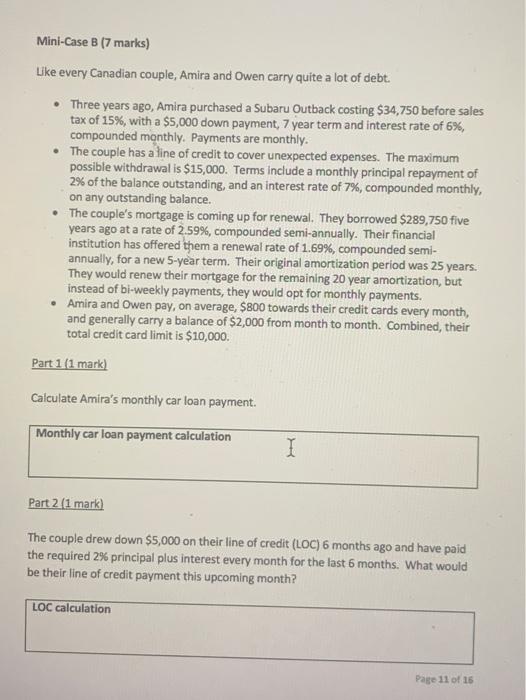

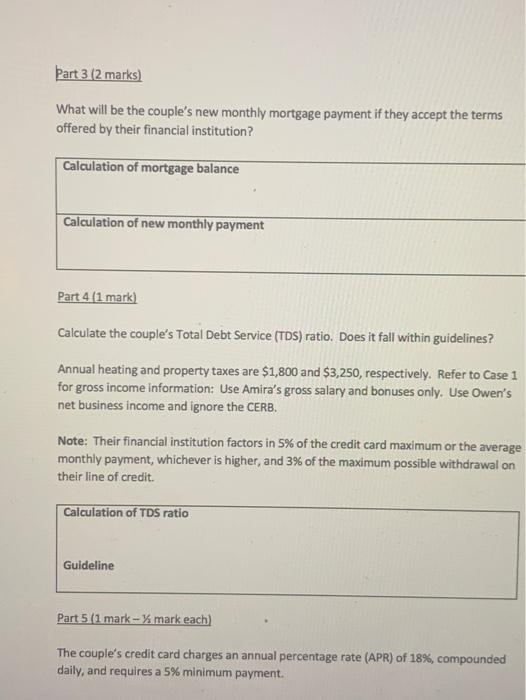

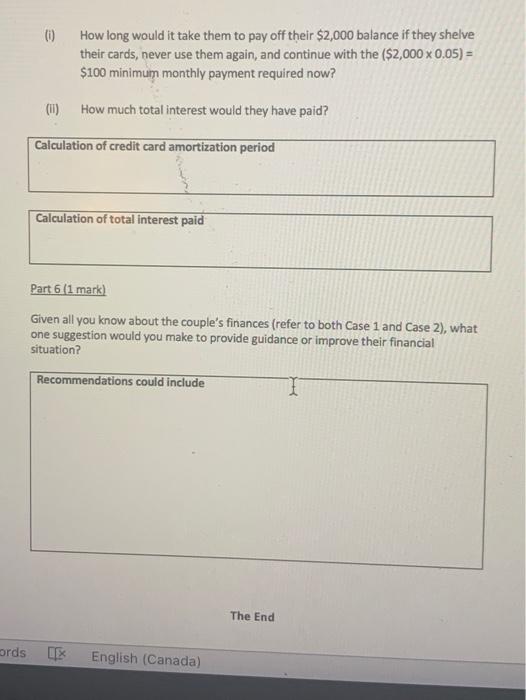

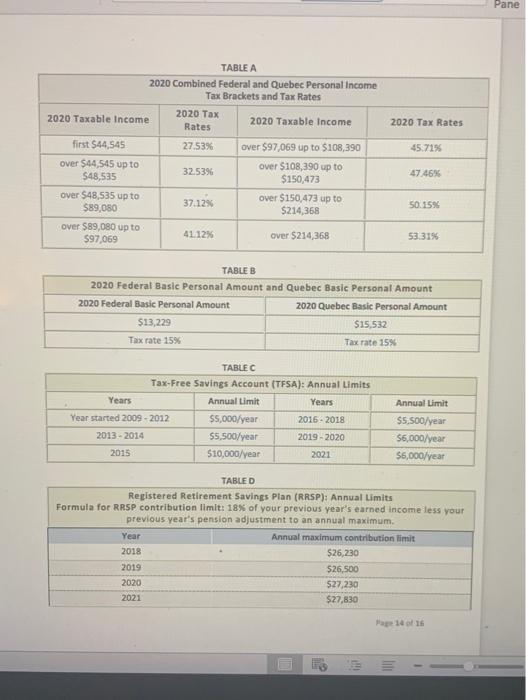

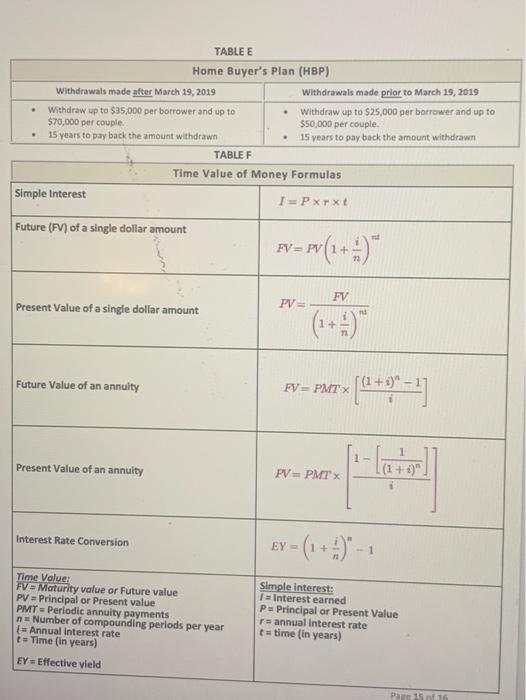

Mini-Case B (7 marks) Like every Canadian couple, Amira and Owen carry quite a lot of debt. Three years ago, Amira purchased a Subaru Outback costing $34,750 before sales tax of 15%, with a $5,000 down payment, 7 year term and interest rate of 6%, compounded monthly. Payments are monthly. The couple has a line of credit to cover unexpected expenses. The maximum possible withdrawal is $15,000. Terms include a monthly principal repayment of 2% of the balance outstanding, and an interest rate of 7%, compounded monthly, on any outstanding balance. The couple's mortgage is coming up for renewal. They borrowed $289,750 five years ago at a rate of 2.59%, compounded semi-annually. Their financial institution has offered them a renewal rate of 1.69%, compounded semi- annually, for a new 5-year term. Their original amortization period was 25 years. They would renew their mortgage for the remaining 20 year amortization, but instead of bi-weekly payments, they would opt for monthly payments. Amira and Owen pay, on average, $800 towards their credit cards every month, and generally carry a balance of $2,000 from month to month. Combined, their total credit card limit is $10,000. Part 1 (1 mark) Calculate Amira's monthly car loan payment. Monthly car loan payment calculation I Part 2 (1 mark) The couple drew down $5,000 on their line of credit (LOC) 6 months ago and have paid the required 2% principal plus interest every month for the last 6 months. What would be their line of credit payment this upcoming month? LOC calculation Page 11 of 15 part 3 (2 marks) What will be the couple's new monthly mortgage payment if they accept the terms offered by their financial institution? Calculation of mortgage balance Calculation of new monthly payment Part 4 (1 mark) Calculate the couple's Total Debt Service (TDS) ratio. Does it fall within guidelines? Annual heating and property taxes are $1,800 and $3,250, respectively. Refer to Case 1 for gross income information: Use Amira's gross salary and bonuses only. Use Owen's net business income and ignore the CERB. Note: Their financial institution factors in 5% of the credit card maximum or the average monthly payment, whichever is higher, and 3% of the maximum possible withdrawal on their line of credit. Calculation of TDS ratio Guideline Part 5 (1 mark -- % mark each) The couple's credit card charges an annual percentage rate (APR) of 18%, compounded daily, and requires a 5% minimum payment. 00 How long would it take them to pay off their $2,000 balance if they shelve their cards, never use them again, and continue with the ($2,000 x 0.05) = $100 minimum monthly payment required now? How much total interest would they have paid? Calculation of credit card amortization period Calculation of total interest paid Part 6 (1 mark) Given all you know about the couple's finances (refer to both Case 1 and Case 2), what one suggestion would you make to provide guidance or improve their financial situation? Recommendations could include The End ords English (Canada) Pane TABLE A 2020 Combined Federal and Quebec Personal Income Tax Brackets and Tax Rates 2020 Tax 2020 Taxable income 2020 Taxable income Rates 2020 Tax Rates first $44,545 27.53% over $97,069 up to $108,390 45.71% over $44.545 up to $48,535 32.5396 over $108,390 up to $150,473 47.46% over $48,535 up to $89,080 37.12% over $150,473 up to $214,368 50.1596 over $89,080 up to $97,069 41.12% over $214,368 53.31% TABLE B 2020 Federal Basic Personal Amount and Quebec Basic Personal Amount 2020 Federal Basic Personal Amount 2020 Quebec Basic Personal Amount $13,229 $15,532 Tax rate 15% Tax rate 15% TABLE C Tax-Free Savings Account (TFSA): Annual Limits Years Annual Limit Years Annual Limit Year started 2009-2012 $5,000/year 2016. 2018 $5.500/year 2013-2014 2019-2020 $6,000/year $5,500/year $10,000/year 2015 2021 $5,000/year TABLED Registered Retirement Savings Plan (RRSP): Annual Limits Formula for RRSP contribution limit: 18% of your previous year's earned Income less your previous year's pension adjustment to an annual maximum. Year Annual maximum contribution limit 2018 $26,230 2019 $26,500 $27,230 2020 2021 $27,830 Page 1 of 1 TABLE E Home Buyer's Plan (HBP) withdrawals made after March 19, 2019 withdrawals made prior to March 19, 2018 . Withdraw up to $35,000 per borrower and up to $70,000 per couple 15 years to pay back the amount withdrawn Withdraw up to $25,000 per borrower and up to $50,000 per couple 15 years to pay back the amount withdrawn TABLE F Time Value of Money Formulas Simple Interest I=Pxrxt Future (FV) of a single dollar amount FV=PY(1+) FV Present Value of a single dollar amount PV = (1+ :) Future Value of an annuity |(1+)" FPMTX 1- Present Value of an annuity PV = PMTX (1 + :)" Interest Rate Conversion EY = (1+6) Time Value: FV Maturity value or Future value PV = Principal or Present value PMT = Periodic annuity payments n = Number of compounding periods per year Annual Interest rate time (in years) EY = Effective yield Simple interest: I Interest earned Ps Principal or Present Value rs annual Interest rate t = time (in years) Page 15 of 1 Mini-Case B (7 marks) Like every Canadian couple, Amira and Owen carry quite a lot of debt. Three years ago, Amira purchased a Subaru Outback costing $34,750 before sales tax of 15%, with a $5,000 down payment, 7 year term and interest rate of 6%, compounded monthly. Payments are monthly. The couple has a line of credit to cover unexpected expenses. The maximum possible withdrawal is $15,000. Terms include a monthly principal repayment of 2% of the balance outstanding, and an interest rate of 7%, compounded monthly, on any outstanding balance. The couple's mortgage is coming up for renewal. They borrowed $289,750 five years ago at a rate of 2.59%, compounded semi-annually. Their financial institution has offered them a renewal rate of 1.69%, compounded semi- annually, for a new 5-year term. Their original amortization period was 25 years. They would renew their mortgage for the remaining 20 year amortization, but instead of bi-weekly payments, they would opt for monthly payments. Amira and Owen pay, on average, $800 towards their credit cards every month, and generally carry a balance of $2,000 from month to month. Combined, their total credit card limit is $10,000. Part 1 (1 mark) Calculate Amira's monthly car loan payment. Monthly car loan payment calculation I Part 2 (1 mark) The couple drew down $5,000 on their line of credit (LOC) 6 months ago and have paid the required 2% principal plus interest every month for the last 6 months. What would be their line of credit payment this upcoming month? LOC calculation Page 11 of 15 part 3 (2 marks) What will be the couple's new monthly mortgage payment if they accept the terms offered by their financial institution? Calculation of mortgage balance Calculation of new monthly payment Part 4 (1 mark) Calculate the couple's Total Debt Service (TDS) ratio. Does it fall within guidelines? Annual heating and property taxes are $1,800 and $3,250, respectively. Refer to Case 1 for gross income information: Use Amira's gross salary and bonuses only. Use Owen's net business income and ignore the CERB. Note: Their financial institution factors in 5% of the credit card maximum or the average monthly payment, whichever is higher, and 3% of the maximum possible withdrawal on their line of credit. Calculation of TDS ratio Guideline Part 5 (1 mark -- % mark each) The couple's credit card charges an annual percentage rate (APR) of 18%, compounded daily, and requires a 5% minimum payment. 00 How long would it take them to pay off their $2,000 balance if they shelve their cards, never use them again, and continue with the ($2,000 x 0.05) = $100 minimum monthly payment required now? How much total interest would they have paid? Calculation of credit card amortization period Calculation of total interest paid Part 6 (1 mark) Given all you know about the couple's finances (refer to both Case 1 and Case 2), what one suggestion would you make to provide guidance or improve their financial situation? Recommendations could include The End ords English (Canada) Pane TABLE A 2020 Combined Federal and Quebec Personal Income Tax Brackets and Tax Rates 2020 Tax 2020 Taxable income 2020 Taxable income Rates 2020 Tax Rates first $44,545 27.53% over $97,069 up to $108,390 45.71% over $44.545 up to $48,535 32.5396 over $108,390 up to $150,473 47.46% over $48,535 up to $89,080 37.12% over $150,473 up to $214,368 50.1596 over $89,080 up to $97,069 41.12% over $214,368 53.31% TABLE B 2020 Federal Basic Personal Amount and Quebec Basic Personal Amount 2020 Federal Basic Personal Amount 2020 Quebec Basic Personal Amount $13,229 $15,532 Tax rate 15% Tax rate 15% TABLE C Tax-Free Savings Account (TFSA): Annual Limits Years Annual Limit Years Annual Limit Year started 2009-2012 $5,000/year 2016. 2018 $5.500/year 2013-2014 2019-2020 $6,000/year $5,500/year $10,000/year 2015 2021 $5,000/year TABLED Registered Retirement Savings Plan (RRSP): Annual Limits Formula for RRSP contribution limit: 18% of your previous year's earned Income less your previous year's pension adjustment to an annual maximum. Year Annual maximum contribution limit 2018 $26,230 2019 $26,500 $27,230 2020 2021 $27,830 Page 1 of 1 TABLE E Home Buyer's Plan (HBP) withdrawals made after March 19, 2019 withdrawals made prior to March 19, 2018 . Withdraw up to $35,000 per borrower and up to $70,000 per couple 15 years to pay back the amount withdrawn Withdraw up to $25,000 per borrower and up to $50,000 per couple 15 years to pay back the amount withdrawn TABLE F Time Value of Money Formulas Simple Interest I=Pxrxt Future (FV) of a single dollar amount FV=PY(1+) FV Present Value of a single dollar amount PV = (1+ :) Future Value of an annuity |(1+)" FPMTX 1- Present Value of an annuity PV = PMTX (1 + :)" Interest Rate Conversion EY = (1+6) Time Value: FV Maturity value or Future value PV = Principal or Present value PMT = Periodic annuity payments n = Number of compounding periods per year Annual Interest rate time (in years) EY = Effective yield Simple interest: I Interest earned Ps Principal or Present Value rs annual Interest rate t = time (in years) Page 15 of 1