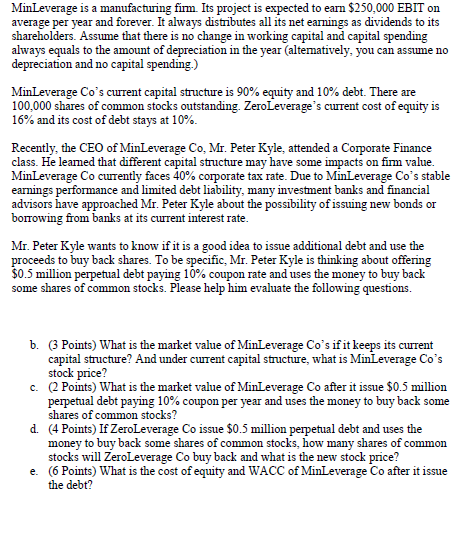

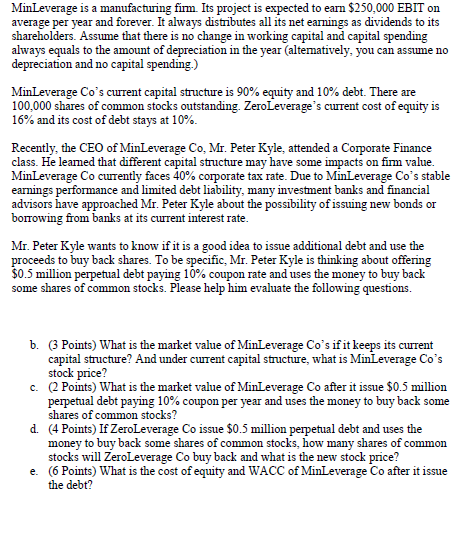

MinLeverage is a manufacturing firm. Its project is expected to earn $250,000 EBIT on average per year and forever. It always distributes all its net earnings as dividends to its shareholders. Assume that there is no change in working capital and capital spending always equals to the amount of depreciation in the year (altematively, you can assume no depreciation and no capital spending.) MinLeverage Co's current capital structure is 90% equity and 10% debt. There are 100,000 shares of common stocks outstanding. ZeroLeverage's current cost of equity is 16% and its cost of debt stays at 10%. Recently, the CEO of MinLeverage Co, Mr. Peter Kyle attended a Corporate Finance class. He leamed that different capital structure may have some impacts on fimm value. MinLeverage Co currently faces 40% corporate tax rate. Due to MinLeverage Co's stable earnings performance and limited debt liability, many investment banks and financial advisors have approached Mr. Peter Kyle about the possibility of issuing new bonds or borrowing from banks at its current interest rate. Mr. Peter Kyle wants to know if it is a good idea to issue additional debt and use the proceeds to buy back shares. To be specific, Mr. Peter Kyle is thinking about offering $0.5 million perpetual debt paying 10% coupon rate and uses the money to buy back some shares of common stocks. Please help him evaluate the following questions. b. (3 Points) What is the market value of MinLeverage Co's if it keeps its current capital structure? And under current capital structure, what is MinLeverage Co's stock price? c. (Points) What is the market value of MinLeverage Co after it issue $0.5 million perpetual debt paying 10% coupon per year and uses the money to buy back some shares of common stocks? d. (4 Points) If ZeroLeverage Co issue $0.5 million perpetual debt and uses the money to buy back some shares of common stocks, how many shares of common stocks will ZeroLeverage Co buy back and what is the new stock price? e. ( Points) What is the cost of equity and WACC of MinLeverage Co after it issue the debt