Answered step by step

Verified Expert Solution

Question

1 Approved Answer

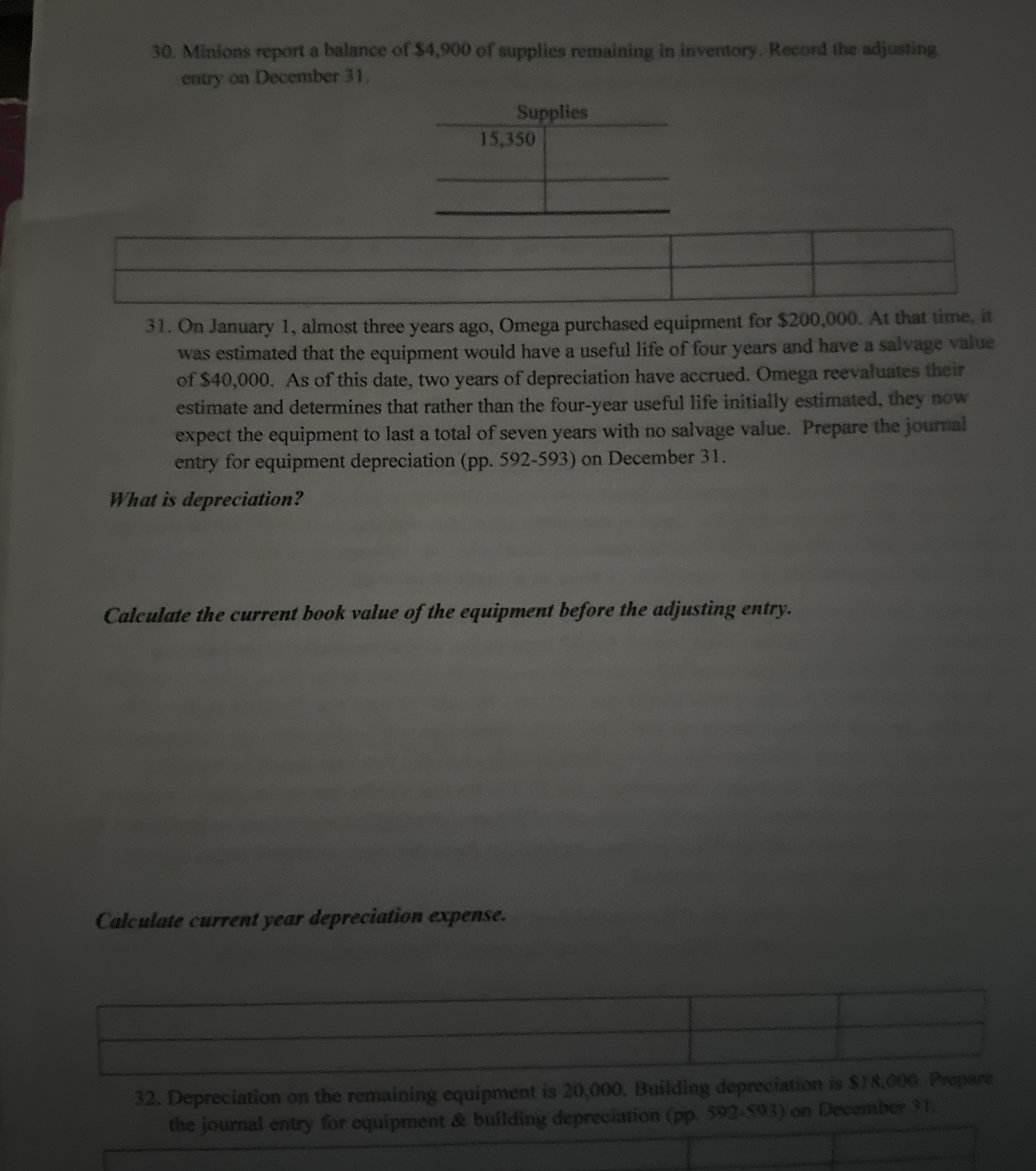

Minfons report a balance of $ 4 , 9 0 0 of supplies rEmaining in inventury. Resond the afivisiry entry on December 3 1 .

Minfons report a balance of $ of supplies rEmaining in inventury. Resond the afivisiry

entry on December

On January almost three years ago, Omega purchased equipment for $ At that time it

was estimated that the equipment would have a useful life of four years and have a salvage value

of $ As of this date, two years of depreciation have accrued. Omega reevaluates thent

estimate and determines that rather than the fouryear useful life initially estimated, they now

expect the equipment to last a total of seven years with no salvage value. Prepare the journas

entry for equipment depreciation pp on December

What is depreciation?

Calculate the current book value of the equipment before the adjusting entry.

Minions report a balance of $ of supplies remaining in invertory. Record the adjusting

entry on December

On January almost three years ago, Omega purchased equipment for $ At that time, it

was estimated that the equipment would have a useful life of four years and have a salvage value

of $ As of this date, two years of depreciation have accrued. Omega reevaluates their

estimate and determines that rather than the fouryear useful life initially estimated, they now

expect the equipment to last a total of seven years with no salvage value. Prepare the journal

entry for equipment depreciation pp on December

What is depreciation?

Calculate the current book value of the equipment before the adjusting entry.

Calculate current year depreciation expense.

Depreciation on the remaining equipment is Buikding depreciation is $ prepare

the journal entry for equipment & building depreciation p on December

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started