Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Milk & Cream processes milk and produces yogurt and cream with skim milk as the by product. The milk is processed in the Churning

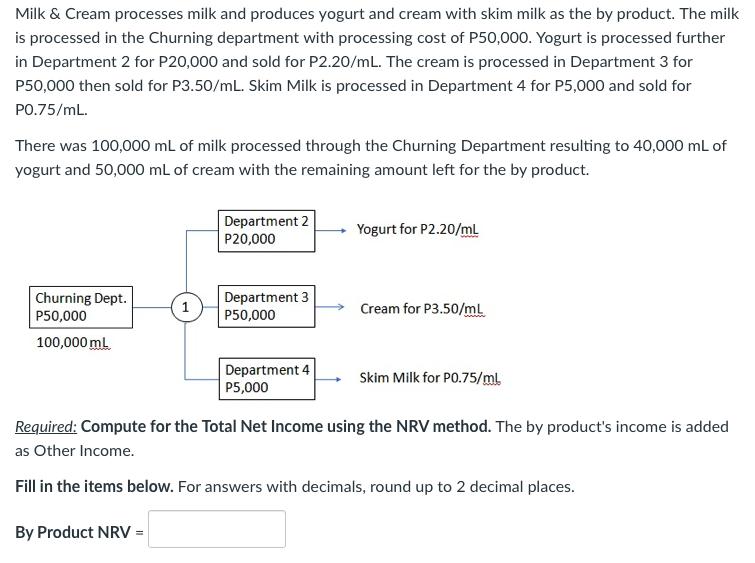

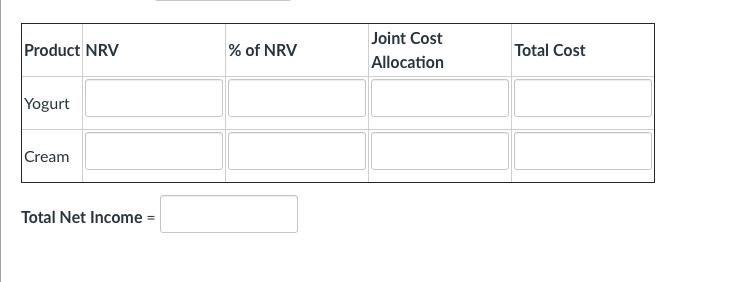

Milk & Cream processes milk and produces yogurt and cream with skim milk as the by product. The milk is processed in the Churning department with processing cost of P50,000. Yogurt is processed further in Department 2 for P20,000 and sold for P2.20/mL. The cream is processed in Department 3 for P50,000 then sold for P3.50/mL. Skim Milk is processed in Department 4 for P5,000 and sold for PO.75/mL. There was 100,000 mL of milk processed through the Churning Department resulting to 40,000 mL of yogurt and 50,000 mL of cream with the remaining amount left for the by product. Churning Dept. P50,000 100,000 mL 1 By Product NRV Department 2 P20,000 Department 3 P50,000 Department 4 P5,000 Yogurt for P2.20/mL Cream for P3.50/mL Skim Milk for P0.75/ml Required: Compute for the Total Net Income using the NRV method. The by product s income is added as Other Income. Fill in the items below. For answers with decimals, round up to 2 decimal places. Product NRV Yogurt Cream Total Net Income = % of NRV Joint Cost Allocation Total Cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Sno Particulars Skim Milk i By product produced in ML 10000 1000004000050000 ii S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started