Answered step by step

Verified Expert Solution

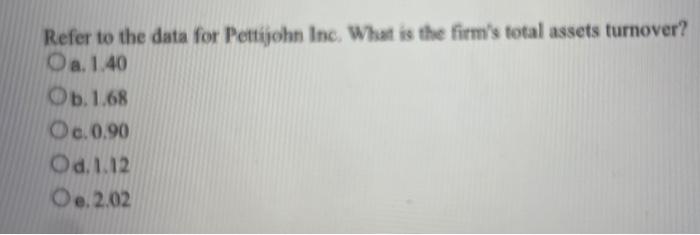

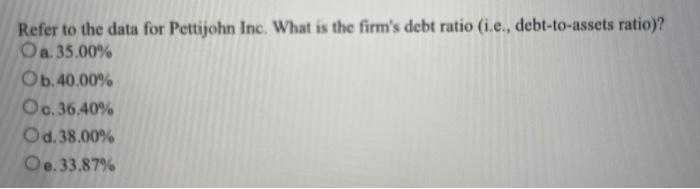

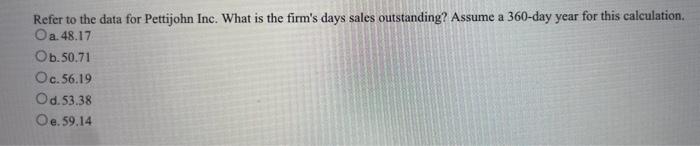

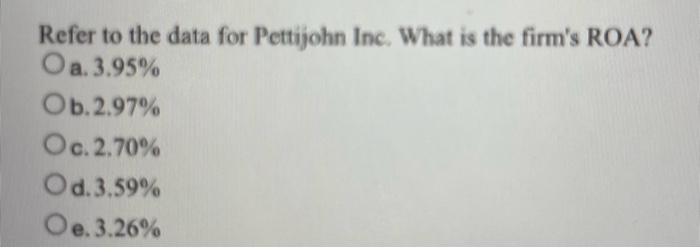

Question

1 Approved Answer

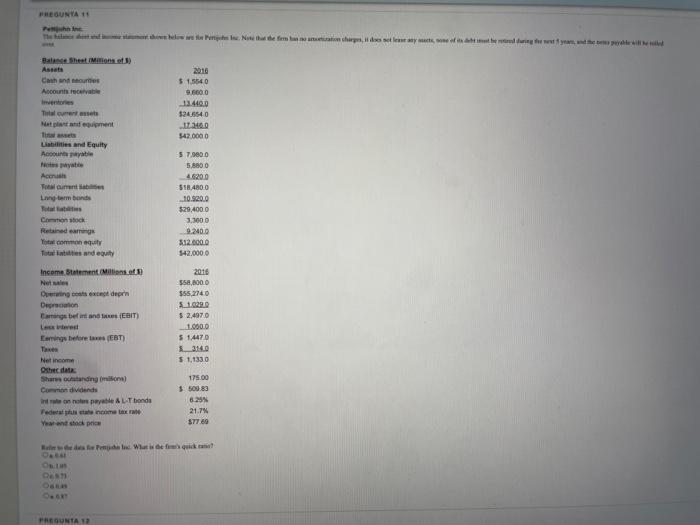

minedusta if Bemiwhn ine the ki Balges sheet railions of 3 ) Liabilities and Equity Aesourth firpatien 57,9800 Anites Natyatio 5sin0 Aceniat Focki carmert iabilise

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started