Answered step by step

Verified Expert Solution

Question

1 Approved Answer

[Mints. Caso IP 1,000. Caso II. 17.000) Treatment of unrealised rent recovered (From AY 2002-03 onwards) (Section 25AA It shall be deemed as income of

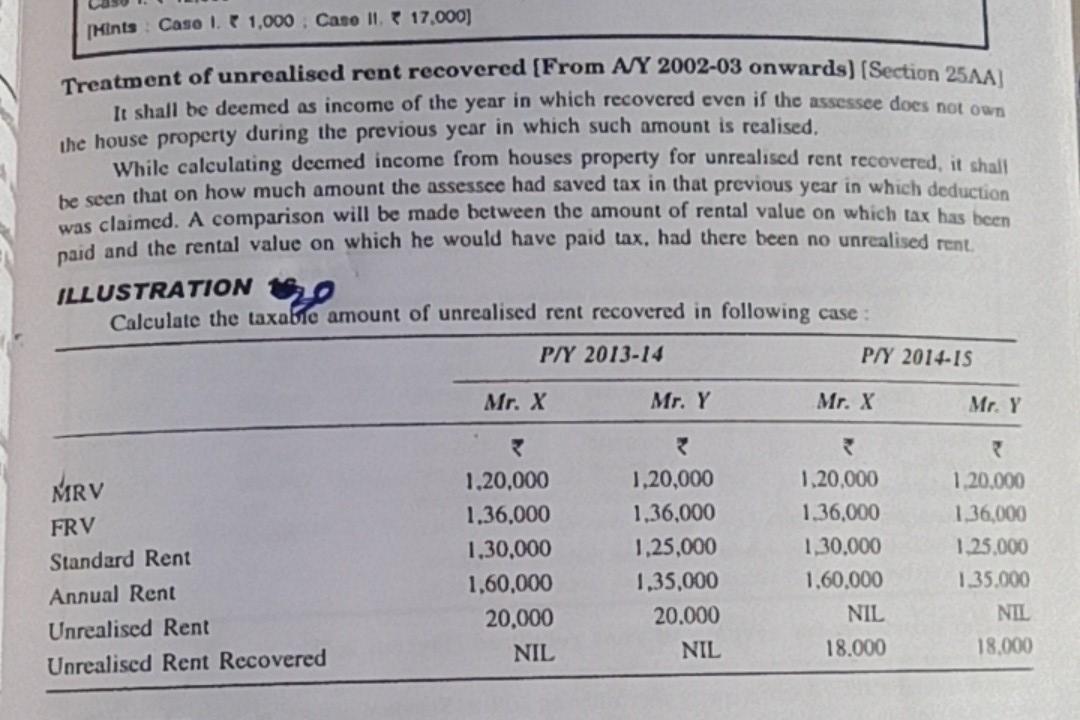

[Mints. Caso IP 1,000. Caso II. 17.000) Treatment of unrealised rent recovered (From AY 2002-03 onwards) (Section 25AA It shall be deemed as income of the year in which recovered even if the assessee does not own the house property during the previous year in which such amount is realised. While calculating deemed income from houses property for unrealised rent recovered, it shall be seen that on how much amount the assessce had saved tax in that previous year in which deduction was claimed. A comparison will be made between the amount of rental value on which tax has been paid and the rental value on which he would have paid tax, had there been no unrealised rent ILLUSTRATION O Calculate the taxable amount of unrealised rent recovered in following case : P/Y 2013-14 P/Y 2014-15 Mr. X Mr. Y Mr. X Mr. Y MRV FRV Standard Rent Annual Rent Unrealised Rent Unrealised Rent Recovered 1.20,000 1.36.000 1,30,000 1,60,000 20,000 NIL 1,20,000 1.36.000 1,25,000 1.35,000 20.000 NIL 1,20,000 1.36,000 1,30,000 1.60.000 NIL 18.000 1.20.000 1,36,000 1.25.000 1.35.000 NIL 18.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started