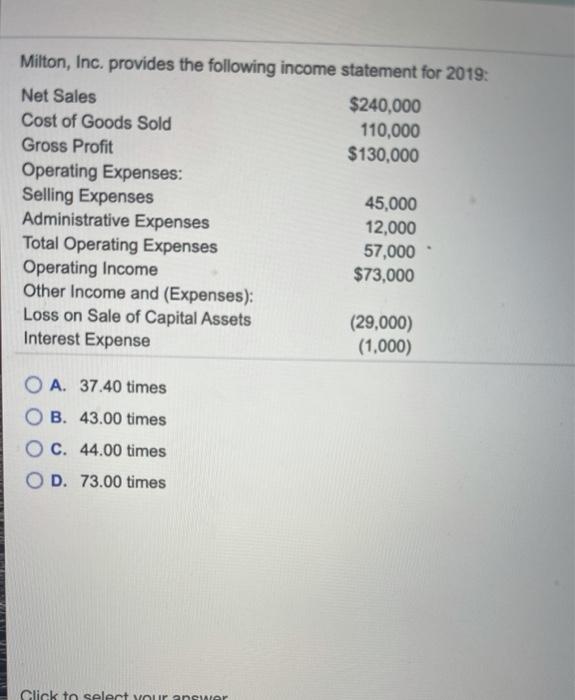

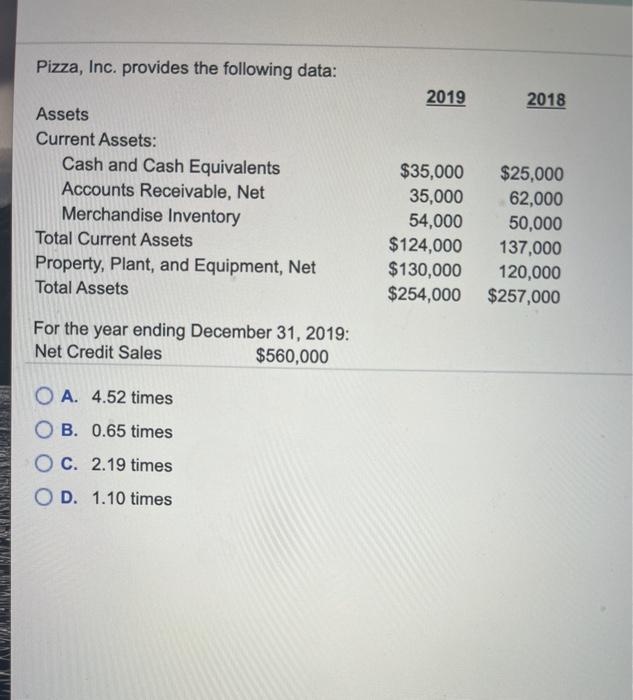

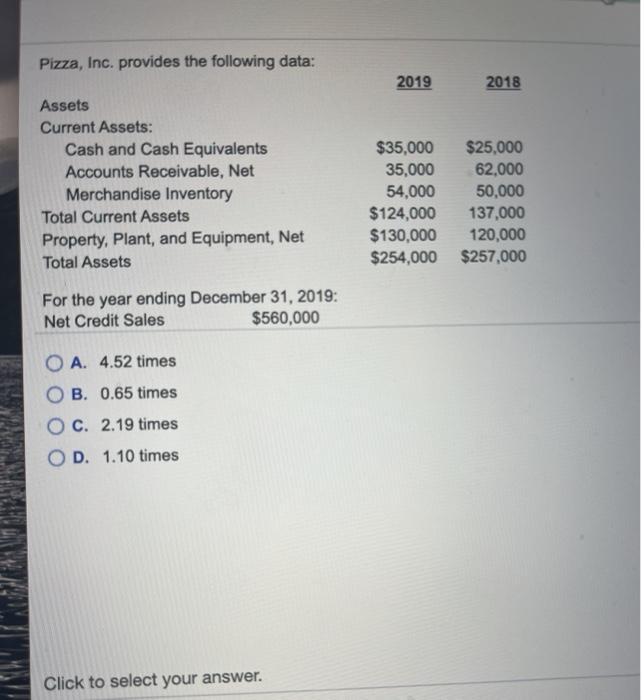

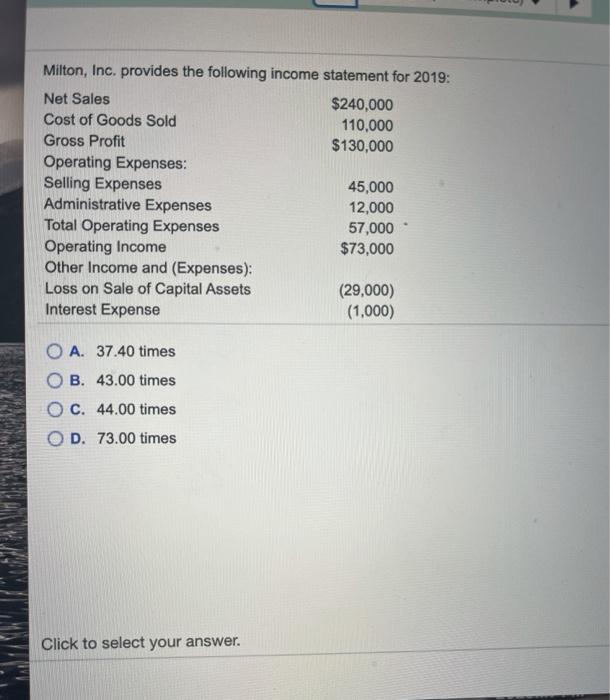

Milton, Inc. provides the following income statement for 2019: Net Sales $240,000 Cost of Goods Sold 110,000 Gross Profit $130,000 Operating Expenses: Selling Expenses 45,000 Administrative Expenses 12,000 Total Operating Expenses 57,000 Operating Income $73,000 Other Income and (Expenses): Loss on Sale of Capital Assets (29,000) Interest Expense (1,000) O A. 37.40 times OB. 43.00 times O C. 44.00 times OD. 73.00 times Click to select your answer Pizza, Inc. provides the following data: 2019 2018 Assets Current Assets: Cash and Cash Equivalents Accounts Receivable, Net Merchandise Inventory Total Current Assets Property, Plant, and Equipment, Net Total Assets $35,000 35,000 54,000 $124,000 $130,000 $254,000 $25,000 62,000 50,000 137,000 120,000 $257,000 For the year ending December 31, 2019: Net Credit Sales $560,000 O A. 4.52 times OB. 0.65 times O C. 2.19 times OD. 1.10 times WITHIN Pizza, Inc. provides the following data: 2019 2018 Assets Current Assets: Cash and Cash Equivalents Accounts Receivable, Net Merchandise Inventory Total Current Assets Property, Plant, and Equipment, Net Total Assets $35,000 35,000 54,000 $124,000 $130,000 $254,000 $25,000 62,000 50,000 137,000 120,000 $257,000 For the year ending December 31, 2019: Net Credit Sales $560,000 O A. 4.52 times B. 0.65 times O c. 2.19 times OD. 1.10 times Click to select your answer. Milton, Inc. provides the following income statement for 2019: Net Sales $240,000 Cost of Goods Sold 110,000 Gross Profit $130,000 Operating Expenses: Selling Expenses 45,000 Administrative Expenses 12,000 Total Operating Expenses 57,000 Operating Income $73,000 Other Income and (Expenses): Loss on Sale of Capital Assets (29,000) Interest Expense (1.000) O A. 37.40 times OB. 43.00 times O C. 44.00 times OD. 73.00 times Click to select your answer. Milton, Inc. provides the following income statement for 2019: Net Sales $240,000 Cost of Goods Sold 110,000 Gross Profit $130,000 Operating Expenses: Selling Expenses 45,000 Administrative Expenses 12,000 Total Operating Expenses 57,000 Operating Income $73,000 Other Income and (Expenses): Loss on Sale of Capital Assets (29,000) Interest Expense (1,000) O A. 37.40 times OB. 43.00 times O C. 44.00 times OD. 73.00 times Click to select your answer Pizza, Inc. provides the following data: 2019 2018 Assets Current Assets: Cash and Cash Equivalents Accounts Receivable, Net Merchandise Inventory Total Current Assets Property, Plant, and Equipment, Net Total Assets $35,000 35,000 54,000 $124,000 $130,000 $254,000 $25,000 62,000 50,000 137,000 120,000 $257,000 For the year ending December 31, 2019: Net Credit Sales $560,000 O A. 4.52 times OB. 0.65 times O C. 2.19 times OD. 1.10 times WITHIN Pizza, Inc. provides the following data: 2019 2018 Assets Current Assets: Cash and Cash Equivalents Accounts Receivable, Net Merchandise Inventory Total Current Assets Property, Plant, and Equipment, Net Total Assets $35,000 35,000 54,000 $124,000 $130,000 $254,000 $25,000 62,000 50,000 137,000 120,000 $257,000 For the year ending December 31, 2019: Net Credit Sales $560,000 O A. 4.52 times B. 0.65 times O c. 2.19 times OD. 1.10 times Click to select your answer. Milton, Inc. provides the following income statement for 2019: Net Sales $240,000 Cost of Goods Sold 110,000 Gross Profit $130,000 Operating Expenses: Selling Expenses 45,000 Administrative Expenses 12,000 Total Operating Expenses 57,000 Operating Income $73,000 Other Income and (Expenses): Loss on Sale of Capital Assets (29,000) Interest Expense (1.000) O A. 37.40 times OB. 43.00 times O C. 44.00 times OD. 73.00 times Click to select your