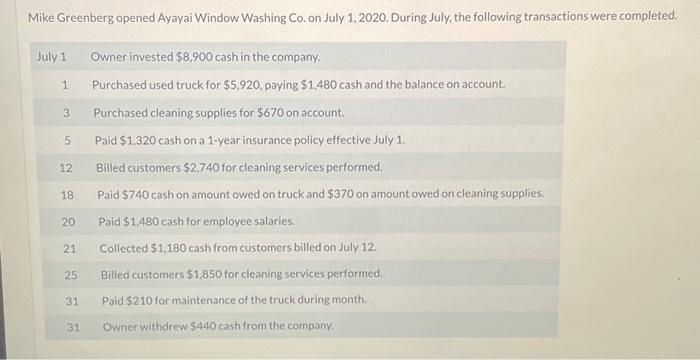

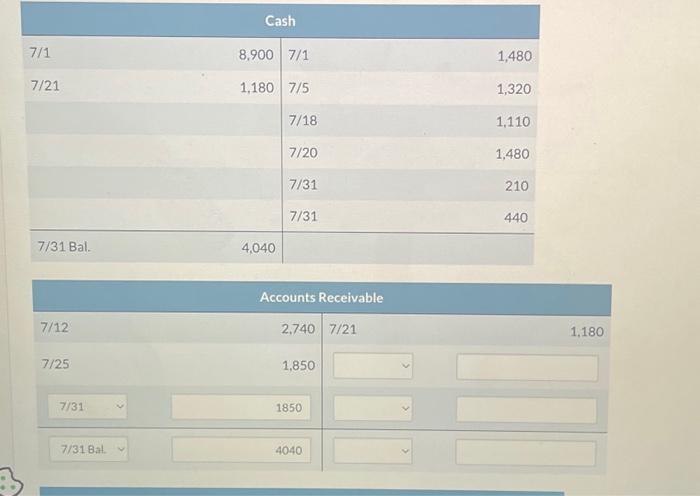

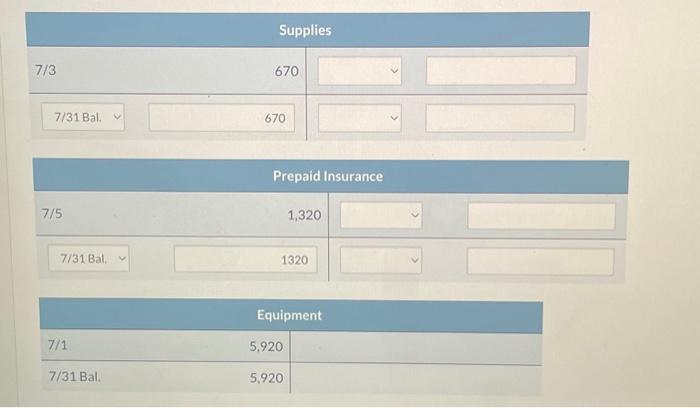

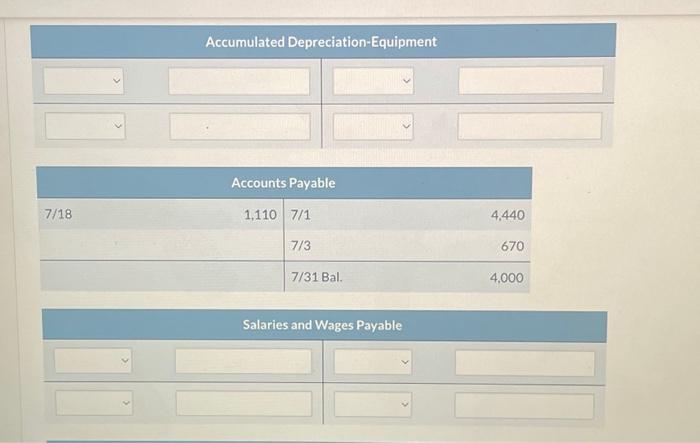

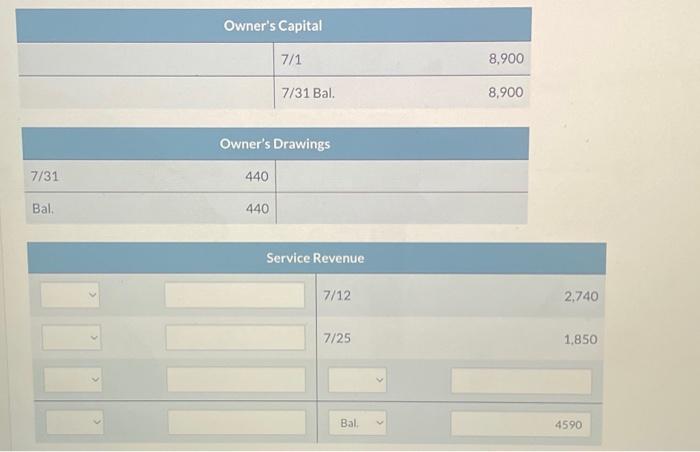

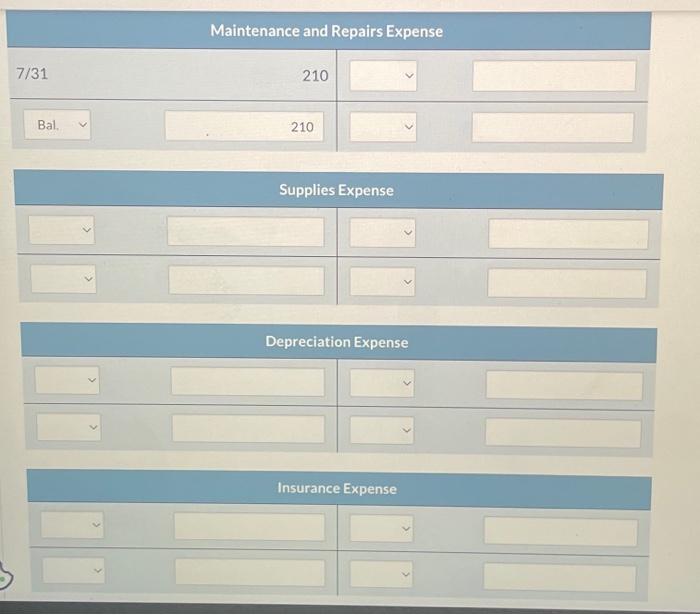

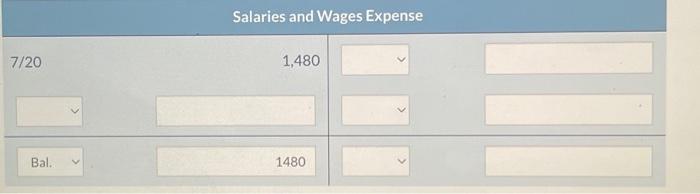

Mike Greenberg opened Ayayai Window Washing Co. on July 1, 2020. During July, the following transactions were completed. July 1 Owner invested $8,900 cash in the company. 1 Purchased used truck for $5,920, paying $1,480 cash and the balance on account. 3 Purchased cleaning supplies for $670 on account. 5 Paid $1,320 cash on a 1-year insurance policy effective July 1. 12 Billed customers $2,740 for cleaning services performed. 18 Paid $740 cash on amount owed on truck and $370 on amount owed on cleaning supplies. 20 Paid $1,480 cash for employee salaries. 21 Collected $1,180 cash from customers billed on July 12. 25 Billed customers $1,850 for cleaning services performed. 31 Paid $210 for maintenance of the truck during month. 31 Owner withdrew $440 cash from the company. \begin{tabular}{|lr|r|r|} \hline \multicolumn{3}{|c|}{ Accounts Receivable } \\ \hline 7/12 & 2,740 & 7/21 & 1,180 \\ \hline 7/25 & 1,850 & & \\ \hline 7/31 & 1850 & & \\ \hline 7/31 BaL & 4040 & & \\ \hline \end{tabular} Accumulated Depreciation-Equipment \begin{tabular}{|c|c|c|} \hline \multicolumn{4}{c|}{ Maintenance and Repairs Expense } \\ \hline 7/31 & 210 & \\ \hline Bal. & 210 & \\ \hline \end{tabular} Depreciation Expense Salaries and Wages Expense 7/20 1,480 Bal. 1480 Mike Greenberg opened Ayayai Window Washing Co. on July 1, 2020. During July, the following transactions were completed. July 1 Owner invested $8,900 cash in the company. 1 Purchased used truck for $5,920, paying $1,480 cash and the balance on account. 3 Purchased cleaning supplies for $670 on account. 5 Paid $1,320 cash on a 1-year insurance policy effective July 1. 12 Billed customers $2,740 for cleaning services performed. 18 Paid $740 cash on amount owed on truck and $370 on amount owed on cleaning supplies. 20 Paid $1,480 cash for employee salaries. 21 Collected $1,180 cash from customers billed on July 12. 25 Billed customers $1,850 for cleaning services performed. 31 Paid $210 for maintenance of the truck during month. 31 Owner withdrew $440 cash from the company. \begin{tabular}{|lr|r|r|} \hline \multicolumn{3}{|c|}{ Accounts Receivable } \\ \hline 7/12 & 2,740 & 7/21 & 1,180 \\ \hline 7/25 & 1,850 & & \\ \hline 7/31 & 1850 & & \\ \hline 7/31 BaL & 4040 & & \\ \hline \end{tabular} Accumulated Depreciation-Equipment \begin{tabular}{|c|c|c|} \hline \multicolumn{4}{c|}{ Maintenance and Repairs Expense } \\ \hline 7/31 & 210 & \\ \hline Bal. & 210 & \\ \hline \end{tabular} Depreciation Expense Salaries and Wages Expense 7/20 1,480 Bal. 1480