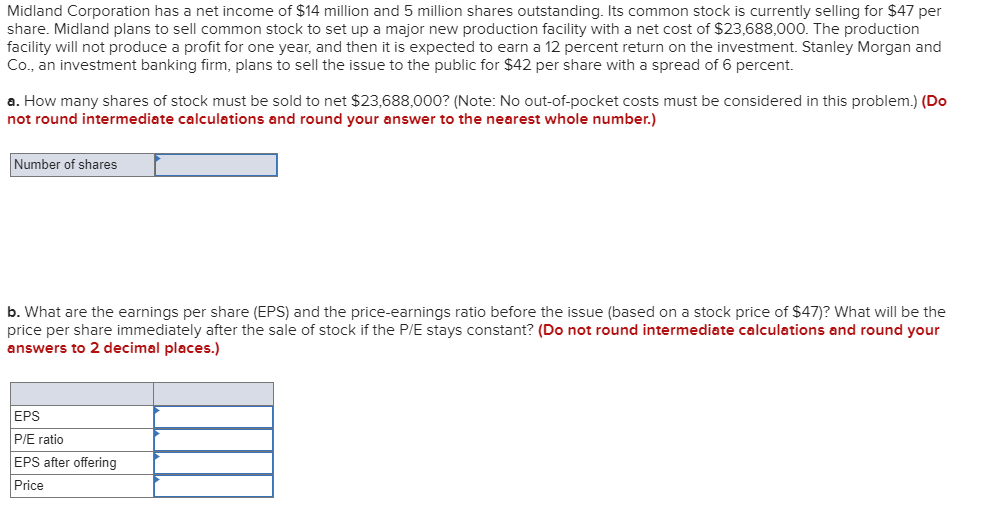

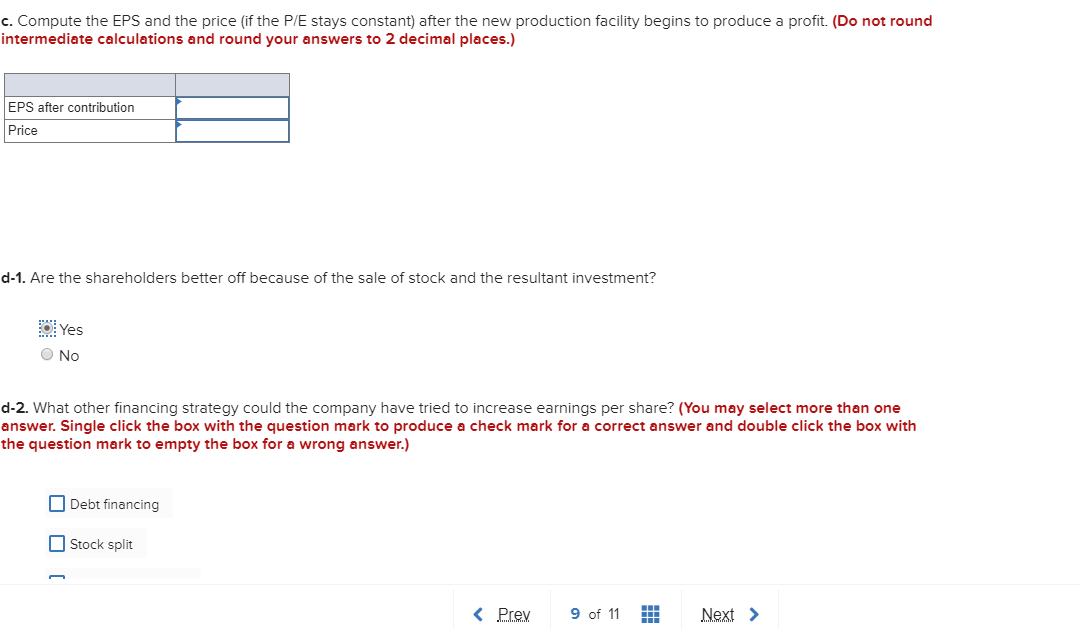

Midland Corporation has a net income of $14 million and 5 million shares outstanding. Its common stock is currently selling for $47 per share. Midland plans to sell common stock to set up a major new production facility with a net cost of $23,688,000. The production facility will not produce a profit for one year, and then it is expected to earn a 12 percent return on the investment. Stanley Morgan and Co., an investment banking firm, plans to sell the issue to the public for $42 per share with a spread of 6 percent. a. How many shares of stock must be sold to net $23,688,000? (Note: No out-of-pocket costs must be considered in this problem.) (Do not round intermediate calculations and round your answer to the nearest whole number.) Number of shares b. What are the earnings per share (EPS) and the price-earnings ratio before the issue (based on a stock price of $47)? What will be the price per share immediately after the sale of stock if the P/E stays constant? (Do not round intermediate calculations and round your answers to 2 decimal places.) EPS P/E ratio EPS after offering Price c. Compute the EPS and the price (if the P/E stays constant) after the new production facility begins to produce a profit. (Do not round intermediate calculations and round your answers to 2 decimal places.) EPS after contribution Price d-1. Are the shareholders better off because of the sale of stock and the resultant investment? Ol Yes No d-2. What other financing strategy could the company have tried to increase earnings per share? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer.) Debt financing Stock split Midland Corporation has a net income of $14 million and 5 million shares outstanding. Its common stock is currently selling for $47 per share. Midland plans to sell common stock to set up a major new production facility with a net cost of $23,688,000. The production facility will not produce a profit for one year, and then it is expected to earn a 12 percent return on the investment. Stanley Morgan and Co., an investment banking firm, plans to sell the issue to the public for $42 per share with a spread of 6 percent. a. How many shares of stock must be sold to net $23,688,000? (Note: No out-of-pocket costs must be considered in this problem.) (Do not round intermediate calculations and round your answer to the nearest whole number.) Number of shares b. What are the earnings per share (EPS) and the price-earnings ratio before the issue (based on a stock price of $47)? What will be the price per share immediately after the sale of stock if the P/E stays constant? (Do not round intermediate calculations and round your answers to 2 decimal places.) EPS P/E ratio EPS after offering Price c. Compute the EPS and the price (if the P/E stays constant) after the new production facility begins to produce a profit. (Do not round intermediate calculations and round your answers to 2 decimal places.) EPS after contribution Price d-1. Are the shareholders better off because of the sale of stock and the resultant investment? Ol Yes No d-2. What other financing strategy could the company have tried to increase earnings per share? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer.) Debt financing Stock split