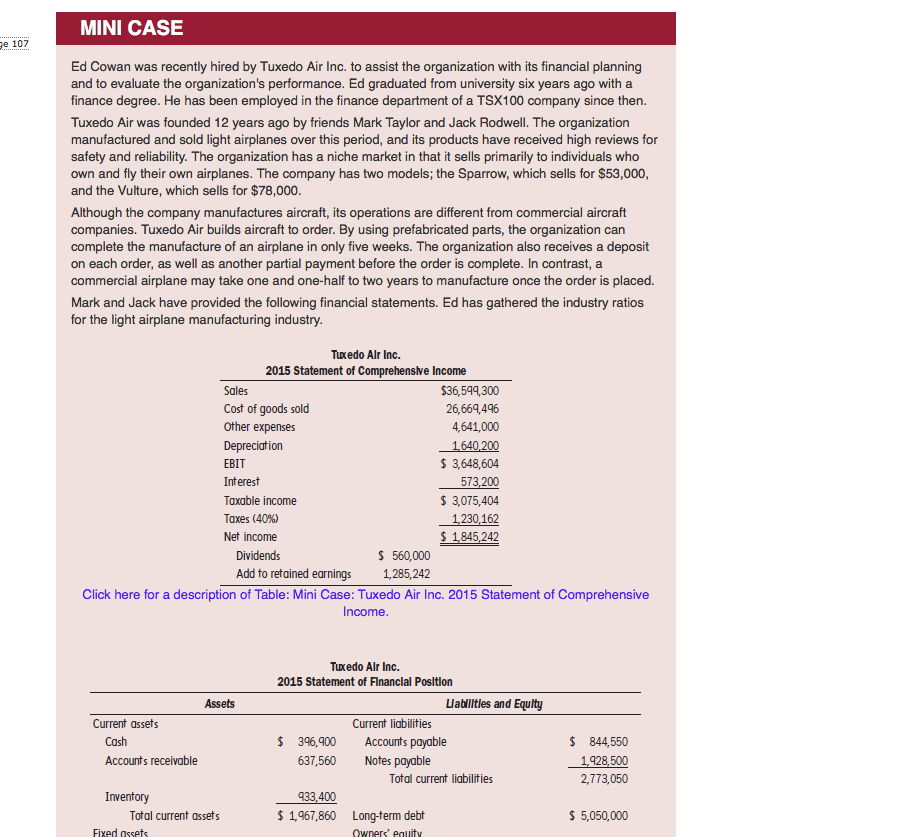

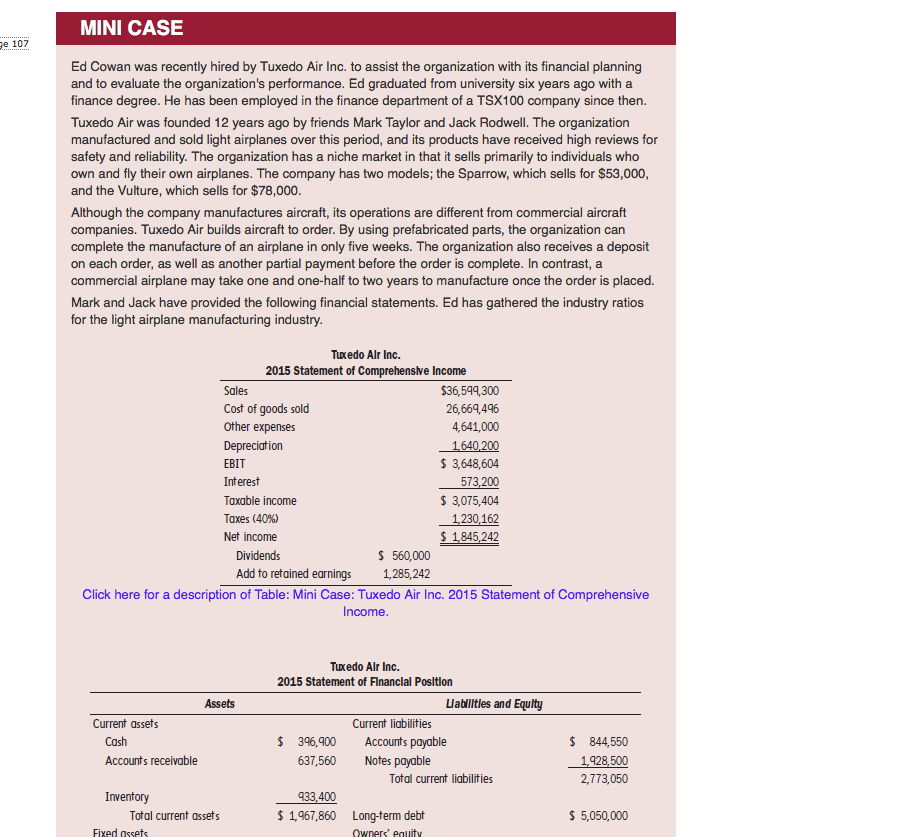

MINI CASE ge 107 Ed Cowan was recently hired by Tuxedo Air Inc. to assist the organization with its financial planning and to evaluate the organization's performance. Ed graduated from university six years ago with a finance degree. He has been employed in the finance department of a TSX100 company since then. Tuxedo Air was founded 12 years ago by friends Mark Taylor and Jack Rodwell. The organization manufactured and sold light airplanes over this period, and its products have received high reviews for safety and reliability. The organization has a niche market in that it sells primarily to individuals who own and fly their own airplanes. The company has two models; the Sparrow, which sells for $53,000, and the Vulture, which sells for $78,000. Although the company manufactures aircraft, its operations are different from commercial aircraft companies. Tuxedo Air builds aircraft to order. By using prefabricated parts, the organization can complete the manufacture of an airplane in only five weeks. The organization also receives a deposit on each order, as well as another partial payment before the order is complete. In contrast, a commercial airplane may take one and one-half to two years to manufacture once the order is placed. Mark and Jack have provided the following financial statements. Ed has gathered the industry ratios for the light airplane manufacturing industry. Tuxedo Alr Inc. 2015 Statement of Comprehensive Income Sales $36,599,300 Cost of goods sold 26,669,496 Other expenses 4,641,000 Depreciation 1.640,200 EBIT $ 3,648,604 Interest 573,200 Taxable income $ 3,075,404 Taxes (40%) 1,230,162 Net income $ 1,845,242 Dividends $ 560,000 Add to retained earnings 1,285,242 Click here for a description of Table: Mini Case: Tuxedo Air Inc. 2015 Statement of Comprehensive Income. Assets Current assets Cash Tuxedo Alr Inc. 2015 Statement of Financial Position Llabilities and Equity Current liabilities $ 396,900 Accounts payable 637,560 Notes payable Total current liabilities 933,400 $ 1,967,860 Long-term debt Accounts receivable $ 844,550 1,928,500 2,773,050 Inventory Total current assets Fixed assets $ 5,050,000 Owners' equity MINI CASE ge 107 Ed Cowan was recently hired by Tuxedo Air Inc. to assist the organization with its financial planning and to evaluate the organization's performance. Ed graduated from university six years ago with a finance degree. He has been employed in the finance department of a TSX100 company since then. Tuxedo Air was founded 12 years ago by friends Mark Taylor and Jack Rodwell. The organization manufactured and sold light airplanes over this period, and its products have received high reviews for safety and reliability. The organization has a niche market in that it sells primarily to individuals who own and fly their own airplanes. The company has two models; the Sparrow, which sells for $53,000, and the Vulture, which sells for $78,000. Although the company manufactures aircraft, its operations are different from commercial aircraft companies. Tuxedo Air builds aircraft to order. By using prefabricated parts, the organization can complete the manufacture of an airplane in only five weeks. The organization also receives a deposit on each order, as well as another partial payment before the order is complete. In contrast, a commercial airplane may take one and one-half to two years to manufacture once the order is placed. Mark and Jack have provided the following financial statements. Ed has gathered the industry ratios for the light airplane manufacturing industry. Tuxedo Alr Inc. 2015 Statement of Comprehensive Income Sales $36,599,300 Cost of goods sold 26,669,496 Other expenses 4,641,000 Depreciation 1.640,200 EBIT $ 3,648,604 Interest 573,200 Taxable income $ 3,075,404 Taxes (40%) 1,230,162 Net income $ 1,845,242 Dividends $ 560,000 Add to retained earnings 1,285,242 Click here for a description of Table: Mini Case: Tuxedo Air Inc. 2015 Statement of Comprehensive Income. Assets Current assets Cash Tuxedo Alr Inc. 2015 Statement of Financial Position Llabilities and Equity Current liabilities $ 396,900 Accounts payable 637,560 Notes payable Total current liabilities 933,400 $ 1,967,860 Long-term debt Accounts receivable $ 844,550 1,928,500 2,773,050 Inventory Total current assets Fixed assets $ 5,050,000 Owners' equity