Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Micro, an accrual basis corporation, reported $506,100 net income before tax on its financial statements prepared in accordance with GAAP. Micros records reveal the following

Micro, an accrual basis corporation, reported $506,100 net income before tax on its financial statements prepared in accordance with GAAP. Micros records reveal the following information:

- Micro paid $25,200 in legal fees and $96,000 to a former employee to settle a claim of sexual harassment. To avoid negative publicity, Micro insisted that the settlement include a confidentiality agreement.

- Late in the year, Micro entered into a five-year licensing agreement with an unrelated firm. The agreement entitles the firm to use a Micro trade name in marketing its own product. In return, the firm will pay Micro an annual royalty of 1 percent of gross revenues from sales of the product. The firm paid a $42,000 advanced royalty to Micro on the day the agreement was finalized. For financial statement purposes, this prepayment was credited to an unearned revenue account.

- At its final meeting for the year, Micros board of directors authorized a $15,600 salary bonus for the corporations president to reward him for an outstanding performance. Micro paid the bonus on January 12. The president doesnt own enough Micro stock to make him a related party for federal tax purposes.

- Micro was incorporated last year. On its first tax return, it reported a $21,500 net operating loss.

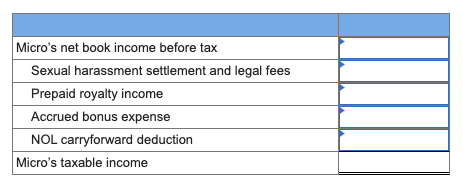

Compute Micro's taxable income by showing the adjustments to book income to arrive at taxable income. (Amounts to be deducted should be indicated with a minus sign.)

Micro's net book income before tax Sexual harassment settlement and legal fees Prepaid royalty income Accrued bonus expense NOL carryforward deduction Micro's taxable income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started