Answered step by step

Verified Expert Solution

Question

1 Approved Answer

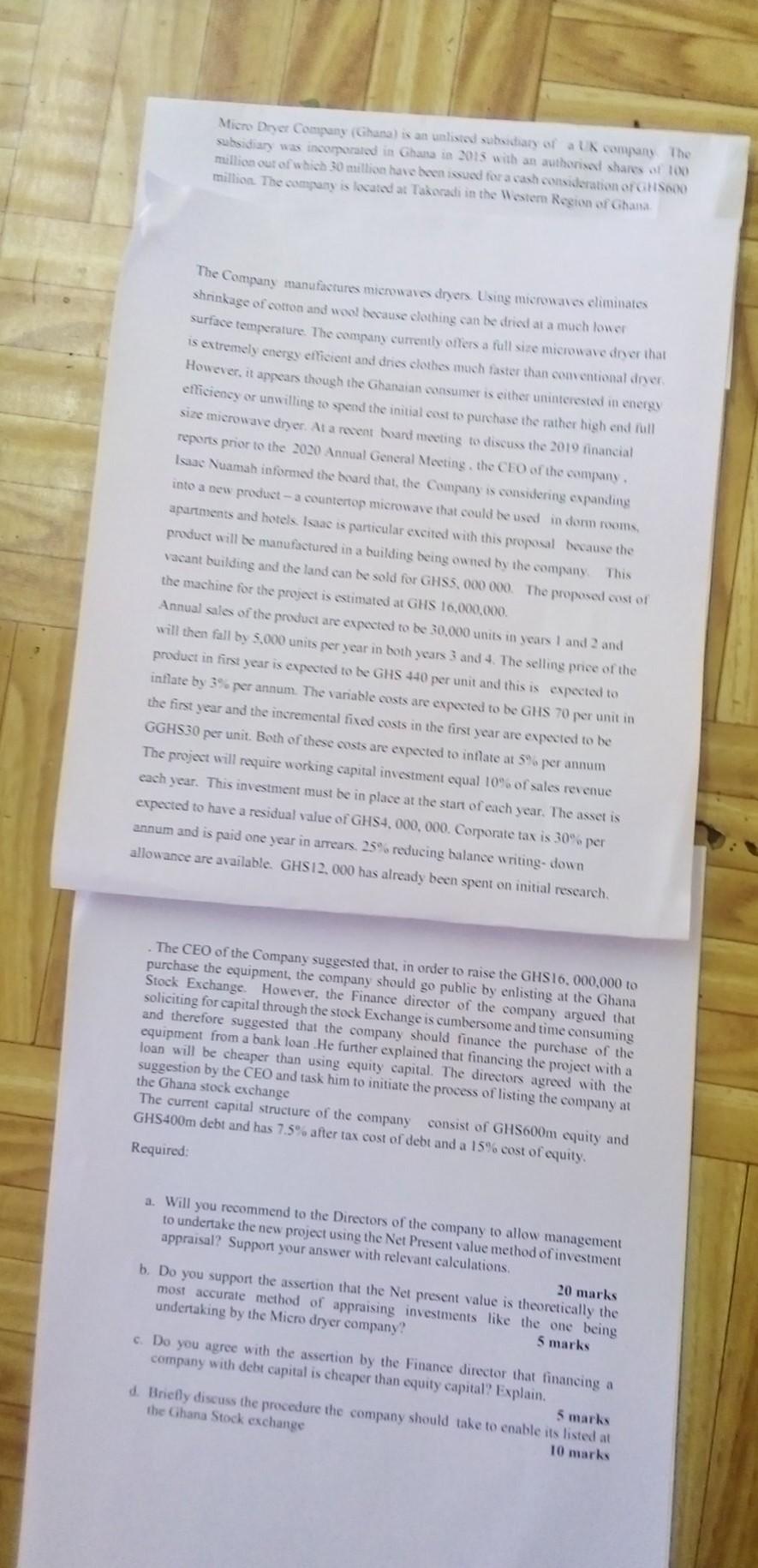

Micro Dryer Company (Ghana) is an unlisted subsidiary of a company. The subsidiary was incorporated in Ghana in 2015 with an authoriset shares of 100

Micro Dryer Company (Ghana) is an unlisted subsidiary of a company. The subsidiary was incorporated in Ghana in 2015 with an authoriset shares of 100 million out of which 30 million have been issued for a cash consideration or GHSCO million. The company is located at Takoradi in the Western Region of Ghana The Company manufactures microwave diners. Using microwaves eliminates shrinkage of cotton and wool because clothing can be dried at a much lower surface temperature. The company currently offers a full size microwave doser that is extremely energy efficient and dries clothes much faster than conventional dner However, it appears though the Ghanaian consumer is either uninterested in energy efficiency or unwilling to spend the initial cast to purchase the rather high end till size microwave der. At a recent boant meeting to discuss the 2019 financial reports prior to the 2020 Annual General Meeting the CEO of the company. Isaac Vuamah informed the beard that, the Company is considering expanding into a new product - a countertop microwave that could be used in dorm rooms, apartments and hotels Isaac is particular excited with this proposal because the product will be manufactured in a building being owned by the company vacant building and the land can be sold for GHS5 000 000. The proposed cost of the machine for the project is estimated at GHS 16,000,000 Annual sales of the product are expected to be 30.000 units in years 1 and 2 and will then fall by 5,000 units per year in both years 3 and 4. The selling price of the product in first year is expected to be GHS 440 per unit and this is expected to inflate by 3% per annum. The vanable costs are expected to be GHS 70 per unit in the first year and the incremental fixed costs in the first year are expected to be GGHS30 per unit. Both of these costs are expected to intlate at 5% per annum The project will require working capital investment equal 10% of sales revenue each year. This investment must be in place at the start of each year. The asset is expected to have a residual value of GHS4,000,000. Corporate tax is 30% per annum and is paid one year in arrears. 25% reducing balance writing down allowance are available. GHS12.000 has already been spent on initial research. The CEO of the Company suggested that, in order to raise the GHS16,000,000 to purchase the equipment, the company should go public by enlisting at the Ghana Stock Exchange. However, the Finance director of the company argued that soliciting for capital through the stock Exchange is cumbersome and time consuming and therefore suggested that the company should finance the purchase of the equipment from a bank loan.He further explained that financing the project with a loan will be cheaper than using equity capital. The directors agreed with the suggestion by the CEO and task him to initiate the process of listing the company at the Ghana stock exchange The current capital structure of the company consist of GHS600m equity and GHS400m debt and has 7.5% after tax cost debt and a 15% cost of equity. Required: a. Will you recommend to the Directors of the company to allow management to undertake the new project using the Net Present value method of investment appraisal? Support your answer with relevant calculations. 20 marks b. Do you support the assertion that the Net present value is theoretically the most accurate method of appraising investments like the one being undertaking by the Micro dryer company? 5 marks c. Do you agree with the assertion by the Finance director that financing a company with debt capital is cheaper than equity capital? Explain. 5 marks d. Briefly discuss the procedure the company should take to enable its listed at the Ghana Stock exchange 10 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started