Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Miller Company acquired an 80 percent interest in Taylor Company on January 1,2022. Miller paid $912,000 in cash to the owners of Taylor to acquire

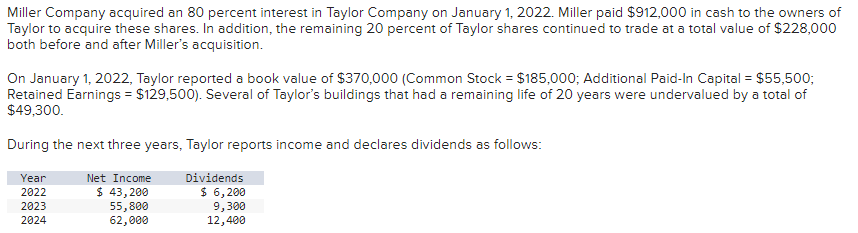

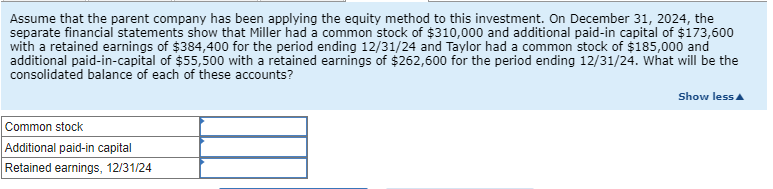

Miller Company acquired an 80 percent interest in Taylor Company on January 1,2022. Miller paid $912,000 in cash to the owners of Taylor to acquire these shares. In addition, the remaining 20 percent of Taylor shares continued to trade at a total value of $228,000 both before and after Miller's acquisition. On January 1, 2022, Taylor reported a book value of $370,000 (Common Stock =$185,000; Additional Paid-In Capital =$55,500; Retained Earnings =$129,500 ). Several of Taylor's buildings that had a remaining life of 20 years were undervalued by a total of $49,300. During the next three years, Taylor reports income and declares dividends as follows: Assume that the parent company has been applying the equity method to this investment. On December 31,2024 , the separate financial statements show that Miller had a common stock of $310,000 and additional paid-in capital of $173,600 with a retained earnings of $384,400 for the period ending 12/31/24 and Taylor had a common stock of $185,000 and additional paid-in-capital of $55,500 with a retained earnings of $262,600 for the period ending 12/31/24. What will be the consolidated balance of each of these accounts

Miller Company acquired an 80 percent interest in Taylor Company on January 1,2022. Miller paid $912,000 in cash to the owners of Taylor to acquire these shares. In addition, the remaining 20 percent of Taylor shares continued to trade at a total value of $228,000 both before and after Miller's acquisition. On January 1, 2022, Taylor reported a book value of $370,000 (Common Stock =$185,000; Additional Paid-In Capital =$55,500; Retained Earnings =$129,500 ). Several of Taylor's buildings that had a remaining life of 20 years were undervalued by a total of $49,300. During the next three years, Taylor reports income and declares dividends as follows: Assume that the parent company has been applying the equity method to this investment. On December 31,2024 , the separate financial statements show that Miller had a common stock of $310,000 and additional paid-in capital of $173,600 with a retained earnings of $384,400 for the period ending 12/31/24 and Taylor had a common stock of $185,000 and additional paid-in-capital of $55,500 with a retained earnings of $262,600 for the period ending 12/31/24. What will be the consolidated balance of each of these accounts Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started