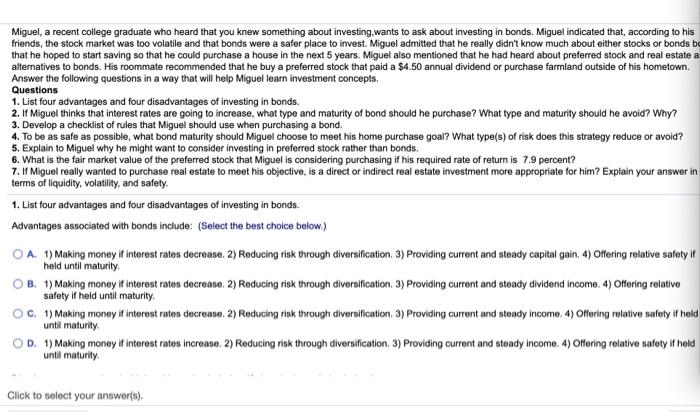

Miguel, a recent college graduate who heard that you knew something about investing,wants to ask about investing in bonds. Miguel indicated that, according to his friends, the stock market was too volatile and that bonds were a safer place to invest. Miguel admitted that he really didn't know much about either stocks or bonds be that he hoped to start saving so that he could purchase a house in the next 5 years. Miguel also mentioned that he had heard about preferred stock and real estate a alternatives to bonds. His roommate recommended that he buy a preferred stock that paid a $4.50 annual dividend or purchase farmland outside of his hometown. Answer the following questions in a way that will help Miguel learn investment concepts, Questions 1. List four advantages and four disadvantages of investing in bonds. 2. If Miguel thinks that interest rates are going to increase, what type and maturity of bond should he purchase? What type and maturity should he avoid? Why? 3. Develop a checklist of rules that Miguel should use when purchasing a bond. 4. To be as safe as possible, what bond maturity should Miguel choose to meet his home purchase goal? What type(s) of risk does this strategy reduce or avoid? 5. Explain to Miguel why he might want to consider investing in preferred stock rather than bonds. 6. What is the fair market value of the preferred stock that Miguel is considering purchasing if his required rate of return is 7.9 percent? 7. I Miguel really wanted to purchase real estate to meet his objective, is a direct or indirect real estate investment more appropriate for him? Explain your answer in terms of liquidity, volatility, and safety 1. List four advantages and four disadvantages of investing in bonds. Advantages associated with bonds include: (Select the best choice below) A. 1) Making money if interest rates decrease. 2) Reducing risk through diversification. 3) Providing current and steady capital gain. 4) Ollering relative safety if held until maturity OB. 1) Making money if interest rates decrease. 2) Reducing risk through diversification. 3) Providing current and steady dividend income. 4) Offering relative safety if held until maturity. OC. 1) Making money if interest rates decrease 2) Reducing risk through diversification. 3) Providing current and steady income. 4) Offering relative safety if held until maturity OD. 1) Making money if interest rates increase. 2) Reducing risk through diversification. 3) Providing current and steady income. 4) Offering relative safety if held until maturity Click to select your answer(s)