Answered step by step

Verified Expert Solution

Question

1 Approved Answer

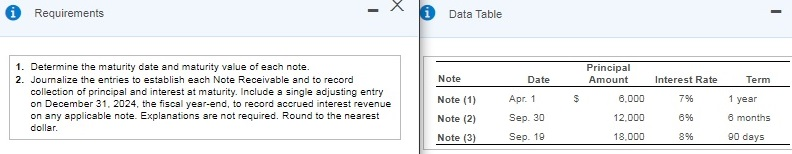

MISSING LAST ONE NOTE 3 THANKS - Requirements Data Table Note Date Principal Amount Interest Rate Term 1. Determine the maturity date and maturity value

MISSING LAST ONE NOTE 3

THANKS

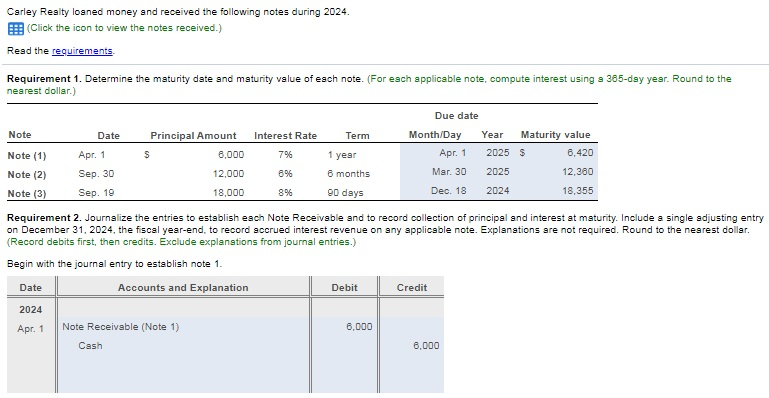

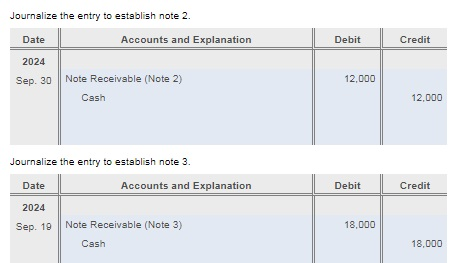

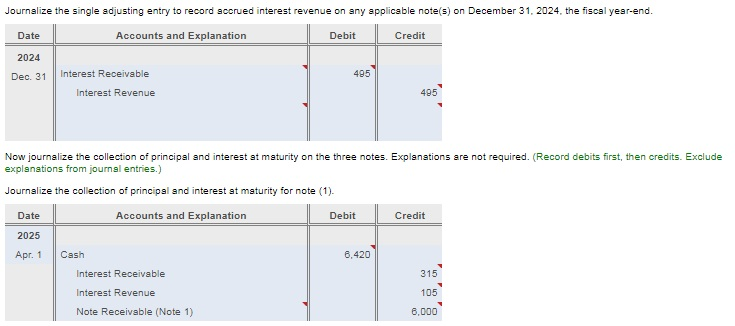

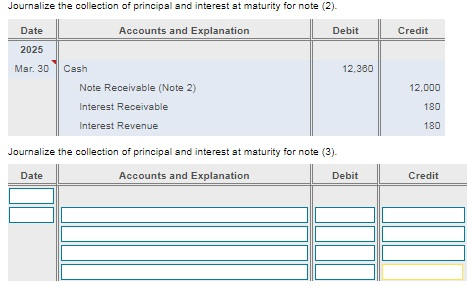

- Requirements Data Table Note Date Principal Amount Interest Rate Term 1. Determine the maturity date and maturity value of each note. 2. Journalize the entries to establish each Note Receivable and to record collection of principal and interest at maturity. Include a single adjusting entry on December 31, 2024, the fiscal year-end, to record accrued interest revenue on any applicable note. Explanations are not required. Round to the nearest dollar $ 6.000 796 1 year Note (1) Note (2) Note (3) Apr 1 Sep. 30 Sep. 19 12.000 696 6 months 18.000 896 90 days Carley Realty loaned money and received the following notes during 2024. Click the icon to view the notes received.) Read the requirements Requirement 1. Determine the maturity date and maturity value of each note. (For each applicable note, compute interest using a 365-day year. Round to the nearest dollar.) Note Date Principal Amount Term Interest Rate 7% s 6,000 Note (1) Note (2) Note (3) Apr. 1 Apr. 1 Sep. 30 Due date Month/Day Year Maturity value 2025 $ 6,420 Mar. 30 2025 12,360 Dec. 18 2024 18,355 8% 1 year 6 months 90 days 12,000 18,000 Sep. 19 8% Requirement 2. Journalize the entries to establish each Note Receivable and to record collection of principal and interest at maturity. Include a single adjusting entry on December 31, 2024, the fiscal year-end, to record accrued interest revenue on any applicable note. Explanations are not required. Round to the nearest dollar. (Record debits first, then credits. Exclude explanations from journal entries.) Begin with the journal entry to establish note 1. Date Accounts and Explanation Debit Credit 2024 Apr. 1 6,000 Note Receivable (Note 1) Cash 6.000 Journalize the entry to establish note 2. Date Accounts and Explanation Debit Credit 2024 Sep. 30 Note Receivable (Note 2) Cash 12.000 12.000 Journalize the entry to establish note 3. Date Accounts and Explanation Debit Credit 2024 Sep. 19 Note Receivable (Note 3) Cash 18.000 18.000 Journalize the single adjusting entry to record accrued interest revenue on any applicable note(s) on December 31, 2024. the fiscal year-end. Date Accounts and Explanation Debit Credit 2024 Dec. 31 495 Interest Receivable Interest Revenue 495 Now journalize the collection of principal and interest at maturity on the three notes. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries.) Journalize the collection of principal and interest at maturity for note (1). Date Accounts and Explanation Debit Credit 2025 Cash 6,420 Apr. 1 315 Interest Receivable Interest Revenue 105 Note Receivable (Note 1) 6.000 Journalize the collection of principal and interest at maturity for note (2). Accounts and Explanation Debit Credit Date 2025 Mar. 30 12,360 12.000 Cash Note Receivable (Note 2) Interest Receivable Interest Revenue 180 180 Journalize the collection of principal and interest at maturity for note (3). Date Accounts and Explanation Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started