Question

Mike purchases a new heavy-duty truck (5-year class recovery property) for his delivery service on March 30, 2022. No other assets were purchased during the

Mike purchases a new heavy-duty truck (5-year class recovery property) for his delivery service on March 30, 2022. No other assets were purchased during the year. The truck is not considered a passenger automobile for purposes of the listed property and luxury automobile limitations. The truck has a depreciable basis of $50,000 and an estimated useful life of 5 years. Assume half-year convention for tax.

a. Calculate the amount of depreciation for 2022 using the straight-line depreciation election, using MACRS tables over the minimum number of years with no bonus depreciation or election to expense. B. Calculate the amount of depreciation for 2022, including bonus depreciation but no election to expense, that Mike could deduct using the MACRS tables.

a. Calculate the amount of depreciation for 2022 using the straight-line depreciation election, using MACRS tables over the minimum number of years with no bonus depreciation or election to expense. B. Calculate the amount of depreciation for 2022, including bonus depreciation but no election to expense, that Mike could deduct using the MACRS tables.

C. Calculate the amount of depreciation for 2022 including the election to expense but no bonus depreciation that Mike could deduct. Assume no income limit on the expense election.

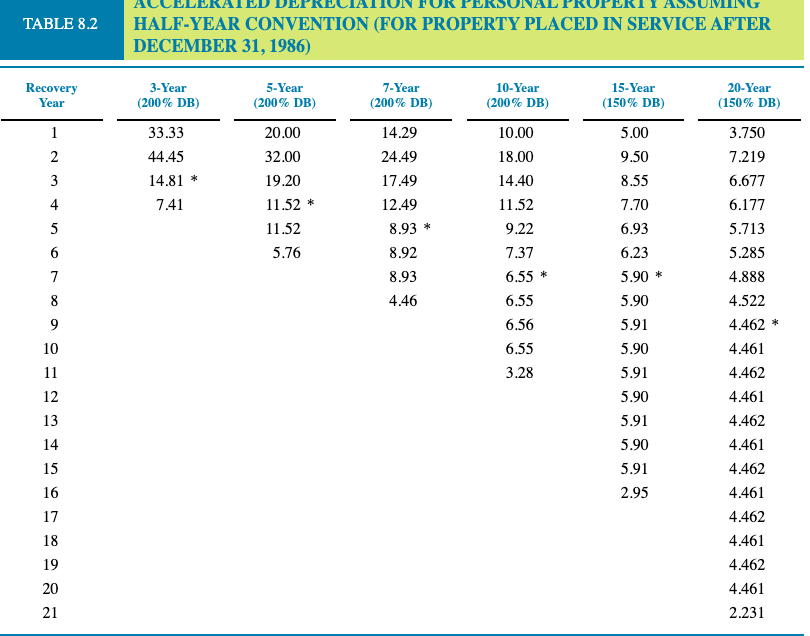

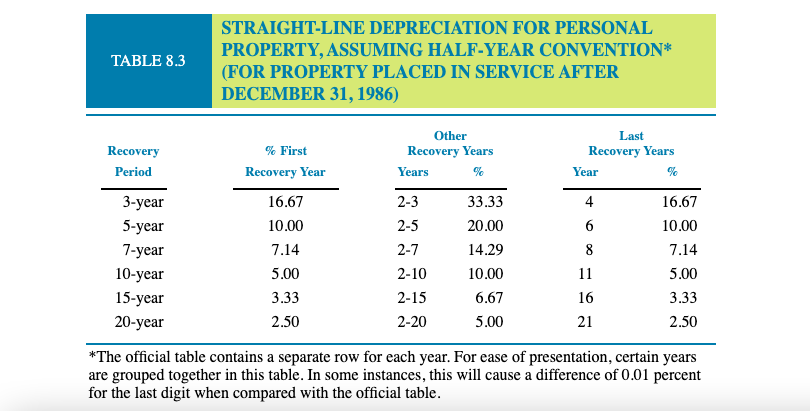

TABLE 8.2 HALF-YEAR CONVENTION (FOR PROPERTY PLACED IN SERVICE AFTER DECEMBER 31, 1986) *The official table contains a separate row for each year. For ease of presentation, certain years are grouped together in this table. In some instances, this will cause a difference of 0.01 percent for the last digit when compared with the official table. TABLE 8.2 HALF-YEAR CONVENTION (FOR PROPERTY PLACED IN SERVICE AFTER DECEMBER 31, 1986) *The official table contains a separate row for each year. For ease of presentation, certain years are grouped together in this table. In some instances, this will cause a difference of 0.01 percent for the last digit when compared with the official tableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started