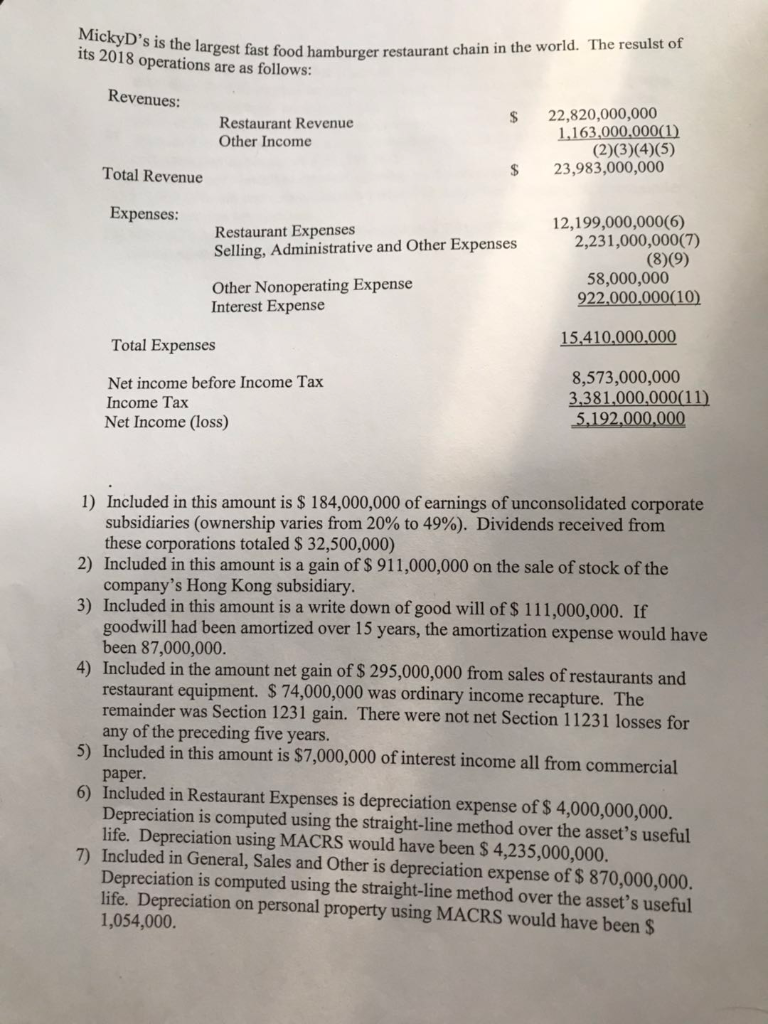

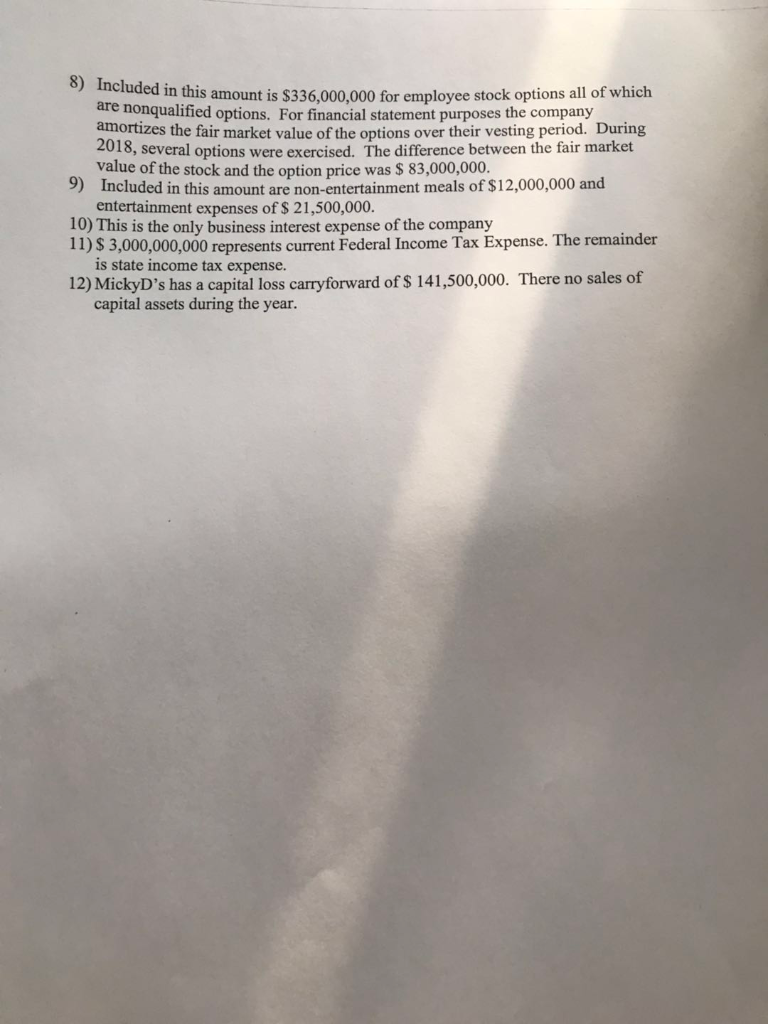

MickyD's is the largest fast food hamburger restaurant chain in its 2018 operations are as follows: the world. The resulst of Revenues: S 22,820,000,000 Restaurant Revenue Other Income $ 23,983,000,000 Total Revenue Expenses: 12,199,000,000(6) Restaurant Expenses Selling, Administrative and Other Expenses 2,231,000,000(7) (8)9) 58,000,000 922,000,000(10) Other Nonoperating Expense Interest Expense 15.410,000,000 Total Expenses 8,573,000,000 3.381000,000(11) 5,192,000,000 Net income before Income Tax Income Tax Net Income (loss) 1) Included in this amount is $ 184,000,000 of earnings of unconsolidated corporate 2) Included in this amount is a gain of $ 911,000,000 on the sale of stock of the 3) Included in this amount is a write down of good will of $ 111,000,000. If 4) Included in the amount net gain of $ 295,000,000 from sales of restaurants and subsidiaries (ownership varies from 20% to 49%). Dividends received from these corporations totaled $ 32,500,000) company's Hong Kong subsidiary. goodwill had been amortized over 15 years, the amortization expense would have been 87,000,000. restaurant equipment. $ 74,000,000 was ordinary income recapture. The remainder was Section 1231 gain. There were not net Section 11231 losses for any of the preceding five years. 5) Included in this amount is $7,000,000 of interest income all from commercial paper 6) Included in Restaurant Expenses is depreciation expense of $ 4,000,000,000 Depreciation is computed using the straight-line method over the asset's useful life. Depreciation using MACRS would have been $ 4,235,000,000. 7) Included in General, Sales and Other is depreciation expense of $ 870,000,000. Depreciation is computed using the straight-line method over the asset's useful life. Depreciation on personal property using MACRS would have been $ 1,054,000 cluded in this amount is $336,000,000 for employee stock options all of which nonqualified options. For financial statement purposes the company amortizes the fair market value of the options over their vesting period. During 2018, several options were exercised. The difference between the fair market value of the stock and the option price was $ 83,000,000. Included in this amount are non-entertainment meals of $12,000,000 and entertainment expenses of $ 21,500,000 9) 10) This is the only business interest expense of the company 11)S 3,000,000,000 represents current Federal Income Tax Expense. The remainder is state income tax expense. 12) MickyD's has a capital loss carryforward of S 141,500,000. There no sales of capital assets during the year Compute MickyD's 2018 regular income tax liability. Please show your calculation. A. B. Compute the amount of business interest that is deductible. Please show you calculations C. Compute MickyD's 2018 earnings and profits. Please show you calculations