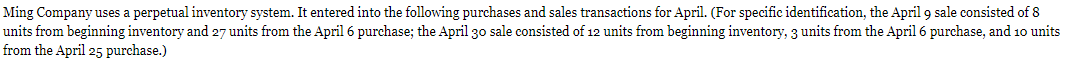

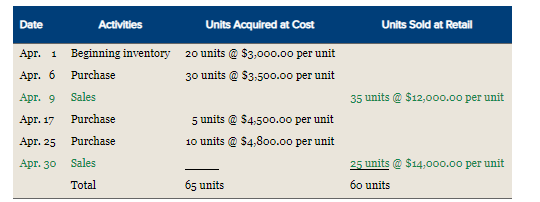

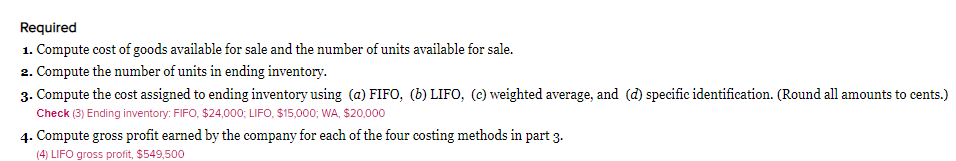

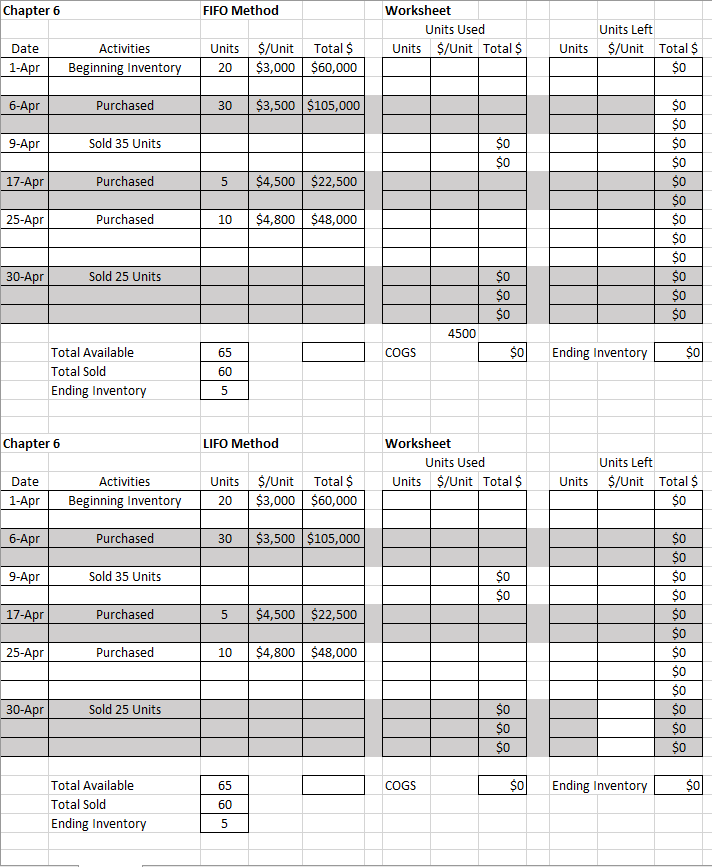

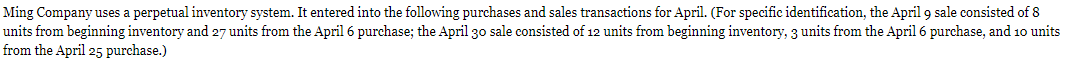

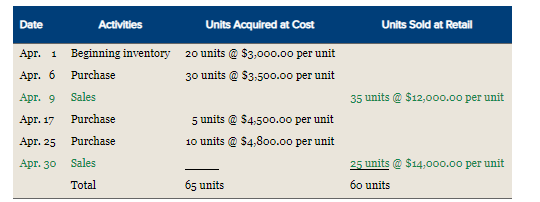

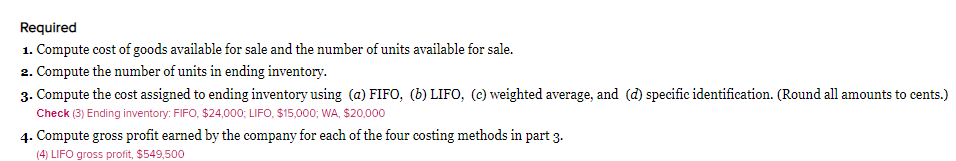

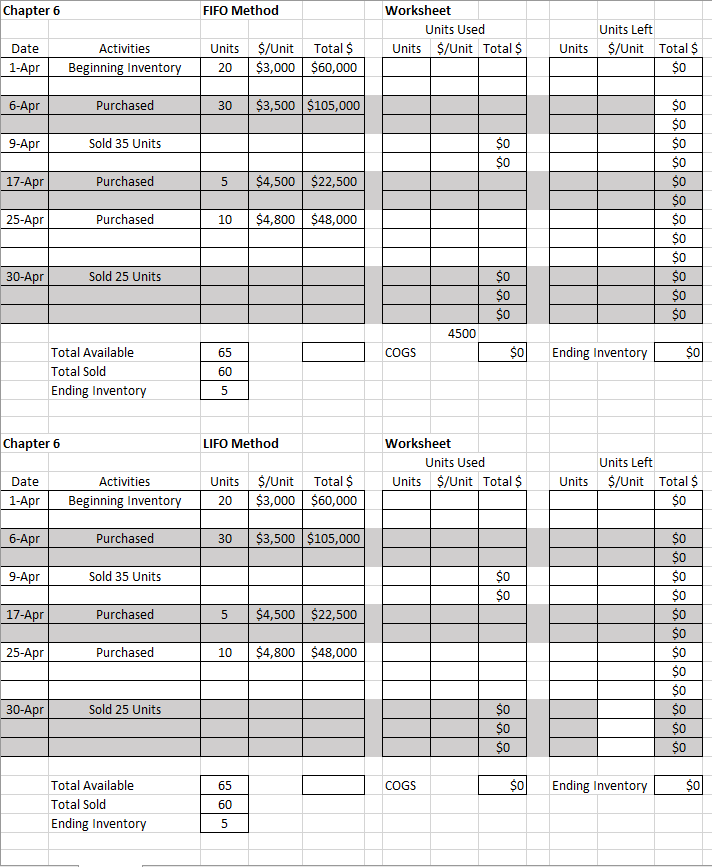

Ming Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for April. (For specific identification, the April 9 sale consisted of 8 units from beginning inventory and 27 units from the April 6 purchase; the April 30 sale consisted of 12 units from beginning inventory, 3 units from the April 6 purchase, and 10 units from the April 25 purchase.) Units Sold at Retail 35 units @ $12,000.00 per unit Date Activities Units Acquired at Cost Apr. 1 Beginning inventory 20 units @ $3,000.00 per unit Apr. 6 Purchase 30 units @ $3,500.00 per unit Apr. 9 Sales Apr. 17 Purchase 5 units @ $4,500.00 per unit Apr. 25 Purchase 10 units @ $4,800.00 per unit Apr. 30 Sales Total 65 units 25 units @ $14,000.00 per unit 60 units Required 1. Compute cost of goods available for sale and the number of units available for sale. 2. Compute the number of units in ending inventory. 3. Compute the cost assigned to ending inventory using (a) FIFO, (6) LIFO, (C) weighted average, and (d) specific identification. (Round all amounts to cents.) Check (3) Ending inventory: FIFO, $24,000; LIFO, $15,000; WA, $20,000 4. Compute gross profit earned by the company for each of the four costing methods in part 3. (4) LIFO gross profit, $549,500 Chapter 6 FIFO Method Worksheet Units Used Units $/Unit Total $ Units Date 1-Apr Activities Beginning Inventory Units $/Unit Total $ 20 $3,000 $60,000 Units Left $/Unit Total $ $0 6-Apr Purchased 30 $3,500 $105,000 9-Apr Sold 35 Units $0 $0 17-Apr Purchased 5 $4,500 $22,500 $0 $0 $0 $0 $0 $0 $0 $0 $0 SO $0 $0 25-Apr Purchased 10 $4,800 $48,000 30-Apr Sold 25 Units $0 SO $0 4500 65 COGS $0 Ending Inventory $0 Total Available Total Sold Ending Inventory 60 5 Chapter 6 LIFO Method Worksheet Units Used Units $/Unit Total $ Units Date 1-Apr Activities Beginning Inventory Units 20 $/Unit Total $ $3,000 $60,000 Units Left $/Unit Total $ $0 6-Apr Purchased 30 $3,500 $105,000 9-Apr Sold 35 Units $0 $0 17-Apr Purchased 5 $4,500 $22,500 SO $0 $0 $0 $0 SO $0 $0 $0 SO $0 SO 25-Apr Purchased 10 $4,800 $48,000 30-Apr Sold 25 Units $0 $0 $0 65 COGS $0 Ending Inventory $0 Total Available Total Sold Ending Inventory 60 5