MIRR unequal lives . Grady Enterprises is looking at two project opportunities for a parcel of land the company currently owns. The first project is a restaurant , and the second project is a sports facility. The projected cash flow of the restaurant is an initial cost of \$1,480,0 with cash flows over the next six years of \$220,000 (year one) $ 220,000 (year two) $ 300,000 years three through five), and $ 1,720,000 (year six ), at which point Grady plans to sell the restaurant The sports facility has the following cash flows: an initial cost of $2,300,000 with cash flows over the next four years of $ 390,000 ( years one through three) and $ 2,860,000 (year four), at which point Grady plans to sell the facility . The appropriate discount rate for the restaurant is 11.0\% and the appropriate discount rate for the sports facility is 12.0% What are the MIRRs for the Grady Enterprises projects ? What are the MIRRs when you adjust for the unequal lives ? Do the MIRR adjusted for unequal lives change the decision based on the MIRRs ? Hint : Take all cash flows to the same ending period as the longest project . If the appropriate reinvestment rate for the restaurant is 11.0%, what is the MIRR of the restaurant project ? % (Round to two decimal places .)

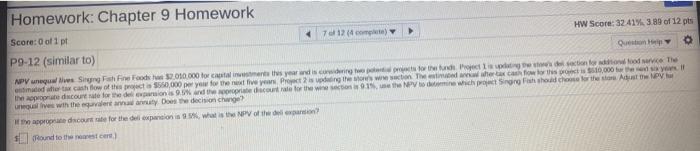

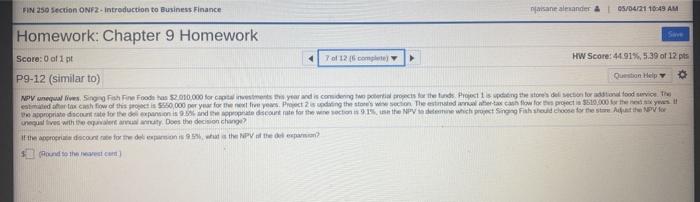

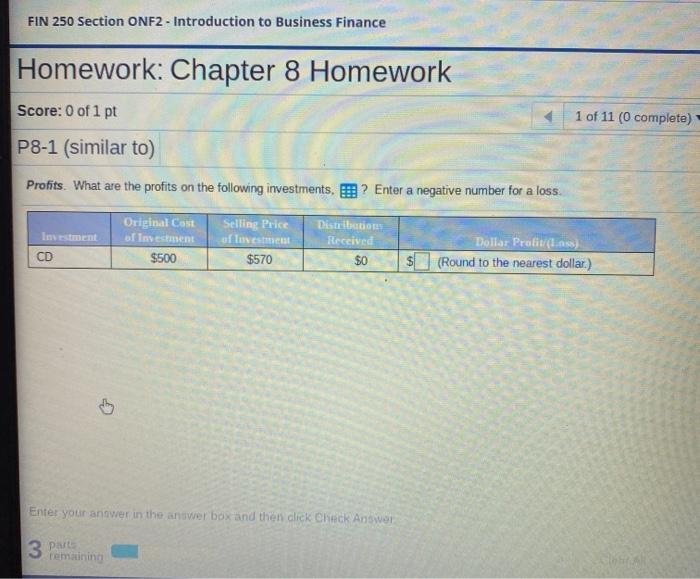

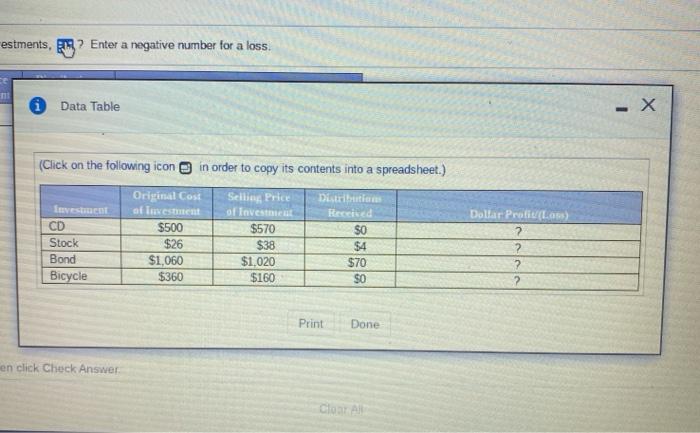

Homework: Chapter 9 Homework Score: 0 of 1 pt 7124cm) HW Score: 32.41% 3.89 of 12 pts P9-12 (similar to) Questo MPV neque Sing Fish Fine Food 10.000 for clients year and is correct secondo med tax cash flow of the actis 5550,000 per year for the next five years propis dinge waton Theraxow to 500.000 the appropriate course for the deleguonis and the recounts for the wine 11NPV one which project Song Fanshod chose the unglives with the equivale aruty Does the decision che? approacourt te forte del pation in what is NPV of dollar SRound to the wester FIN 250 Section ONF2 - Introduction to Business Finance naine ander & 05/04/21 1649 AM Homework: Chapter 9 Homework Score: 0 of 1 pt 7 of 12 11 cm HW Score: 4491%, 5.39 of 12 pts P9-12 (similar to) Question Help NPV nequales Shine Foode has $2.050.000 forint year and is considering to brisateurs Project to the selection for din food serve the har tax cash flow of this project is $580,000 per you for the next five years. Project 2ding the store's Son The estimated when tax cash flow for the project 10,000 for the day e propriate for the power countriate for the sections 315 e NPV in which ting Fish should choose for the store de NV negatives without Does the decisione of the reconstrateforme de post Postele? (und to the area FIN 250 Section ONF2 - Introduction to Business Finance Homework: Chapter 8 Homework Score: 0 of 1 pt 1 of 11 (0 complete) P8-1 (similar to) Profits. What are the profits on the following investments, 6 ? Enter a negative number for a loss Original Cast of Investment $500 Selling Price alueet $570 Distrito Received $0 CD Dollar Profiles) (Round to the nearest dollar.) Enter your answer in the answer box and then dick Check Answer 3 Part remaining estments, Enter a negative number for a loss. i Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) int CD Stock Bond Bicycle Original Cost olluesten $500 $26 $1,060 $360 Selling Price of Investment $570 $38 $1.020 $160 Distribution Beriked SO $4 $70 $0 Dollar Proti (Las) 2 2 2 2 Print Done en click Check Answer COSTA Homework: Chapter 9 Homework Score: 0 of 1 pt 7124cm) HW Score: 32.41% 3.89 of 12 pts P9-12 (similar to) Questo MPV neque Sing Fish Fine Food 10.000 for clients year and is correct secondo med tax cash flow of the actis 5550,000 per year for the next five years propis dinge waton Theraxow to 500.000 the appropriate course for the deleguonis and the recounts for the wine 11NPV one which project Song Fanshod chose the unglives with the equivale aruty Does the decision che? approacourt te forte del pation in what is NPV of dollar SRound to the wester FIN 250 Section ONF2 - Introduction to Business Finance naine ander & 05/04/21 1649 AM Homework: Chapter 9 Homework Score: 0 of 1 pt 7 of 12 11 cm HW Score: 4491%, 5.39 of 12 pts P9-12 (similar to) Question Help NPV nequales Shine Foode has $2.050.000 forint year and is considering to brisateurs Project to the selection for din food serve the har tax cash flow of this project is $580,000 per you for the next five years. Project 2ding the store's Son The estimated when tax cash flow for the project 10,000 for the day e propriate for the power countriate for the sections 315 e NPV in which ting Fish should choose for the store de NV negatives without Does the decisione of the reconstrateforme de post Postele? (und to the area FIN 250 Section ONF2 - Introduction to Business Finance Homework: Chapter 8 Homework Score: 0 of 1 pt 1 of 11 (0 complete) P8-1 (similar to) Profits. What are the profits on the following investments, 6 ? Enter a negative number for a loss Original Cast of Investment $500 Selling Price alueet $570 Distrito Received $0 CD Dollar Profiles) (Round to the nearest dollar.) Enter your answer in the answer box and then dick Check Answer 3 Part remaining estments, Enter a negative number for a loss. i Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) int CD Stock Bond Bicycle Original Cost olluesten $500 $26 $1,060 $360 Selling Price of Investment $570 $38 $1.020 $160 Distribution Beriked SO $4 $70 $0 Dollar Proti (Las) 2 2 2 2 Print Done en click Check Answer COSTA