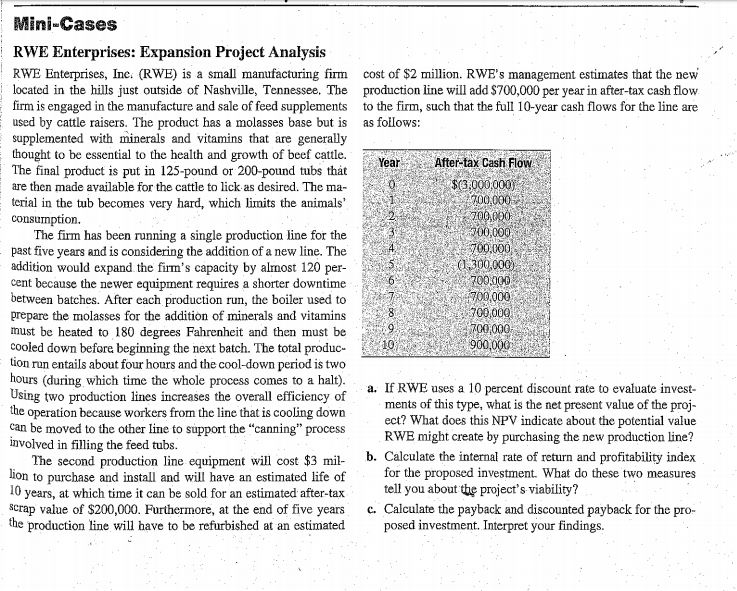

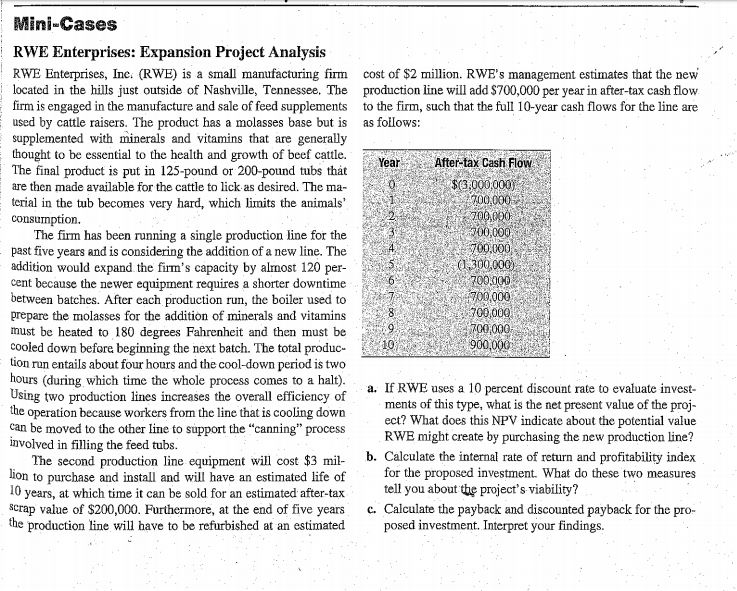

Mini-Cases RWE Enterprises: Expansion Project Analysis RWE Enterprises, Inc. (RWE) is a small manufacturing firm located in the hills just outside of Nashville, Tennessee. The firm is engaged in the manufacture and sale of feed supplements used by cattle raisers. The product has a molasses base but is supplemented with minerals and vitamins that are generally thought to be essential to the health and growth of beef cattle. The final product is put in 125-pound or 200-pound tubs that are then made available for the cattle to lick as desired. The ma- terial in the tub becomes very hard, which limits the animals' consumption cost of $2 million. RWE's management estimates that the new production line will add S700,000 per year in after-tax cash flow to the firm, such that the full 10-year cash flows for the line are as follows YearAfter-tax Cash Flow 2A 013,000,000 100,000 The firm has been running a single production line for the past five years and is considering the addition of a new line. The addition would expand the firm's capacity by almost 120 per cent because the newer equipment requires a shorter downtime between batches. After cach production run, the boiler used to prepare the molasses for the addition of minerals and vitamins must be heated to 180 degrees Fahrenheit and then must be cooled down before beginning the next batch. The total produc tion run entails about four hours and the cool-down period is two hours (during which time the whole process comes to a halo). a. I RWE uses a 10 percent discount rate Using two production lines increases the overall efficiency of the operation because workers from the line that is cooling down can be moved to the other line to support the "canning" process RWE might create by purchasing the new p involved in filling the feed tubs 700000 0300,000) 700000 00,000 700 ,000 C0000 9000 ments of this type, what is the net present value of the proj- ect? What does this NPV indicate about the potential value The second production line equipment will cost $3 mil- b. Calculate the internal rate of return and profitability index lion to purchase and install and will have an estimated life of for the proposed investment. What do these two measures l0 years, at which time it can be sold for an estimated after-tax l you about the project's viability? scrap value of $200,000. Furthermore, at the end of five years c. Calculate the payback and discounted payback for the pro- the production line will have to be refurbished at an estimated posed investment. Interpret your findings