Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MINI CASE Parmalat: Europe's Enron Following such high-profile corporate scandals as Enron and World Com in the United States, European business executives smugly proclaimed

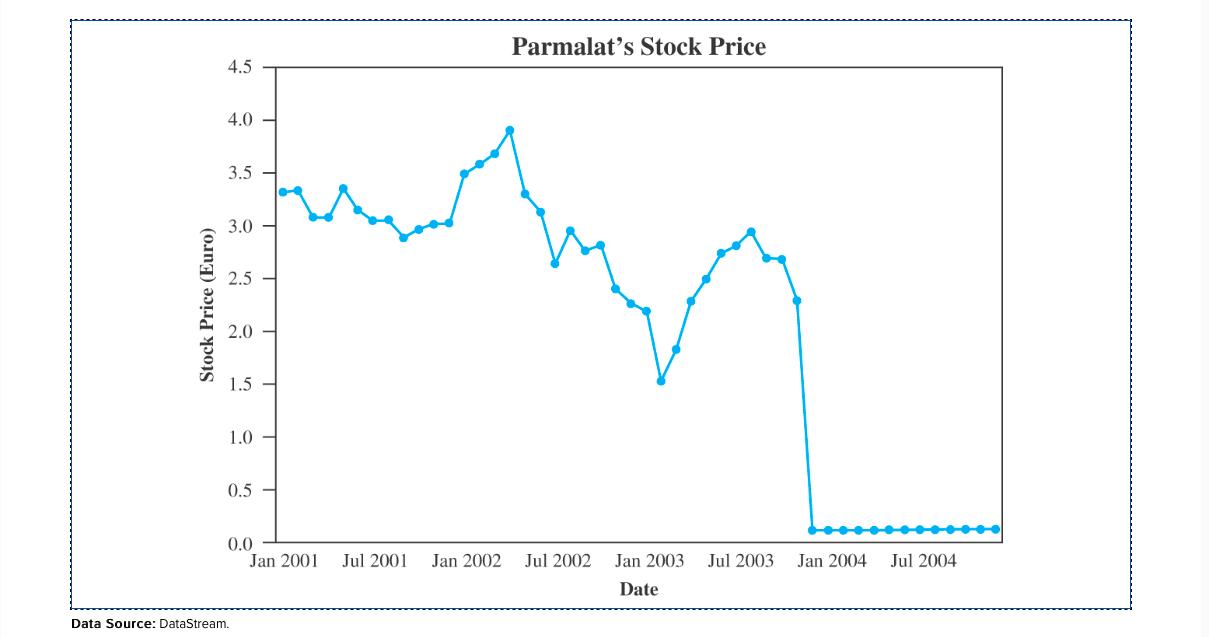

MINI CASE Parmalat: Europe's Enron Following such high-profile corporate scandals as Enron and World Com in the United States, European business executives smugly proclaimed that the same could not happen on their side of the Atlantic as Europe does not share America's laissez-faire capitalism. Unfortunately, however, they were proved wrong quickly when Parmalat, a jewel of Italian capitalism, collapsed spectacularly as a result of massive accounting frauds. Page 113 Parmalat was founded in 1961 as a dairy company. Calisto Tanzi, the founder, transformed Parmalat into a national player by embarking on an aggressive acquisition program in the 1980s when local governments of Italy privatized their municipal dairies. While solidifying its dominant position in the Italian home market, Parmalat aggressively ventured into international markets during the 1990s, establishing operations in 30 countries throughout the Americas, Asia/Pacific, and Southern Africa. To finance its rapid expansion, the company borrowed heavily from international banks and investors. Worldwide sales of Parmalat reached 7.6 billion in 2002 and its aspiration to become the Coca-Cola of milk seemed within reach. However, things began to unravel in 2003. Stock Price (Euro) 4.5 4.0 3.5- 3.0 2.5 2.0 1.5 1.0 0.5- Parmalat's Stock Price 0.0 Jan 2001 Jul 2001 Jan 2002 Jul 2002 Data Source: DataStream. Jan 2003 Jul 2003 Date Jan 2004 Jul 2004 Parmalat first defaulted on a $185 million debt payment in November 2003, which prompted a scrutiny of the firm's finances. Auditors and regulators soon found out that a $4.9 billion cash reserve supposedly held in a Bank of America account of the Cayman Island subsidiary of Parmalat actually did not exist, and that the total debt of the company was around 16 billion- more than double the amount (7.2 billion) shown on the balance sheet. Italian investigators subsequently discovered that Parmalat managers simply "invented assets" to cover the company's debts and falsified accounts over a 15-year period. Following the discovery of massive frauds, Parmalat was forced into bankruptcy in December 2003. Calisto Tanzi, founder and former CEO, was arrested on suspicion of fraud, embezzlement, false accounting, and misleading investors. The Parmalat saga represents the largest and most brazen corporate fraud case in European history and is widely dubbed Europe's Enron. Enrico Bondi, a new CEO of Parmalat, filed a $10 billion lawsuit against Citigroup, Bank of America, and former auditors Grant Thornton and Deloitte Touche Tohmatsu, for sharing responsibility for the company's collapse. He also filed legal actions against UBS of Switzerland and Deutsche Bank for the transactions that allegedly contributed to the collapse of Parmalat. Bondi has alleged that Parmalat's foreign "enablers," including international banks and auditors, were complicit in the frauds. He maintained that they knew about Parmalat's fraudulent finances and helped the company to disguise them in exchange for fat fees. Bondi effectively declared a war on Parmalat's international bankers and creditors. The accompanying graph illustrates Parmalat's share price behavior. Following a sharp drop in share price, trading of the company's shares was suspended on December 22, 2003. Discussion Points 1. How was it possible for Parmalat managers to "cook the books" and hide it for so long? 2. Investigate and discuss the role that international banks and auditors might have played in Parmalat's collapse. 3. Study and discuss Italy's corporate governance regime and its role in the failure of Parmalat. Page 114

Step by Step Solution

★★★★★

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Ans 1 Parmalats managers cooked books and kept it a secret for so long by 1 Managers falsified assets by inventing records that represented nonexisting assets to acquire loans from banks 2 Banks did n...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started