Answered step by step

Verified Expert Solution

Question

1 Approved Answer

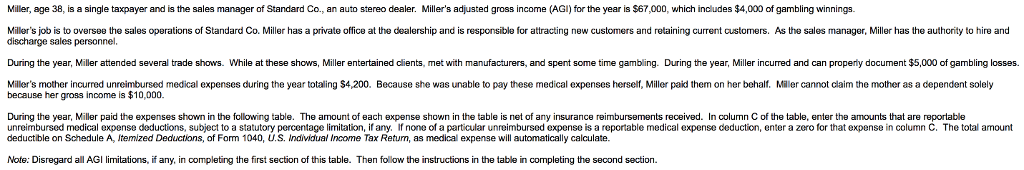

Miller, age 38, is a single taxpayer and is the sales manager of Standard Co., an auto stereo dealer. Miller's adjusted gross income (AGI) for

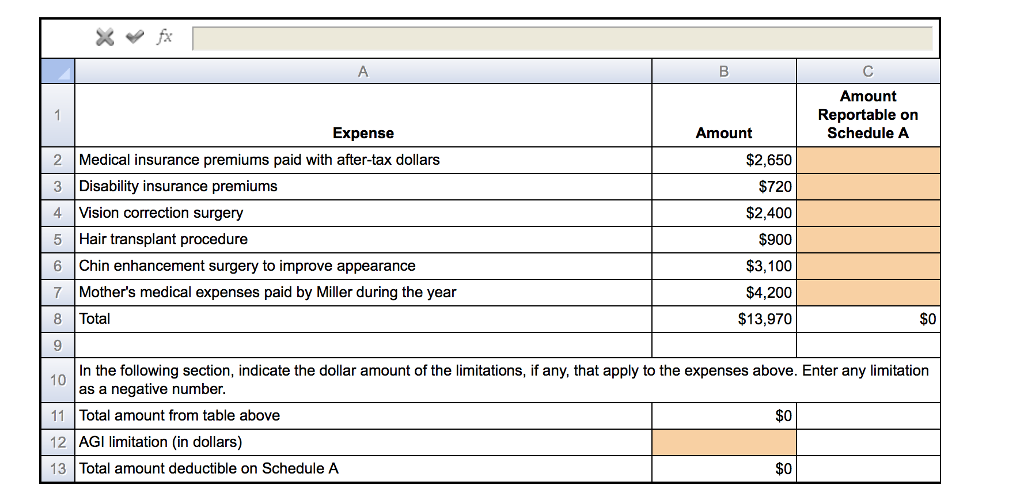

Miller, age 38, is a single taxpayer and is the sales manager of Standard Co., an auto stereo dealer. Miller's adjusted gross income (AGI) for the year is $67,000, which includes $4,000 of gambling winnings. Miller's job is to oversee the sales operations of Standard Co. Miller has a private office at the dealership and is responsible for attracting new customers and retaining current customers. As the sales manager, Miller has the authority to hire and discharge sales personnel During the year, Miller attended several trade shows. While at these shows, Miller entertained clients, met with manufacturers, and spent some time gambling. During the year, Miller incurred and can properly document $5,000 of gambling losses. Miller's mother incurred unreimbursed medical expenses during the year totaling $4.200. Because she was unable to pay these medical expenses herself, Miller paid them on her behalf. Miller cannot claim the mother as a dependent solely because her gross income is $10,000. During the year. Miller paid the expenses shown in the following table. The amount of each expense shown in the table is net of any insurance reimbursements received In column C of the table, enter the amounts that are reportable unreimbursed medical expense deductions, subject to a statutory percentage limitation, if any. If none of a particular unreimbursed expense is a reportable medical expense deduction, enter a zero for that expense in column C. The total amount deductible on Schedule A, Itemized Deductions, of Form 1040, U.S. Individual Income Tax Return, as medical expense will automatically calculate. Note: Disregard all AGI limitations, if any, in completing the first section of this table. Then follow the instructions in the table in completing the second

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started