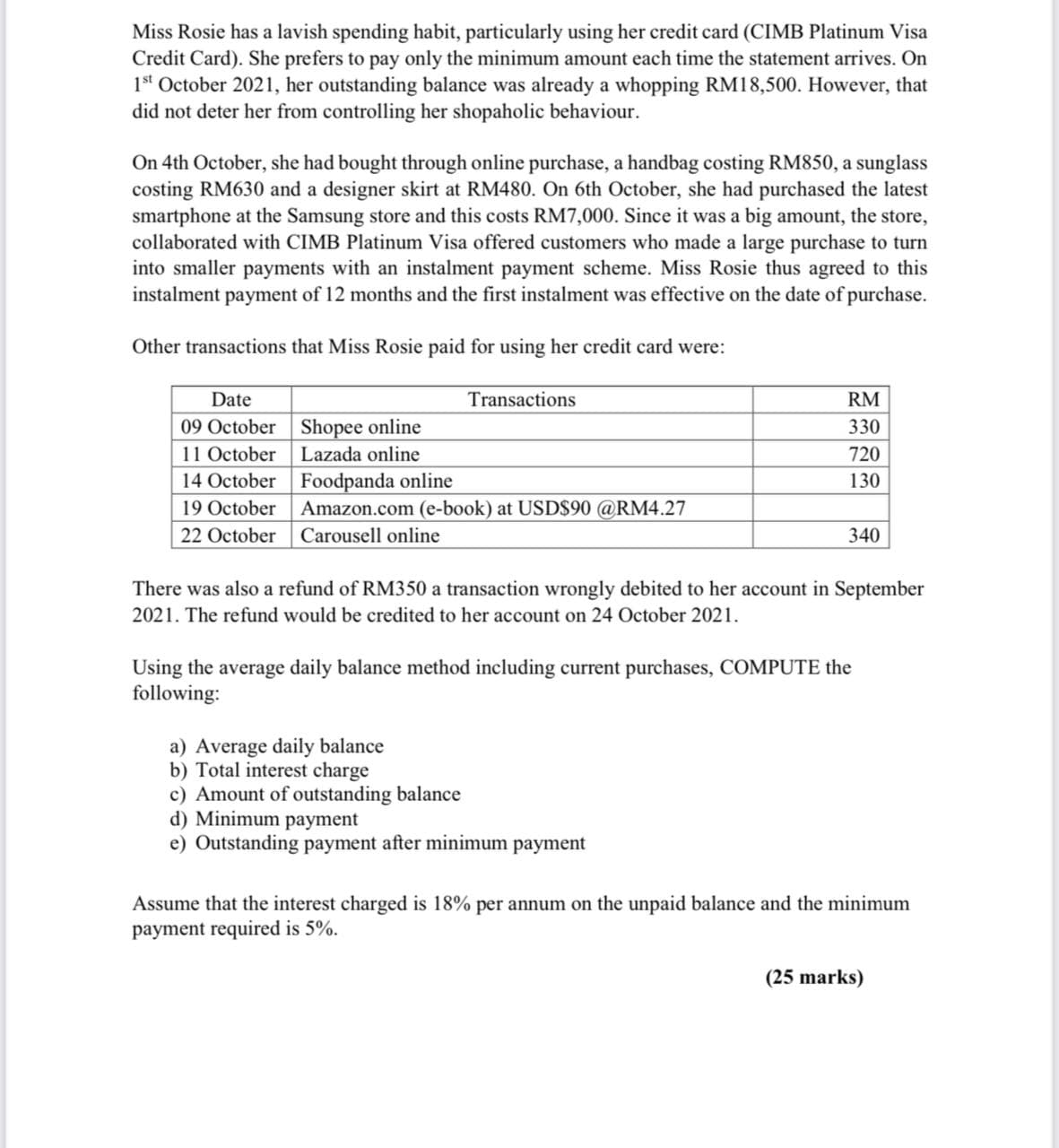

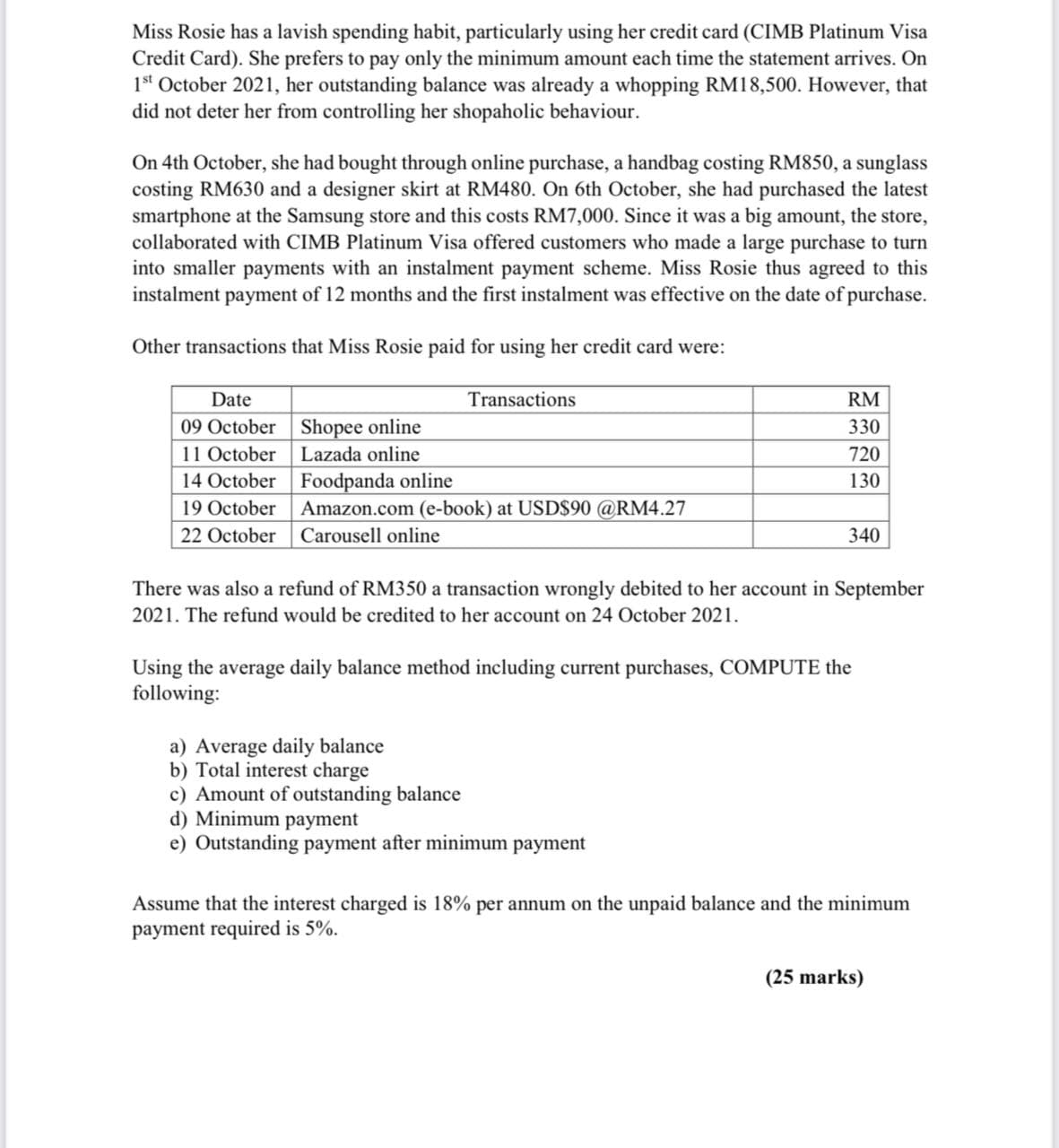

Miss Rosie has a lavish spending habit, particularly using her credit card (CIMB Platinum Visa Credit Card). She prefers to pay only the minimum amount each time the statement arrives. On 1st October 2021, her outstanding balance was already a whopping RM18,500. However, that did not deter her from controlling her shopaholic behaviour. On 4th October, she had bought through online purchase, a handbag costing RM850, a sunglass costing RM630 and a designer skirt at RM480. On 6th October, she had purchased the latest smartphone at the Samsung store and this costs RM7,000. Since it was a big amount, the store, collaborated with CIMB Platinum Visa offered customers who made a large purchase to turn into smaller payments with an instalment payment scheme. Miss Rosie thus agreed to this instalment payment of 12 months and the first instalment was effective on the date of purchase. Other transactions that Miss Rosie paid for using her credit card were: Date Transactions 09 October Shopee online 11 October Lazada online 14 October | Foodpanda online 19 October Amazon.com (e-book) at USD$90 @RM4.27 22 October Carousell online RM 330 720 130 340 There was also a refund of RM350 a transaction wrongly debited to her account in September 2021. The refund would be credited to her account on 24 October 2021. Using the average daily balance method including current purchases, COMPUTE the following: a) Average daily balance b) Total interest charge c) Amount of outstanding balance d) Minimum payment e) Outstanding payment after minimum payment Assume that the interest charged is 18% per annum on the unpaid balance and the minimum payment required is 5%. (25 marks) Miss Rosie has a lavish spending habit, particularly using her credit card (CIMB Platinum Visa Credit Card). She prefers to pay only the minimum amount each time the statement arrives. On 1st October 2021, her outstanding balance was already a whopping RM18,500. However, that did not deter her from controlling her shopaholic behaviour. On 4th October, she had bought through online purchase, a handbag costing RM850, a sunglass costing RM630 and a designer skirt at RM480. On 6th October, she had purchased the latest smartphone at the Samsung store and this costs RM7,000. Since it was a big amount, the store, collaborated with CIMB Platinum Visa offered customers who made a large purchase to turn into smaller payments with an instalment payment scheme. Miss Rosie thus agreed to this instalment payment of 12 months and the first instalment was effective on the date of purchase. Other transactions that Miss Rosie paid for using her credit card were: Date Transactions 09 October Shopee online 11 October Lazada online 14 October | Foodpanda online 19 October Amazon.com (e-book) at USD$90 @RM4.27 22 October Carousell online RM 330 720 130 340 There was also a refund of RM350 a transaction wrongly debited to her account in September 2021. The refund would be credited to her account on 24 October 2021. Using the average daily balance method including current purchases, COMPUTE the following: a) Average daily balance b) Total interest charge c) Amount of outstanding balance d) Minimum payment e) Outstanding payment after minimum payment Assume that the interest charged is 18% per annum on the unpaid balance and the minimum payment required is 5%. (25 marks)