Answered step by step

Verified Expert Solution

Question

1 Approved Answer

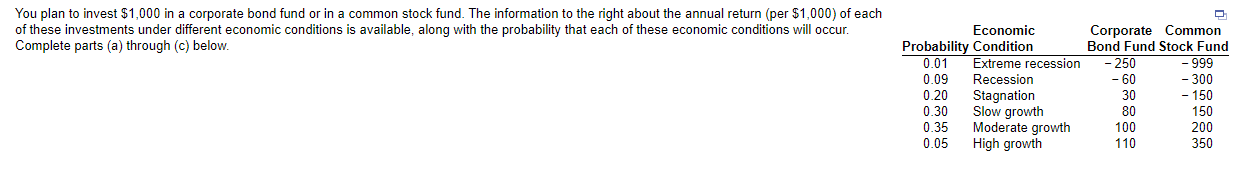

You plan to invest $ 1 , 0 0 0 in a corporate bond fund or in a common stock fund. The information to the

You plan to invest $ in a corporate bond fund or in a common stock fund. The information to the right about the annual return per $ of each

of these investments under different economic conditions is available, along with the probability that each of these economic conditions will occur.

Complete parts a through c below. a Compute the expected return for the corporate bond fund and for the common stock fund.

The expected return for the corporate bond fund is

Round to two decimal places as needed.

The expected return for the common stock fund is

Round to two decimal places as needed.

b Compute the standard deviation for the corporate bond fund and for the common stock fund.

The standard deviation for the corporate bond fund is

Round to two decimal places as needed.

The standard deviation for the common stock fund is

Round to two decimal places as needed.

c Would you invest in the corporate bond fund or the common stock fund? Explain.

Based on the expected value, the common stock fund should be chosen. Since the standard deviation for the common stock fund is more than three times greater than that for the corporate bond fund, the common stock fund

is riskier than

the corporate bond fund and an investor

should carefully weigh the risk when makinga

decision.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started