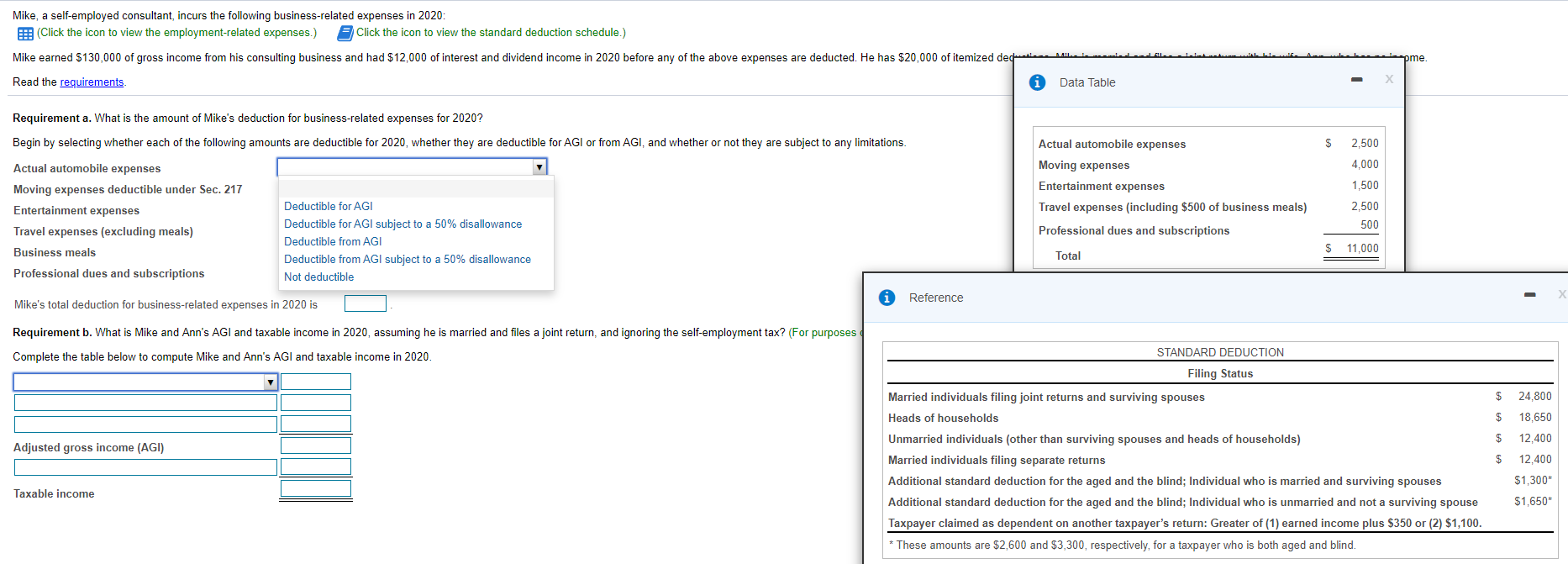

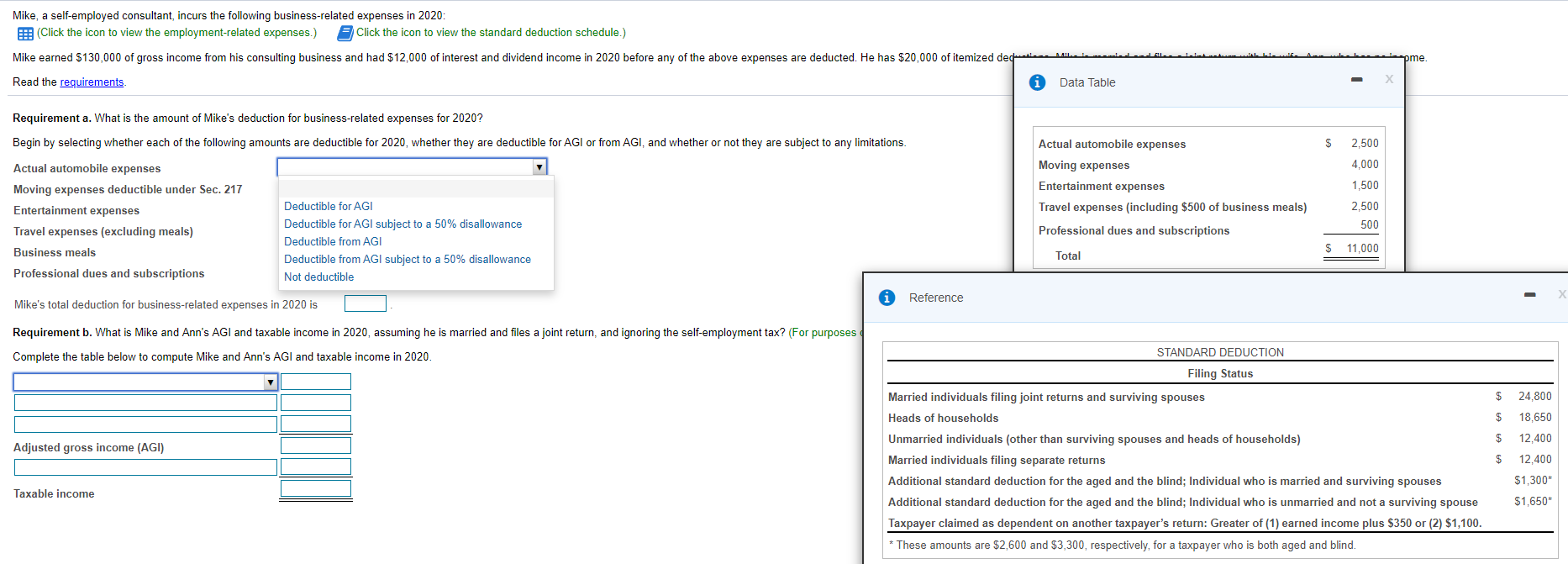

Mike, a self-employed consultant, incurs the following business-related expenses in 2020: (Click the icon to view the employment-related expenses.) Click the icon to view the standard deduction schedule.) Mike earned $130,000 of gross income from his consulting business and had $12,000 of interest and dividend income in 2020 before any of the above expenses are deducted. He has $20,000 of itemized dec pme Read the requirements Data Table Requirement a. What is the amount of Mike's deduction for business-related expenses for 2020? Begin by selecting whether each of the following amounts are deductible for 2020, whether they are deductible for AGI or from AGI, and whether or not they are subject to any limitations. s 2.500 4,000 Actual automobile expenses Moving expenses Entertainment expenses Travel expenses (including $500 of business meals) Professional dues and subscriptions 1,500 Actual automobile expenses Moving expenses deductible under Sec. 217 Entertainment expenses Travel expenses (excluding meals) Business meals Professional dues and subscriptions 2.500 500 Deductible for AGI Deductible for AGI subject to a 50% disallowance Deductible from AGI Deductible from AGI subject to a 50% disallowance Not deductible $ 11.000 Total Reference Mike's total deduction for business-related expenses in 2020 is Requirement b. What is Mike and Ann's AGI and taxable income in 2020, assuming he is married and files a joint return, and ignoring the self-employment tax? (For purposes Complete the table below to compute Mike and Ann's AGI and taxable income in 2020. STANDARD DEDUCTION Filing Status $ 24,800 $ 18,650 $ 12,400 Adjusted gross income (AGI) $ 12,400 Married individuals filing joint returns and surviving spouses Heads of households Unmarried individuals (other than surviving spouses and heads of households) Married individuals filing separate returns Additional standard deduction for the aged and the blind; Individual who is married and surviving spouses Additional standard deduction for the aged and the blind; Individual who is unmarried and not a surviving spouse Taxpayer claimed as dependent on another taxpayer's return: Greater of (1) earned income plus $350 or (2) $1,100. * These amounts are $2,600 and $3,300, respectively, for a taxpayer who is both aged and blind. $1,300* Taxable income $1,650* Mike, a self-employed consultant, incurs the following business-related expenses in 2020: (Click the icon to view the employment-related expenses.) Click the icon to view the standard deduction schedule.) Mike earned $130,000 of gross income from his consulting business and had $12,000 of interest and dividend income in 2020 before any of the above expenses are deducted. He has $20,000 of itemized dec pme Read the requirements Data Table Requirement a. What is the amount of Mike's deduction for business-related expenses for 2020? Begin by selecting whether each of the following amounts are deductible for 2020, whether they are deductible for AGI or from AGI, and whether or not they are subject to any limitations. s 2.500 4,000 Actual automobile expenses Moving expenses Entertainment expenses Travel expenses (including $500 of business meals) Professional dues and subscriptions 1,500 Actual automobile expenses Moving expenses deductible under Sec. 217 Entertainment expenses Travel expenses (excluding meals) Business meals Professional dues and subscriptions 2.500 500 Deductible for AGI Deductible for AGI subject to a 50% disallowance Deductible from AGI Deductible from AGI subject to a 50% disallowance Not deductible $ 11.000 Total Reference Mike's total deduction for business-related expenses in 2020 is Requirement b. What is Mike and Ann's AGI and taxable income in 2020, assuming he is married and files a joint return, and ignoring the self-employment tax? (For purposes Complete the table below to compute Mike and Ann's AGI and taxable income in 2020. STANDARD DEDUCTION Filing Status $ 24,800 $ 18,650 $ 12,400 Adjusted gross income (AGI) $ 12,400 Married individuals filing joint returns and surviving spouses Heads of households Unmarried individuals (other than surviving spouses and heads of households) Married individuals filing separate returns Additional standard deduction for the aged and the blind; Individual who is married and surviving spouses Additional standard deduction for the aged and the blind; Individual who is unmarried and not a surviving spouse Taxpayer claimed as dependent on another taxpayer's return: Greater of (1) earned income plus $350 or (2) $1,100. * These amounts are $2,600 and $3,300, respectively, for a taxpayer who is both aged and blind. $1,300* Taxable income $1,650*