Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Miss Rosie has a lavish spending habit, particularly using her credit card (CIMB Platinum Visa Credit Card). She prefers to pay only the minimum

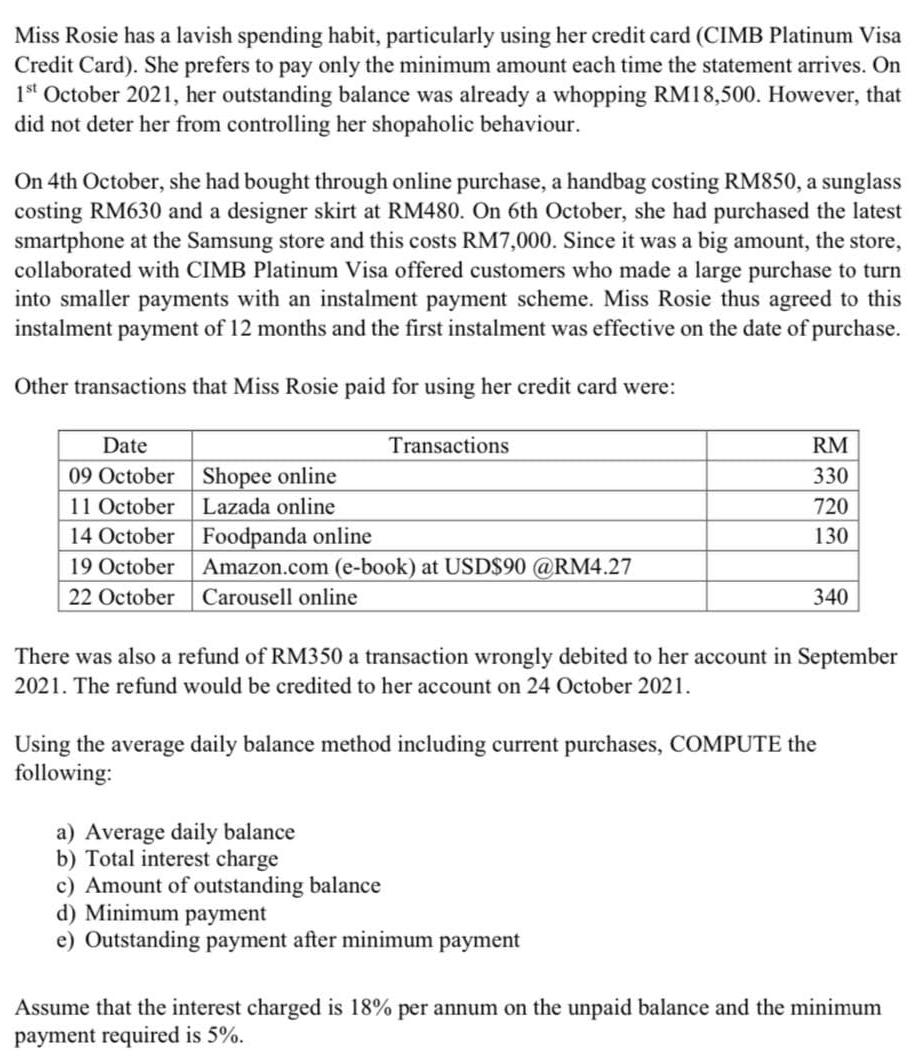

Miss Rosie has a lavish spending habit, particularly using her credit card (CIMB Platinum Visa Credit Card). She prefers to pay only the minimum amount each time the statement arrives. On 1st October 2021, her outstanding balance was already a whopping RM18,500. However, that did not deter her from controlling her shopaholic behaviour. On 4th October, she had bought through online purchase, a handbag costing RM850, a sunglass costing RM630 and a designer skirt at RM480. On 6th October, she had purchased the latest smartphone at the Samsung store and this costs RM7,000. Since it was a big amount, the store, collaborated with CIMB Platinum Visa offered customers who made a large purchase to turn into smaller payments with an instalment payment scheme. Miss Rosie thus agreed to this instalment payment of 12 months and the first instalment was effective on the date of purchase. Other transactions that Miss Rosie paid for using her credit card were: Date 09 October 11 October 14 October 19 October 22 October Shopee online Lazada online Transactions Foodpanda online Amazon.com (e-book) at USD$90 @RM4.27 Carousell online RM 330 720 130 340 There was also a refund of RM350 a transaction wrongly debited to her account in September 2021. The refund would be credited to her account on 24 October 2021. a) Average daily balance b) Total interest charge c) Amount of outstanding balance d) Minimum payment e) Outstanding payment after minimum payment Using the average daily balance method including current purchases, COMPUTE the following: Assume that the interest charged is 18% per annum on the unpaid balance and the minimum payment required is 5%.

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Date Transactions RM Daily Outstanding Balance 01102021 RM1850000 02102021 RM1850000 03102021 RM1850...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started