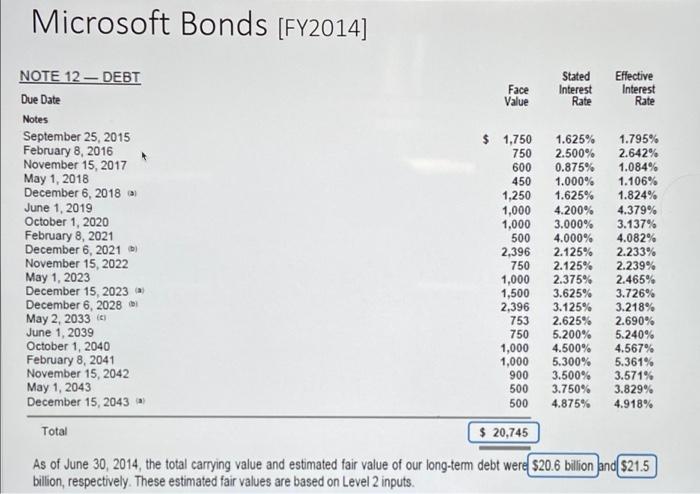

Microsoft Bonds [FY2014] NOTE 12 DEBT Due Date Face Value Stated Interest Rate Effective Interest Rate Notes September 25, 2015 February 8, 2016 November 15, 2017 May 1, 2018 December 6, 2018 June 1, 2019 October 1, 2020 February 8, 2021 December 6, 2021 November 15, 2022 May 1, 2023 December 15, 2023 December 6, 2028 May 2, 2033 June 1, 2039 October 1, 2040 February 8, 2041 November 15, 2042 May 1, 2043 December 15, 2043 $ 1,750 750 600 450 1.250 1,000 1,000 500 2,396 750 1,000 1,500 2,396 753 750 1,000 1,000 900 500 500 1.625% 2.500% 0.875% 1.000% 1.625% 4.200% 3.000% 4.000% 2.125% 2.125% 2.375% 3.625% 3.125% 2.625% 5.200% 4.500% 5.300% 3.500% 3.750% 4.875% 1.795% 2.642% 1.084% 1.106% 1.824% 4.379% 3.137% 4.082% 2.233% 2.239% 2.465% 3.726% 3.218% 2.690% 5.240% 4.567% 5.361% 3.571% 3.829% 4.918% Total $ 20,745 As of June 30, 2014, the total carrying value and estimated fair value of our long-term debt were $20.6 bilion and $21.5 billion, respectively. These estimated fair values are based on Level 2 inputs. Q4: Microsoft reported bond-related interest expense of $597M on its FY2014 income statement. Were cash payments in FY2014 more or less than $597M? How do you know? MacBook Pro Microsoft Bonds [FY2014] NOTE 12 DEBT Due Date Face Value Stated Interest Rate Effective Interest Rate Notes September 25, 2015 February 8, 2016 November 15, 2017 May 1, 2018 December 6, 2018 June 1, 2019 October 1, 2020 February 8, 2021 December 6, 2021 November 15, 2022 May 1, 2023 December 15, 2023 December 6, 2028 May 2, 2033 June 1, 2039 October 1, 2040 February 8, 2041 November 15, 2042 May 1, 2043 December 15, 2043 $ 1,750 750 600 450 1.250 1,000 1,000 500 2,396 750 1,000 1,500 2,396 753 750 1,000 1,000 900 500 500 1.625% 2.500% 0.875% 1.000% 1.625% 4.200% 3.000% 4.000% 2.125% 2.125% 2.375% 3.625% 3.125% 2.625% 5.200% 4.500% 5.300% 3.500% 3.750% 4.875% 1.795% 2.642% 1.084% 1.106% 1.824% 4.379% 3.137% 4.082% 2.233% 2.239% 2.465% 3.726% 3.218% 2.690% 5.240% 4.567% 5.361% 3.571% 3.829% 4.918% Total $ 20,745 As of June 30, 2014, the total carrying value and estimated fair value of our long-term debt were $20.6 bilion and $21.5 billion, respectively. These estimated fair values are based on Level 2 inputs. Q4: Microsoft reported bond-related interest expense of $597M on its FY2014 income statement. Were cash payments in FY2014 more or less than $597M? How do you know? MacBook Pro