Answered step by step

Verified Expert Solution

Question

1 Approved Answer

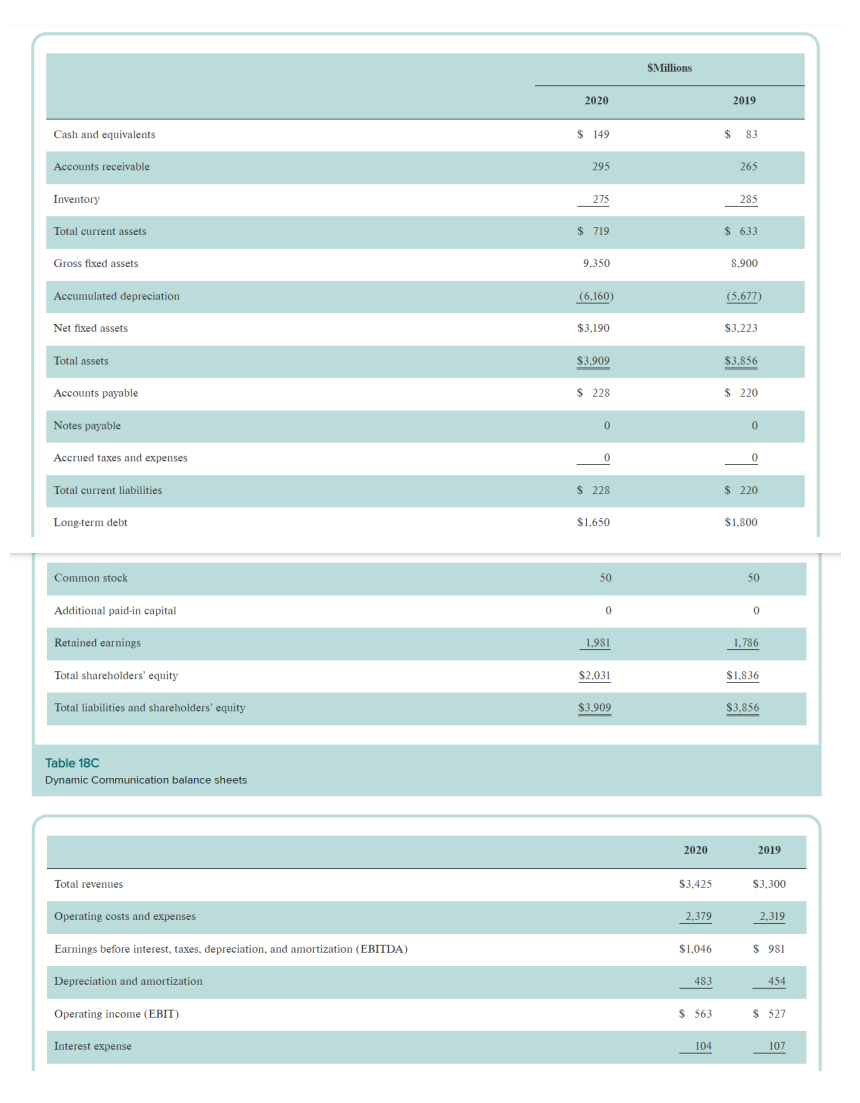

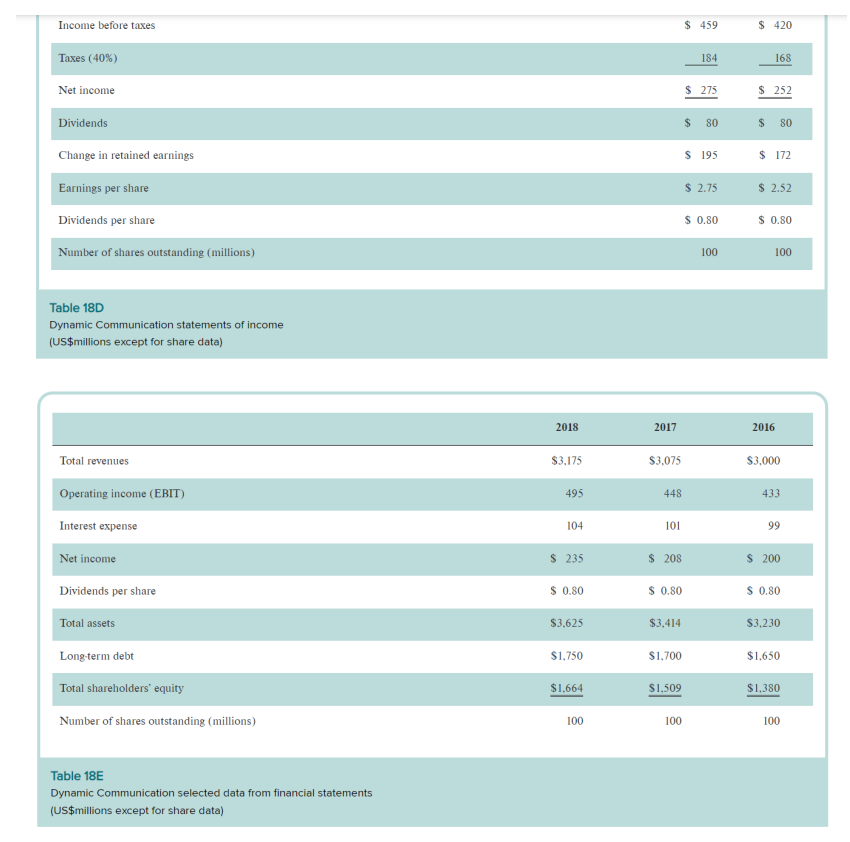

Mike Brandreth, an analyst who specializes in the electronics industry, is preparing a research report on Dynamic Communication. A colleague suggests to Brandreth that he

Mike Brandreth, an analyst who specializes in the electronics industry, is preparing a research report on Dynamic Communication. A colleague suggests to Brandreth that he may be able to determine Dynamic's implied dividend growth rate from Dynamic's current common stock price, using the Gordon growth model. Brandreth believes that the appropriate required rate of return for Dynamic's equity is 8%.

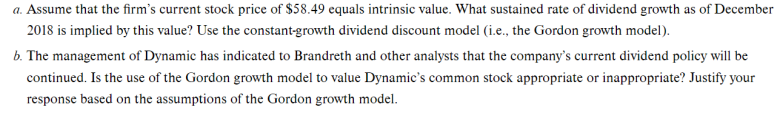

a. Assume that the firm's current stock price of $58.49 equals intrinsic value. What sustained rate of dividend growth as of December 2018 is implied by this value? Use the constant-growth dividend discount model (i.e., the Gordon growth model). b. The management of Dynamic has indicated to Brandreth and other analysts that the company's current dividend policy will be continued. Is the use of the Gordon growth model to value Dynamic's common stock appropriate or inappropriate? Justify your response based on the assumptions of the Gordon growth model

a. Assume that the firm's current stock price of $58.49 equals intrinsic value. What sustained rate of dividend growth as of December 2018 is implied by this value? Use the constant-growth dividend discount model (i.e., the Gordon growth model). b. The management of Dynamic has indicated to Brandreth and other analysts that the company's current dividend policy will be continued. Is the use of the Gordon growth model to value Dynamic's common stock appropriate or inappropriate? Justify your response based on the assumptions of the Gordon growth model Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started