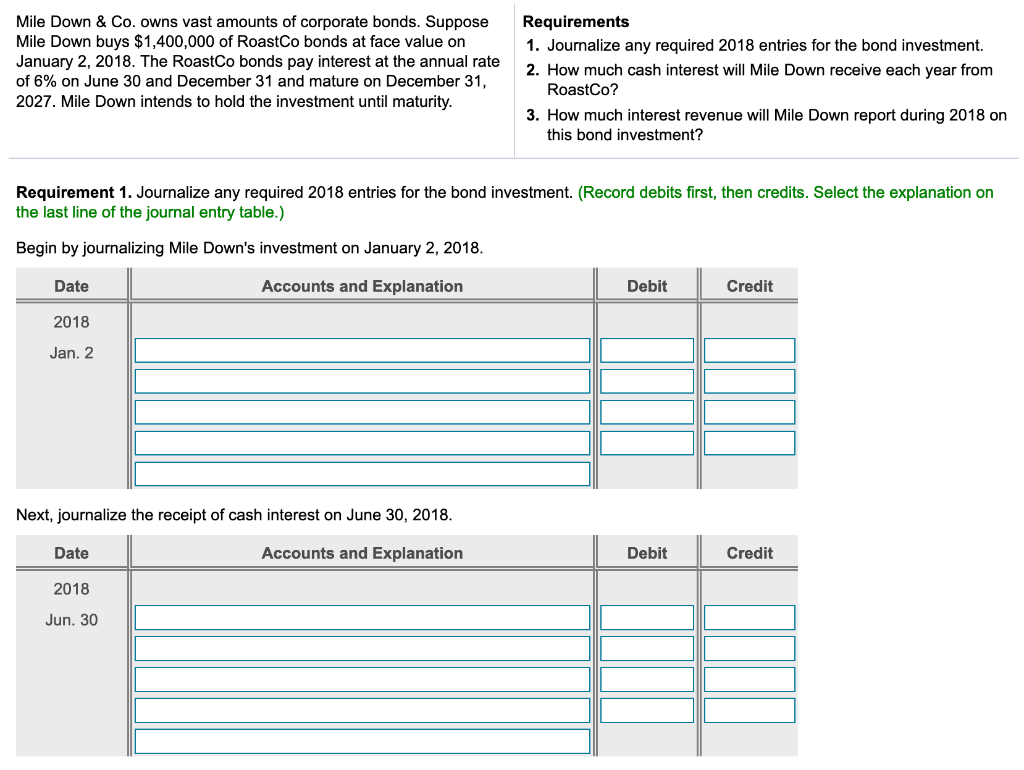

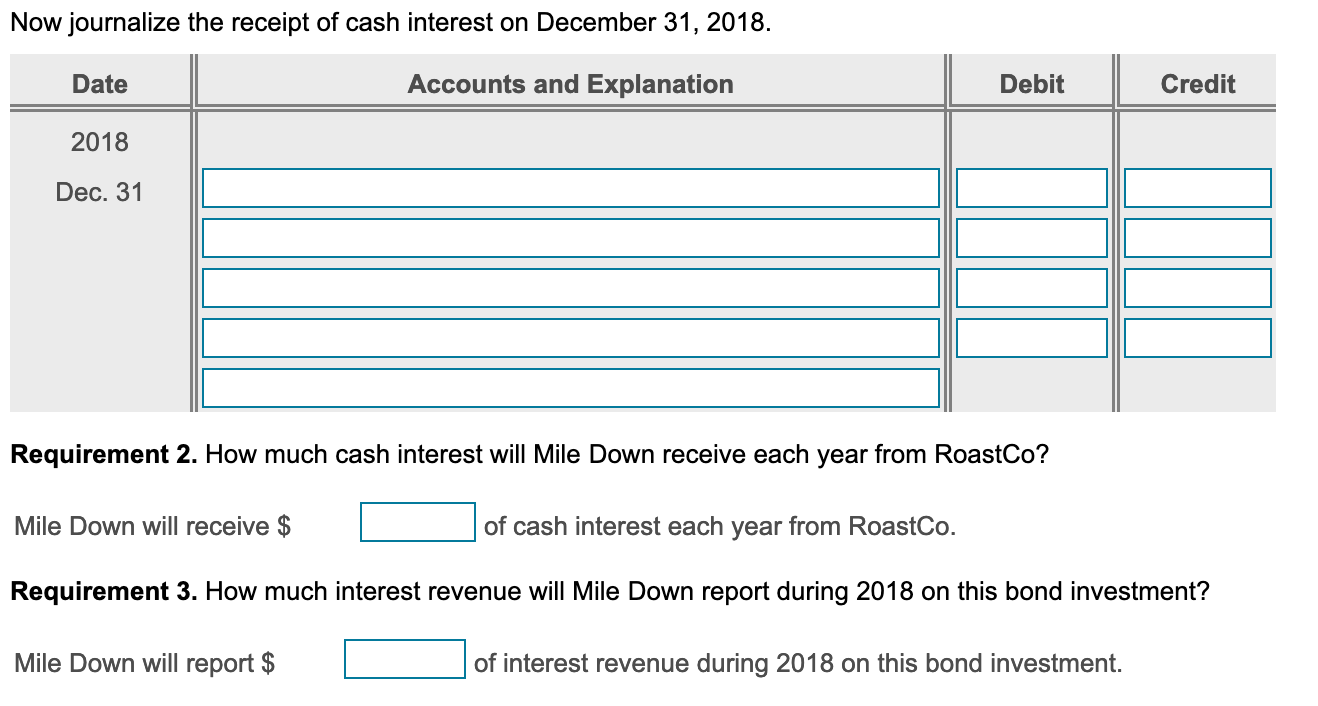

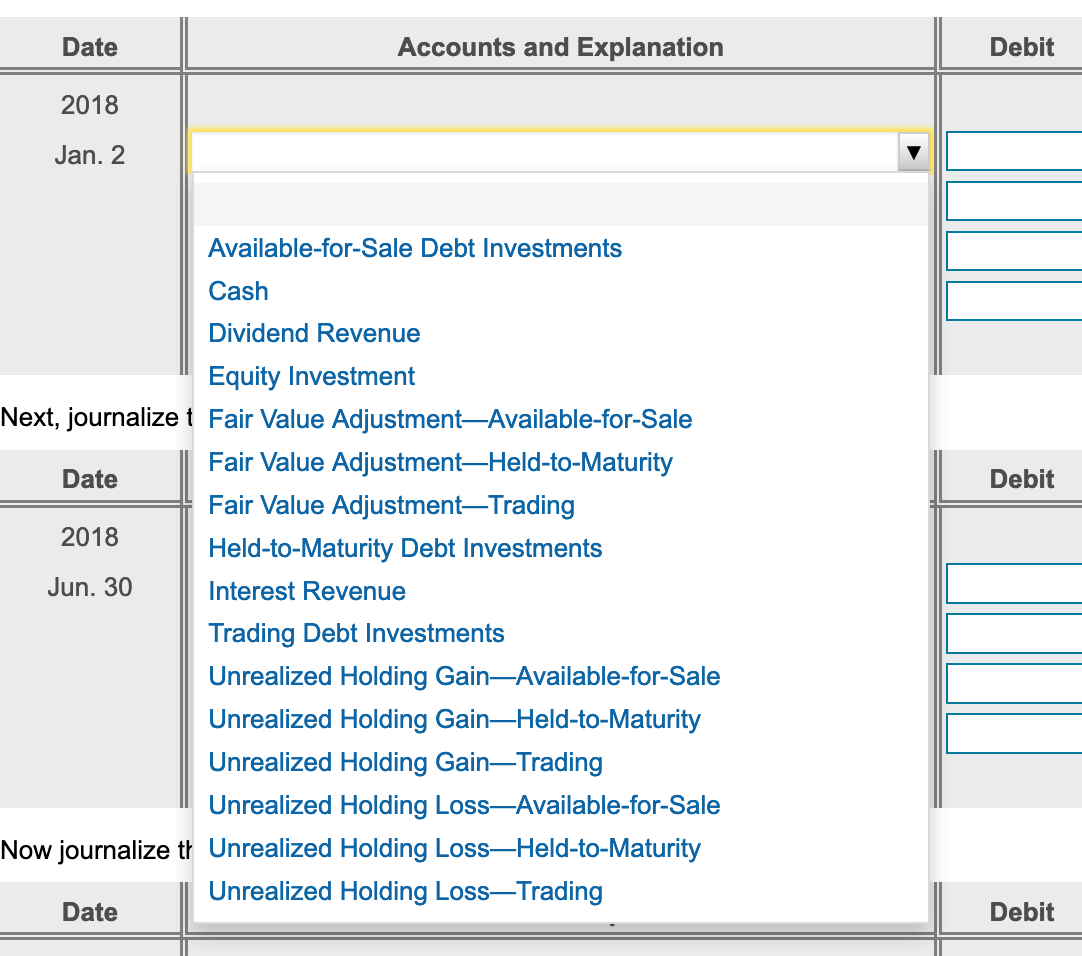

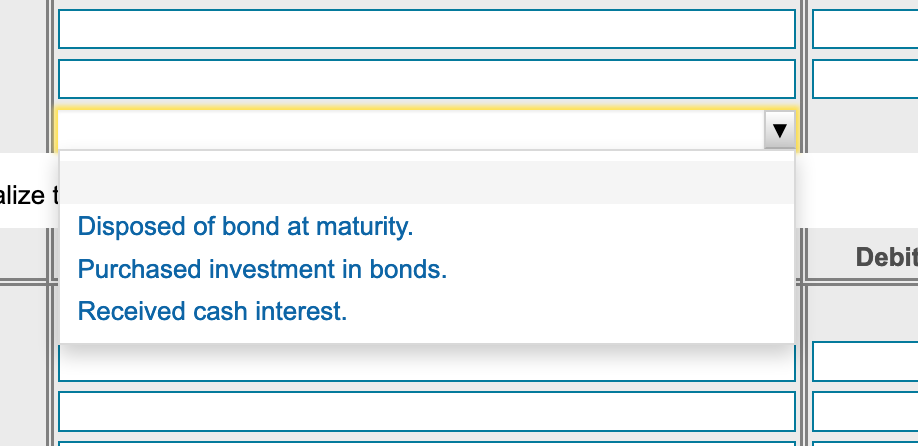

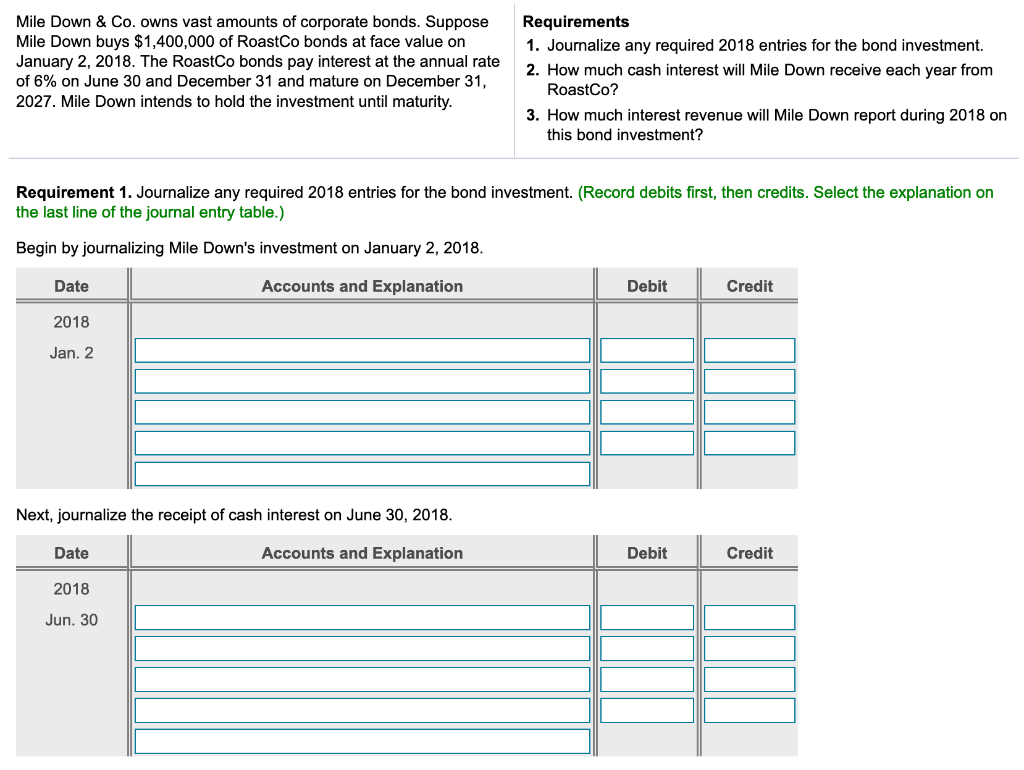

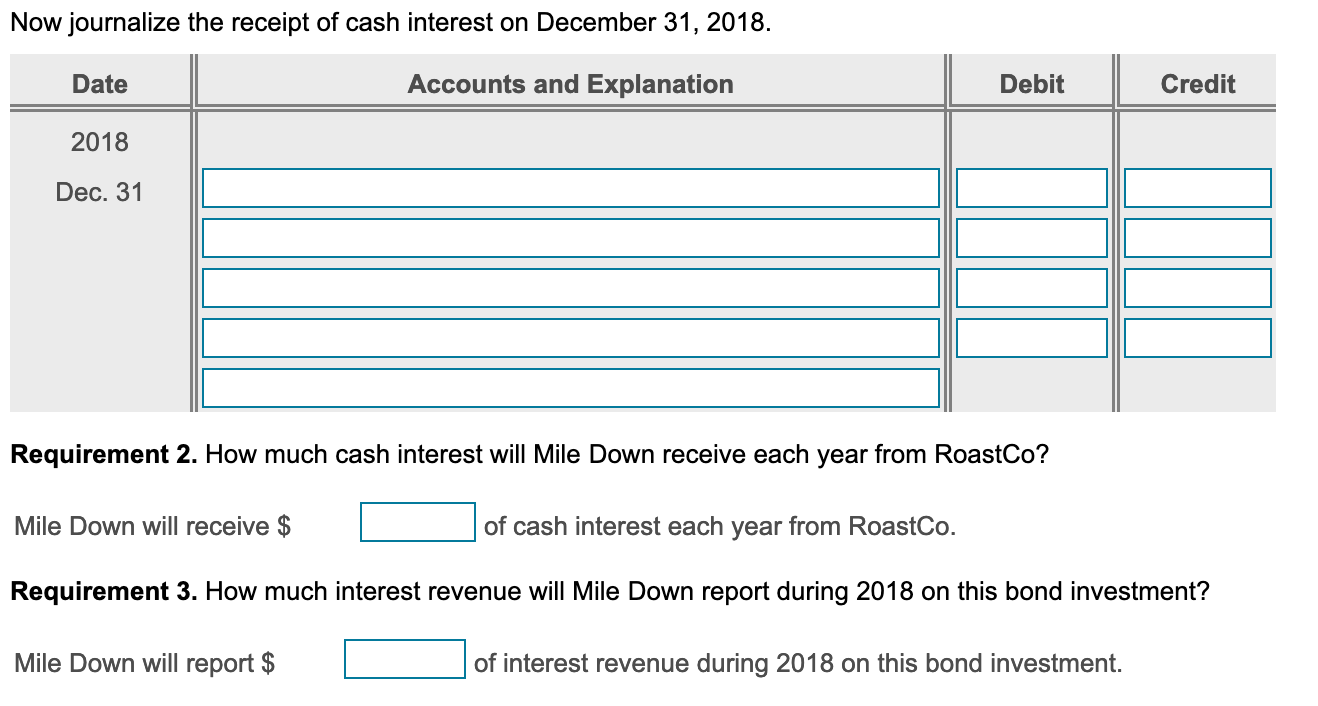

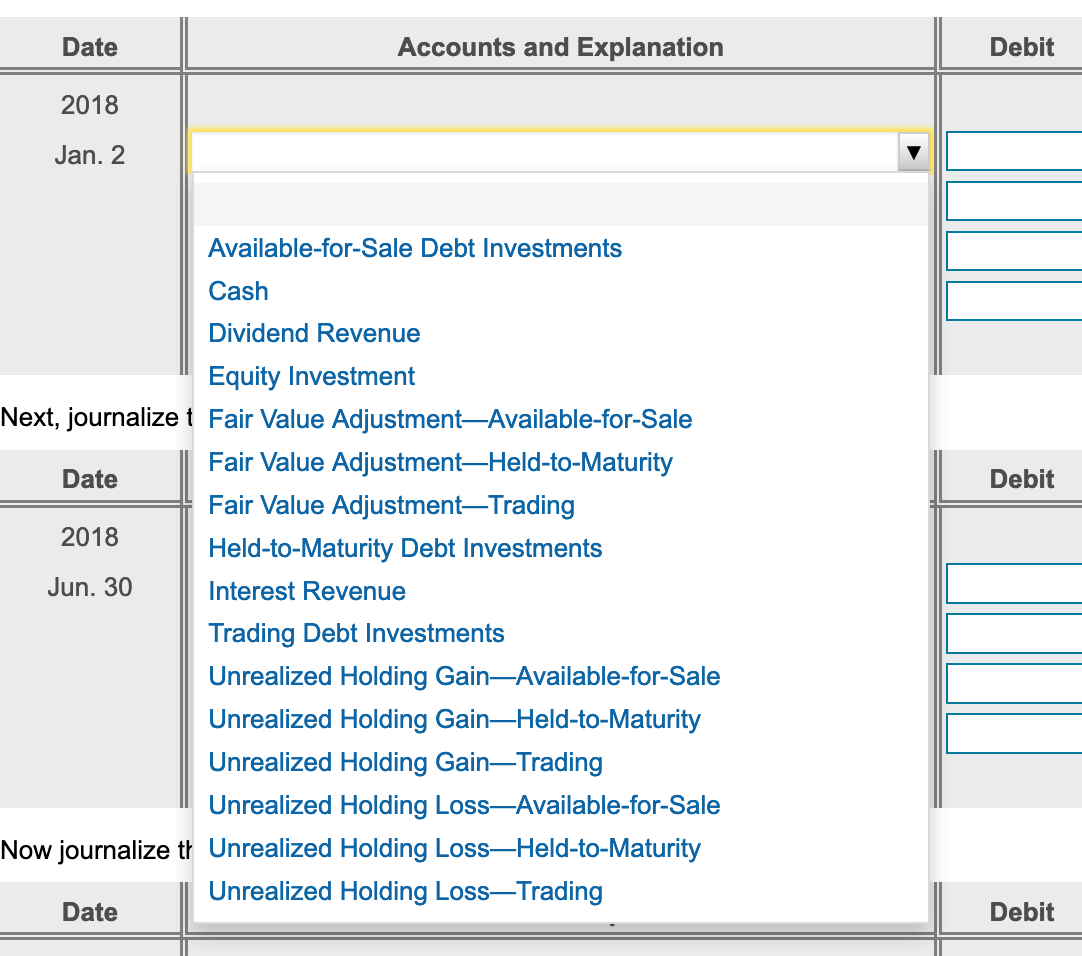

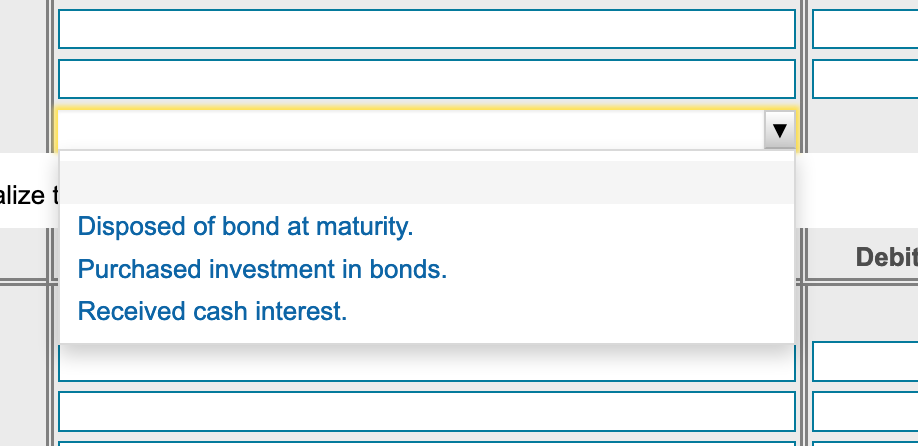

Mile Down & Co. owns vast amounts of corporate bonds. Suppose Mile Down buys $1,400,000 of RoastCo bonds at face value on January 2, 2018. The RoastCo bonds pay interest at the annual rate of 6% on June 30 and December 31 and mature on December 31, 2027. Mile Down intends to hold the investment until maturity. Requirements 1. Journalize any required 2018 entries for the bond investment. 2. How much cash interest will Mile Down receive each year from RoastCo? 3. How much interest revenue will Mile Down report during 2018 on this bond investment? Requirement 1. Journalize any required 2018 entries for the bond investment. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Begin by journalizing Mile Down's investment on January 2, 2018. Date Accounts and Explanation Debit Credit 2018 Jan. 2 Next, journalize the receipt of cash interest on June 30, 2018. Date Accounts and Explanation Debit Credit 2018 Jun. 30 Now journalize the receipt of cash interest on December 31, 2018. Date Accounts and Explanation Debit Credit 2018 Dec. 31 Requirement 2. How much cash interest will Mile Down receive each year from RoastCo? Mile Down will receive $ of cash interest each year from RoastCo. Requirement 3. How much interest revenue will Mile Down report during 2018 on this bond investment? Mile Down will report $ of interest revenue during 2018 on this bond investment. Date Accounts and Explanation Debit 2018 Jan. 2. Debit Available-for-Sale Debt Investments Cash Dividend Revenue Equity Investment Next, journalizet Fair Value Adjustment-Available-for-Sale Fair Value AdjustmentHeld-to-Maturity Date Fair Value AdjustmentTrading 2018 Held-to-Maturity Debt Investments Jun. 30 Interest Revenue Trading Debt Investments Unrealized Holding GainAvailable-for-Sale Unrealized Holding GainHeld-to-Maturity Unrealized Holding GainTrading Unrealized Holding Loss-Available-for-Sale Now journalize th Unrealized Holding Loss-Held-to-Maturity Unrealized Holding Loss-Trading Date Debit alizet Disposed of bond at maturity. Purchased investment in bonds. Received cash interest. Debit