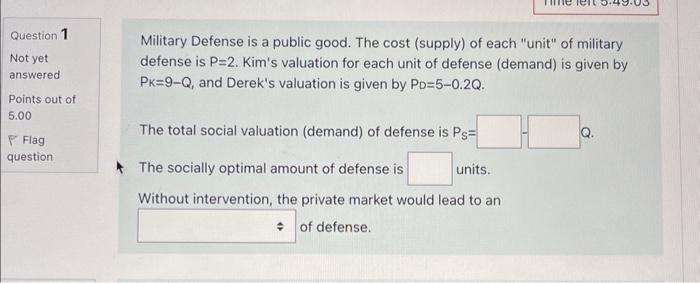

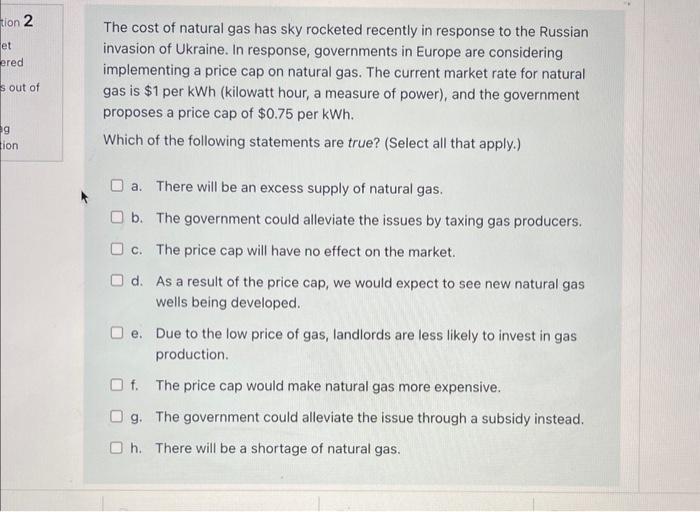

Military Defense is a public good. The cost (supply) of each "unit" of military defense is P=2. Kim's valuation for each unit of defense (demand) is given by PK=9Q, and Derek's valuation is given by PD=50.2Q. The total social valuation (demand) of defense is PS= The socially optimal amount of defense is units. Without intervention, the private market would lead to an of defense. The cost of natural gas has sky rocketed recently in response to the Russian invasion of Ukraine. In response, governments in Europe are considering implementing a price cap on natural gas. The current market rate for natural gas is $1 per kWh (kilowatt hour, a measure of power), and the government proposes a price cap of $0.75 per kWh. Which of the following statements are true? (Select all that apply.) a. There will be an excess supply of natural gas. b. The government could alleviate the issues by taxing gas producers. c. The price cap will have no effect on the market. d. As a result of the price cap, we would expect to see new natural gas wells being developed. e. Due to the low price of gas, landlords are less likely to invest in gas production. f. The price cap would make natural gas more expensive. g. The government could alleviate the issue through a subsidy instead. h. There will be a shortage of natural gas. Military Defense is a public good. The cost (supply) of each "unit" of military defense is P=2. Kim's valuation for each unit of defense (demand) is given by PK=9Q, and Derek's valuation is given by PD=50.2Q. The total social valuation (demand) of defense is PS= The socially optimal amount of defense is units. Without intervention, the private market would lead to an of defense. The cost of natural gas has sky rocketed recently in response to the Russian invasion of Ukraine. In response, governments in Europe are considering implementing a price cap on natural gas. The current market rate for natural gas is $1 per kWh (kilowatt hour, a measure of power), and the government proposes a price cap of $0.75 per kWh. Which of the following statements are true? (Select all that apply.) a. There will be an excess supply of natural gas. b. The government could alleviate the issues by taxing gas producers. c. The price cap will have no effect on the market. d. As a result of the price cap, we would expect to see new natural gas wells being developed. e. Due to the low price of gas, landlords are less likely to invest in gas production. f. The price cap would make natural gas more expensive. g. The government could alleviate the issue through a subsidy instead. h. There will be a shortage of natural gas