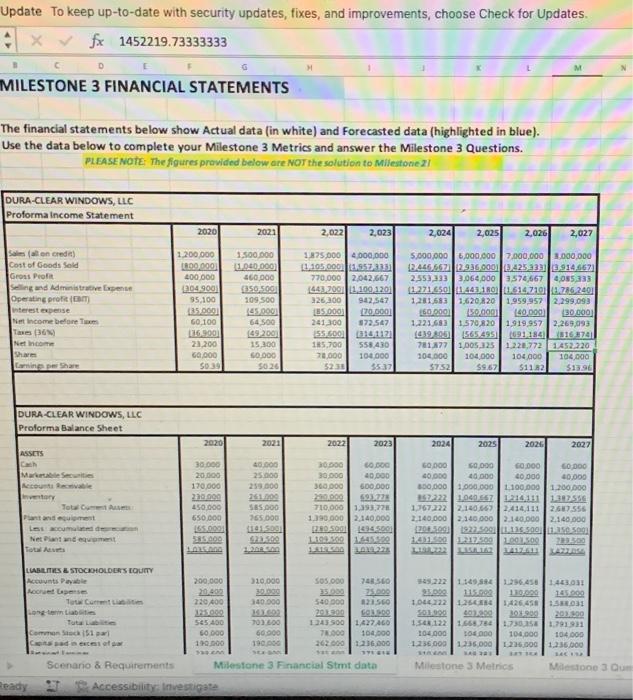

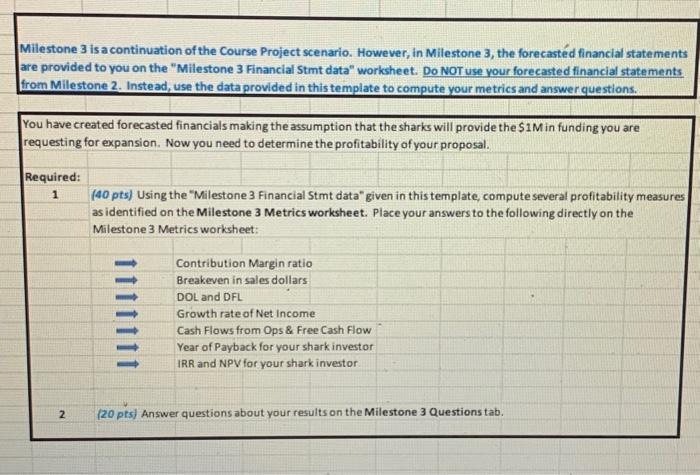

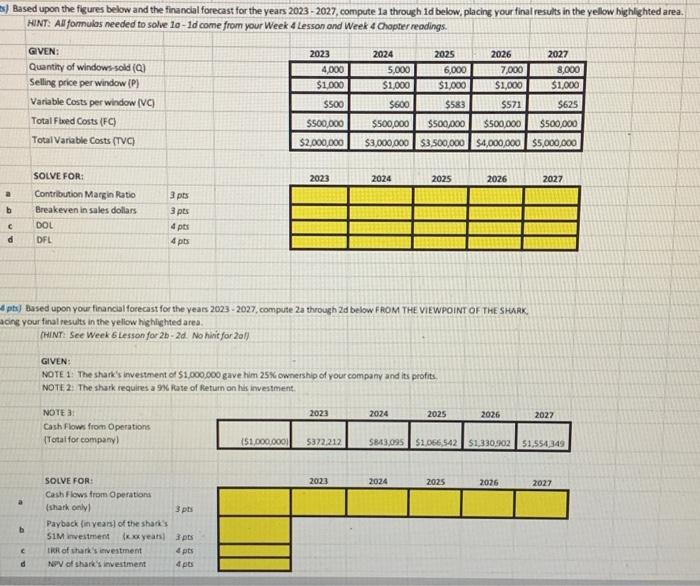

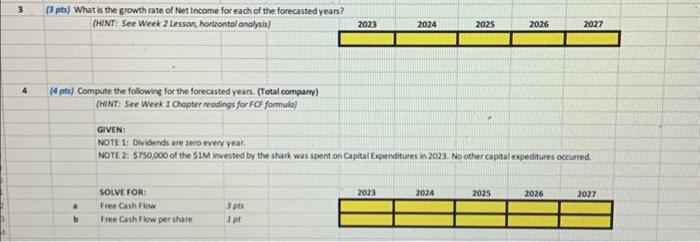

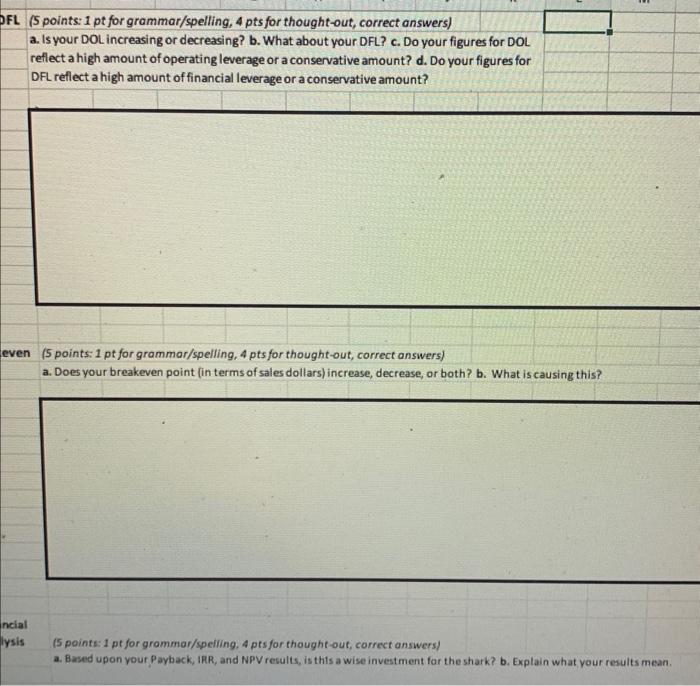

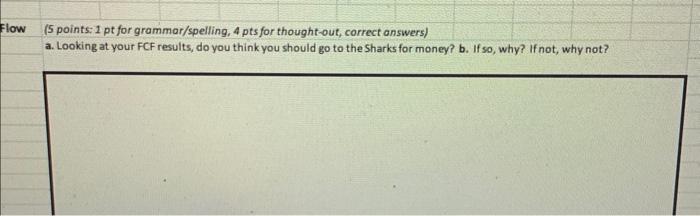

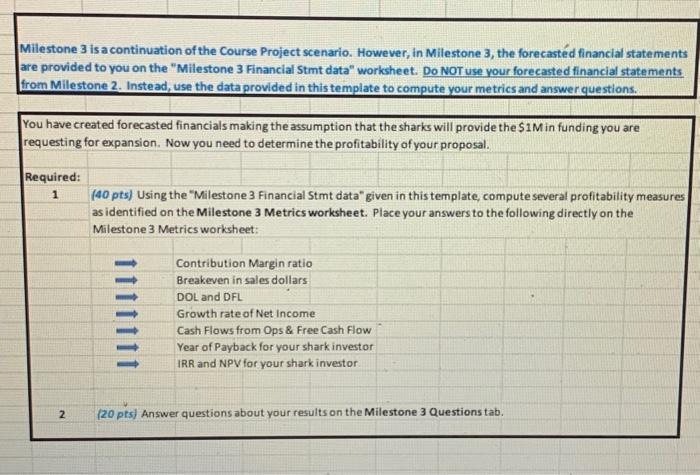

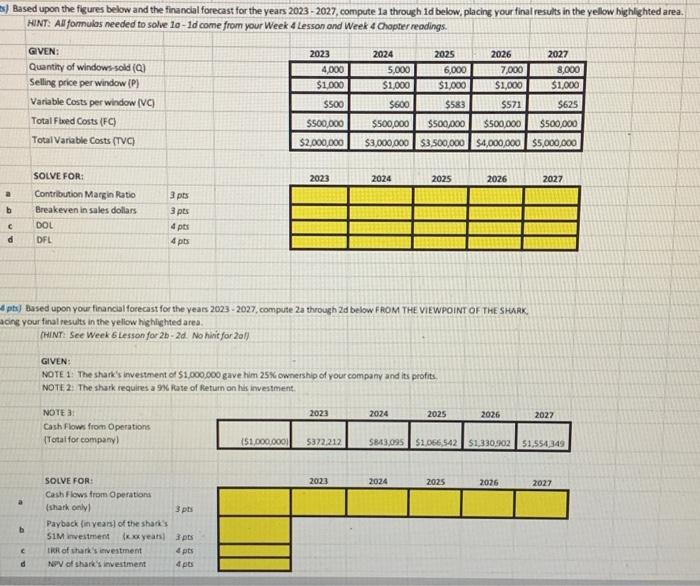

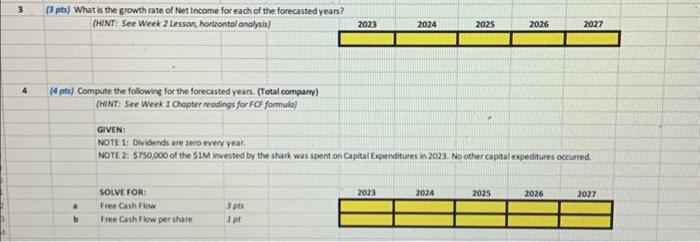

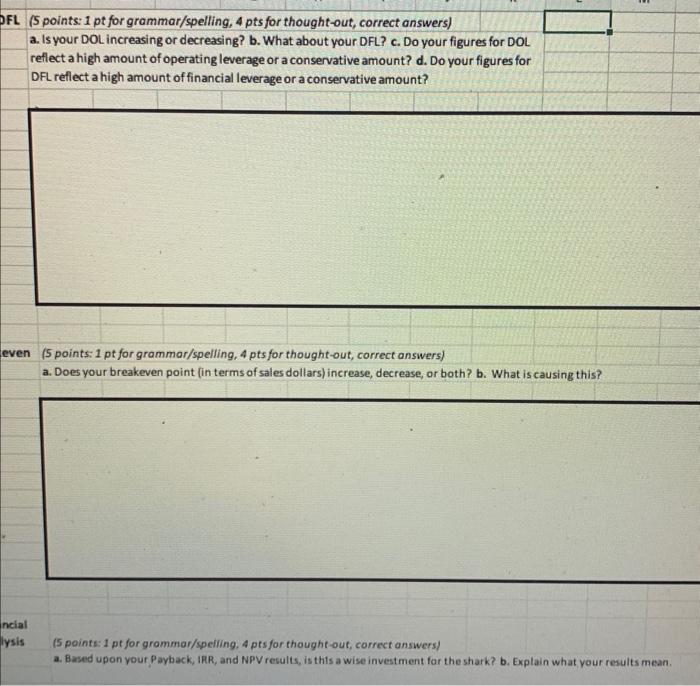

Milestone 3 is a continuation of the Course Project scenario. However, in Milestone 3 , the forecastd financial statements are provided to you on the "Milestone 3 Financial Stmt data" worksheet. Do NOT use your forecasted financial statements from Milestone 2. Instead, use the data provided in this template to compute your metrics and answer questions. The financial statements below show Actual data lin whitel and Forecasted dat a Ihiehliehted in bluel. (5 points: 1 pt for grammar/spelling, 4 pts for thought-out, correct answers) a. Looking at your FCF results, do you think you should go to the Sharks for money? b. If so, why? If not, why not? 3 (3 pts) What is the growth rate of Net income for each of the forecasted years? (HilNT: See Week 2 Lesson, horizontai anolysis] 4 (4 pts) Compste the following for the forecasted years. (Total compamy) (HINT: See Week 1 Chopter reodings for FCF fomula) GIVEN: NOTE 1: Dividendis are tero every year. NOTE 2: $750,000 of the 51M invested by the shak was spent on Captai frpenditures in 2023. No other capital expeditures occurred. Sotveron: Free Cais fliow Based upon the figures below and the financlal forecast for the years 20232027, compute la through 1d below, placing your final results in the yellow highlighted are HeNT: Alf fomulas needed to solve 10 -1d come from your Week 4 Lesson and Week 4 Chopter readings. GVEN: Quantity of windows sold (Q) Selling price per window (P) Variable Costs per window (VC) TotalFbed Costs (FC) Total Variable Costs (TVC) SOLVE FOR: Contribution Matgin Rlatio 3 pts Ereakeven in sales dollars 3 pts Dot 4 pts cdDOLDFL 4pb pts) Based upon your financial forecast for the years 2023 - 2027, compute 2 a through 2d below FROM THE VIEWPOINT OF THE SHAR, ing your final results in the yellow highighted area. (HiNT: Sce Week GL Lesson for 2b2d No hinit for 2al) GIVEN: NOTE 1: The shark's imeitment of 51,000,000 gave him 25\% ownership of rour compamy and its profits. NOT1, 2: The shark requires a 90 frate of Return on his irvestment. (5 points: 1 pt for grommar/speling, 4 ptsfor thought-out, correct answers) a. Based upon your Payback, IRR, and NPV results, is this a wise investment for the shark? b. Explain what your results mean. Milestone 3 is a continuation of the Course Project scenario. However, in Milestone 3 , the forecastd financial statements are provided to you on the "Milestone 3 Financial Stmt data" worksheet. Do NOT use your forecasted financial statements from Milestone 2. Instead, use the data provided in this template to compute your metrics and answer questions. The financial statements below show Actual data lin whitel and Forecasted dat a Ihiehliehted in bluel. (5 points: 1 pt for grammar/spelling, 4 pts for thought-out, correct answers) a. Looking at your FCF results, do you think you should go to the Sharks for money? b. If so, why? If not, why not? 3 (3 pts) What is the growth rate of Net income for each of the forecasted years? (HilNT: See Week 2 Lesson, horizontai anolysis] 4 (4 pts) Compste the following for the forecasted years. (Total compamy) (HINT: See Week 1 Chopter reodings for FCF fomula) GIVEN: NOTE 1: Dividendis are tero every year. NOTE 2: $750,000 of the 51M invested by the shak was spent on Captai frpenditures in 2023. No other capital expeditures occurred. Sotveron: Free Cais fliow Based upon the figures below and the financlal forecast for the years 20232027, compute la through 1d below, placing your final results in the yellow highlighted are HeNT: Alf fomulas needed to solve 10 -1d come from your Week 4 Lesson and Week 4 Chopter readings. GVEN: Quantity of windows sold (Q) Selling price per window (P) Variable Costs per window (VC) TotalFbed Costs (FC) Total Variable Costs (TVC) SOLVE FOR: Contribution Matgin Rlatio 3 pts Ereakeven in sales dollars 3 pts Dot 4 pts cdDOLDFL 4pb pts) Based upon your financial forecast for the years 2023 - 2027, compute 2 a through 2d below FROM THE VIEWPOINT OF THE SHAR, ing your final results in the yellow highighted area. (HiNT: Sce Week GL Lesson for 2b2d No hinit for 2al) GIVEN: NOTE 1: The shark's imeitment of 51,000,000 gave him 25\% ownership of rour compamy and its profits. NOT1, 2: The shark requires a 90 frate of Return on his irvestment. (5 points: 1 pt for grommar/speling, 4 ptsfor thought-out, correct answers) a. Based upon your Payback, IRR, and NPV results, is this a wise investment for the shark? b. Explain what your results mean