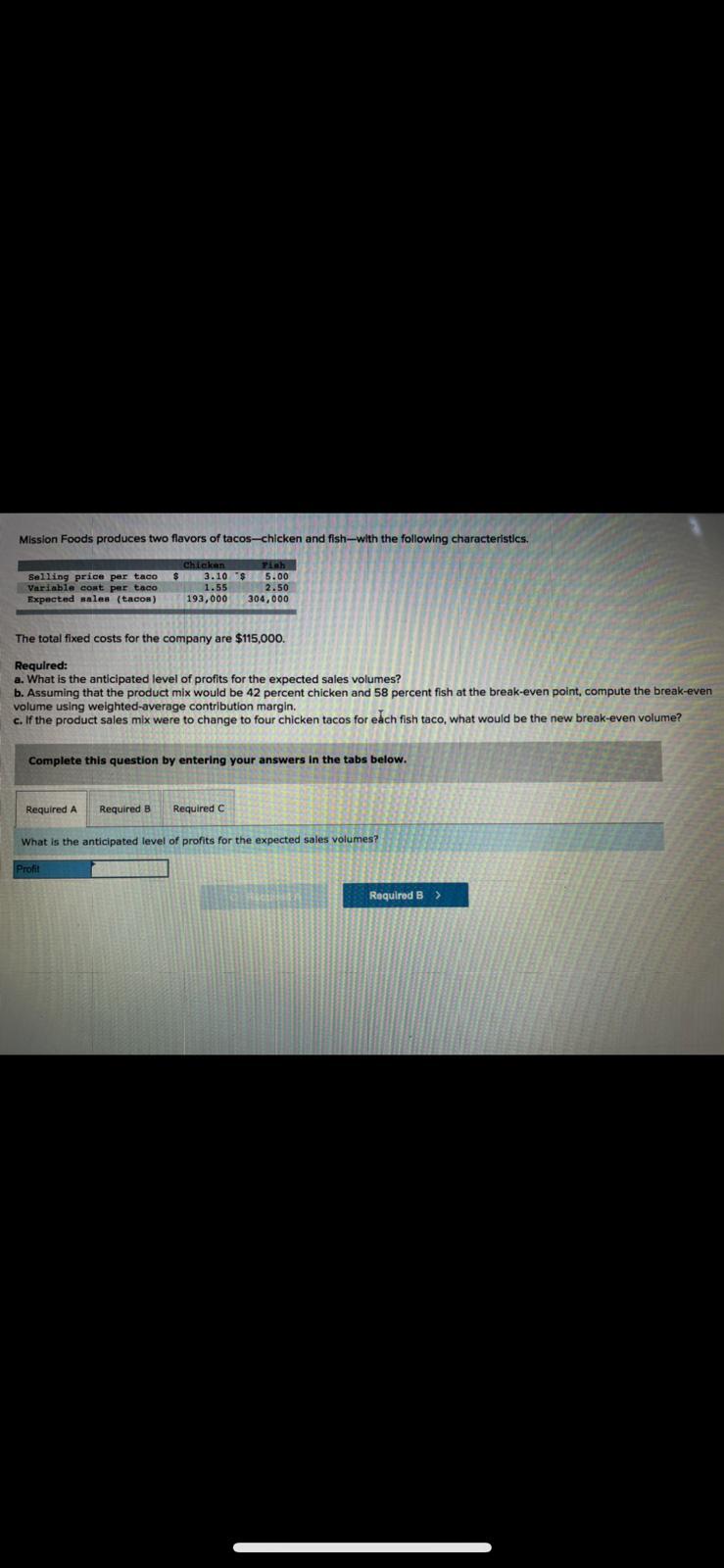

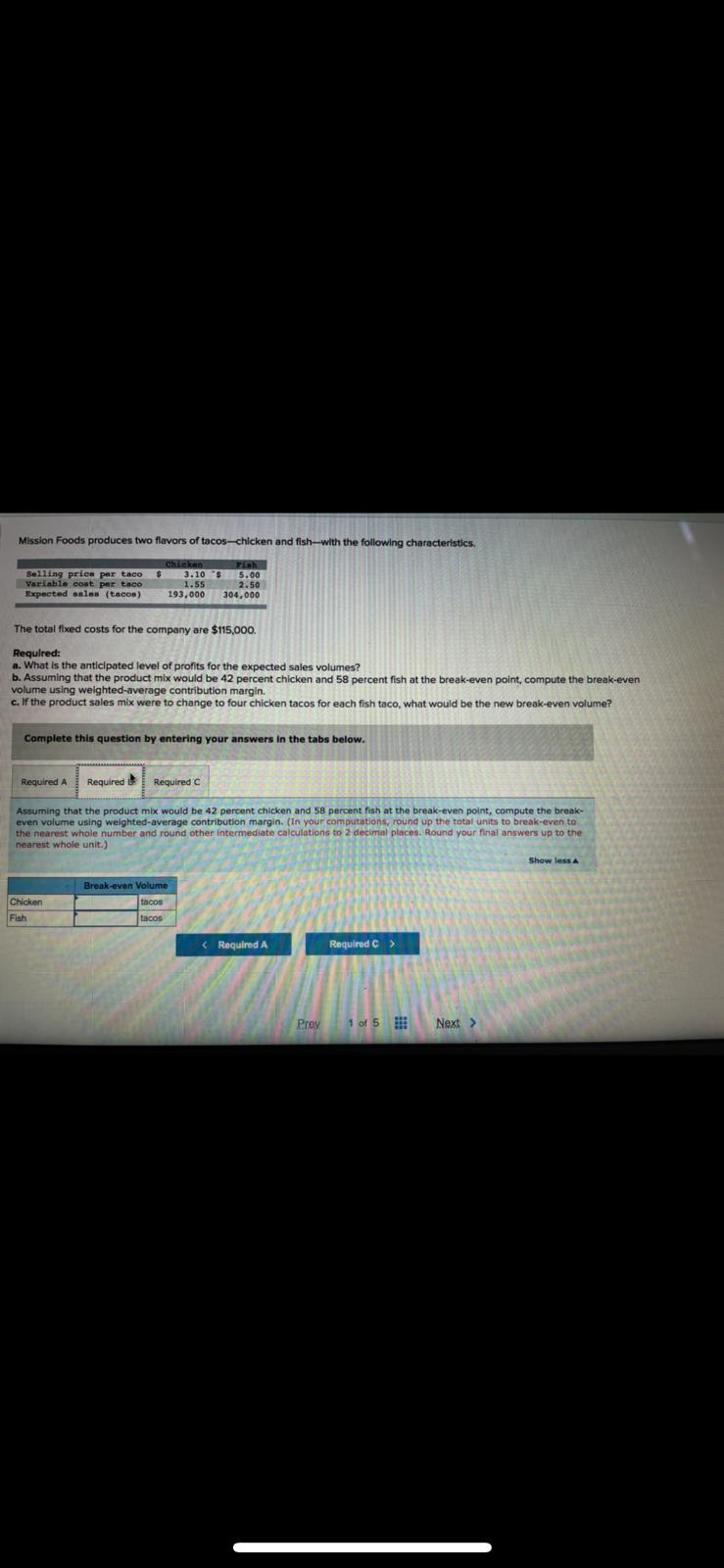

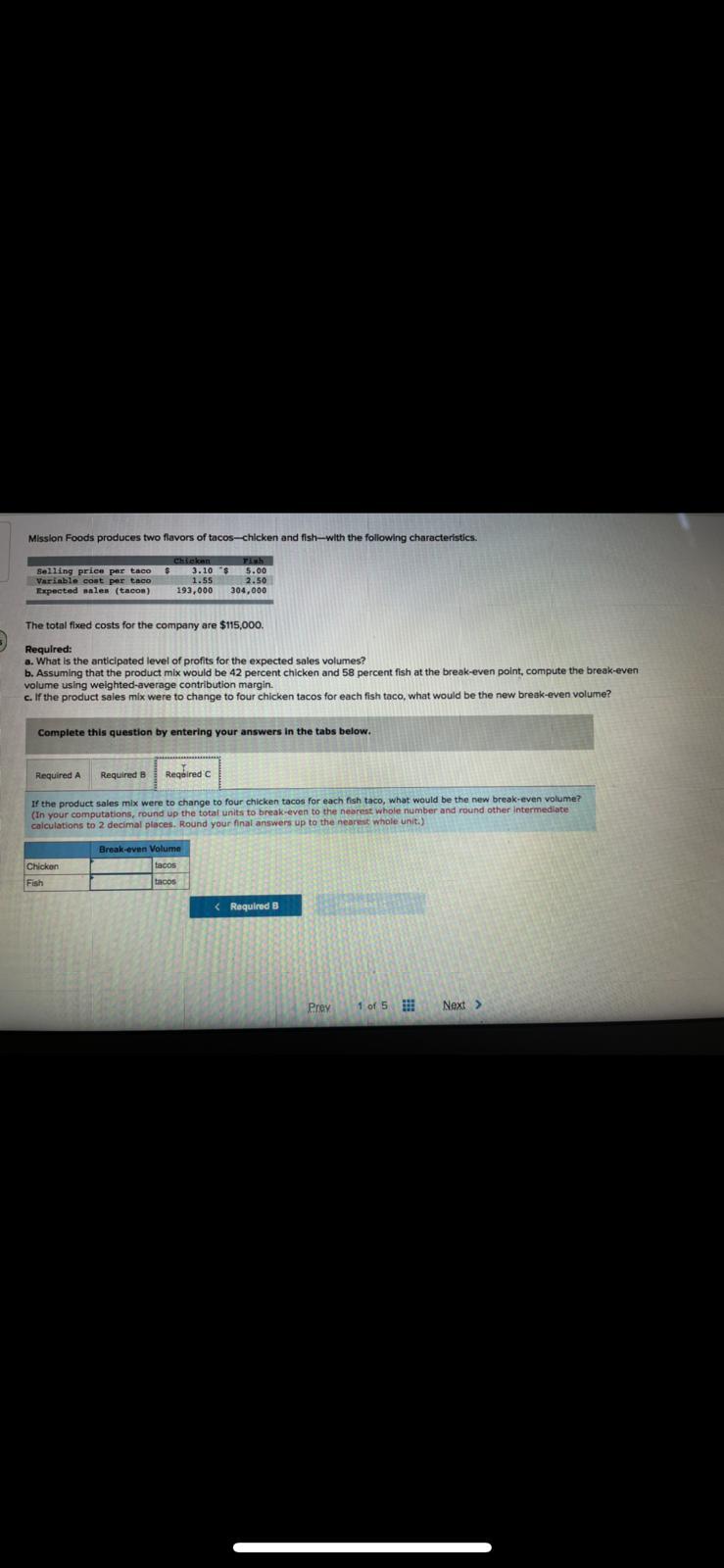

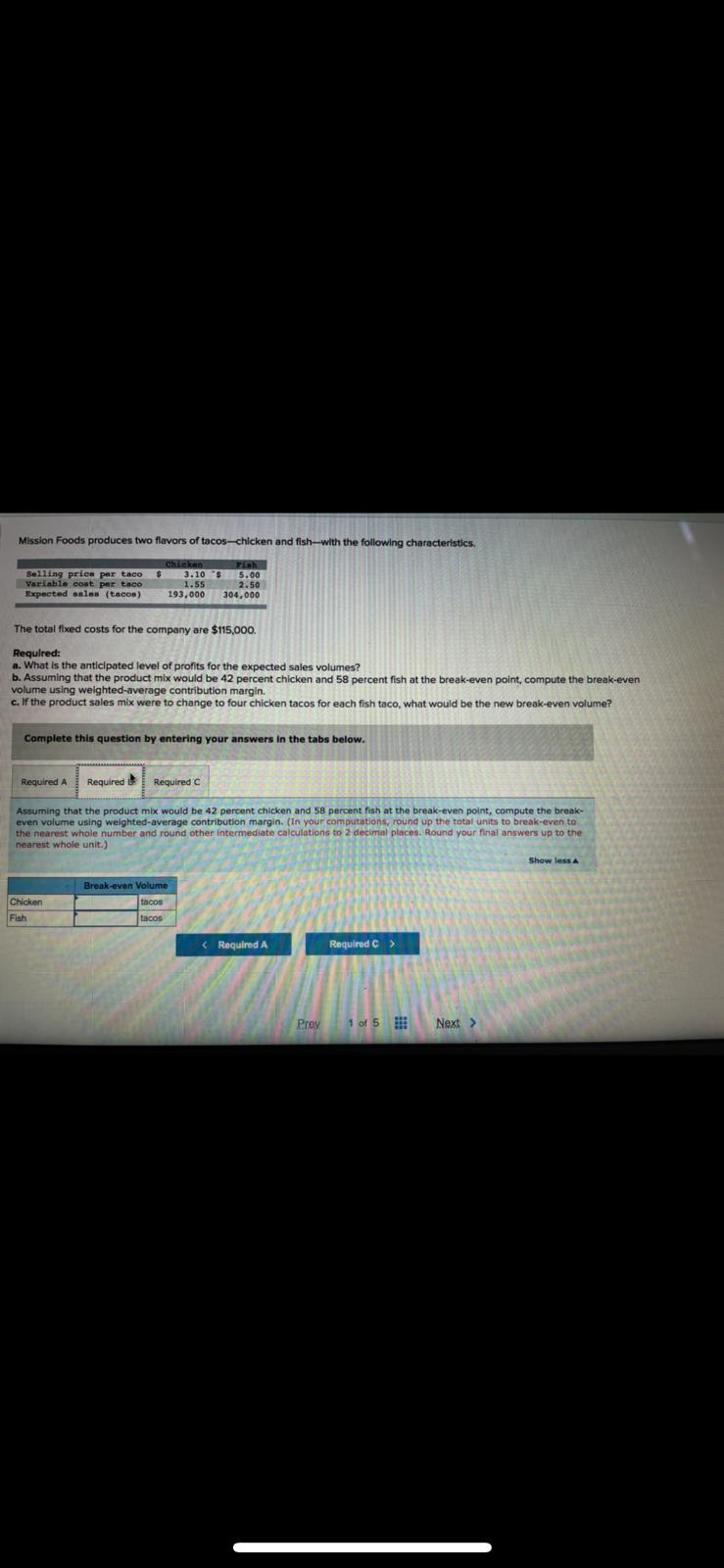

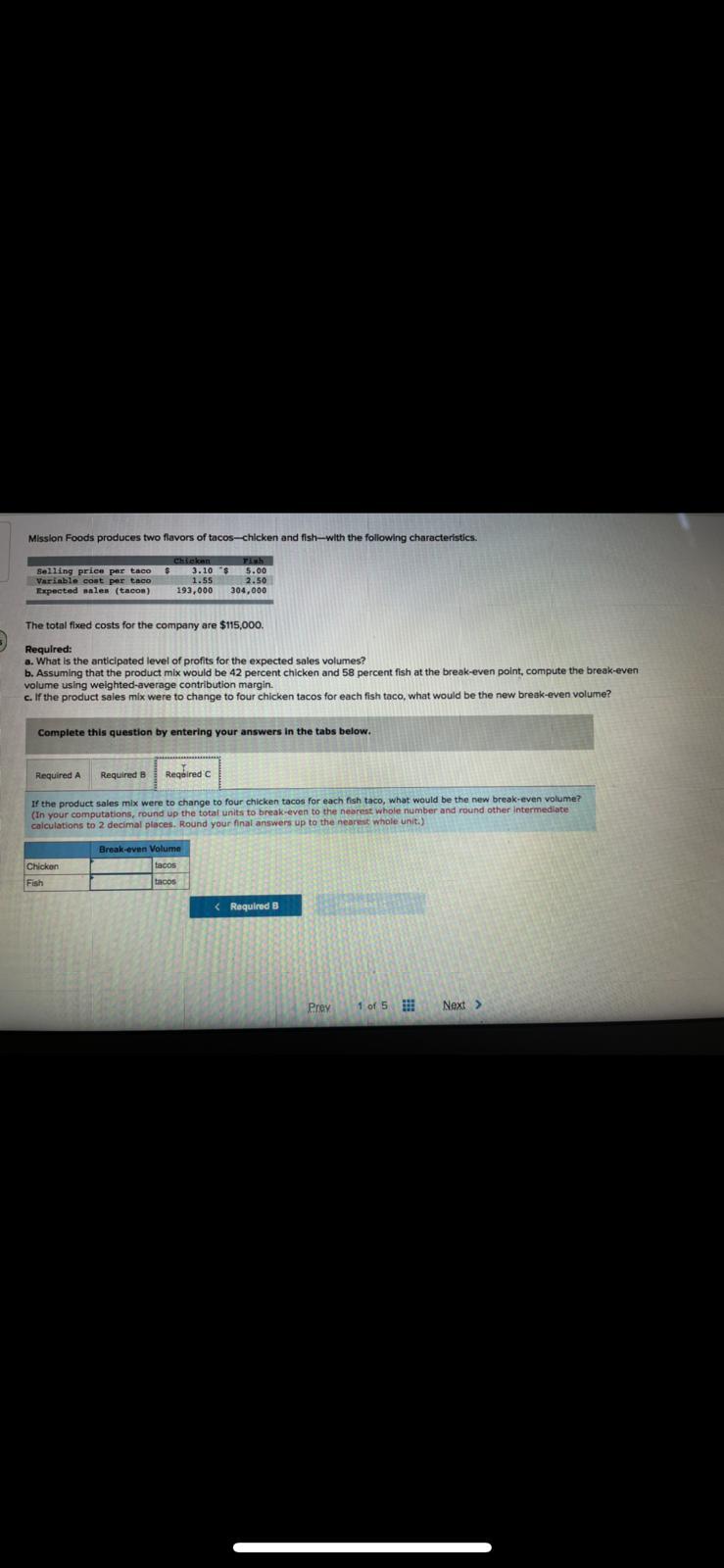

Mission Foods produces two flavors of tacos-chicken and fish-with the following characteristics. Chicken Pinh $ 3.10 $ 1.55 2.50 193,000 304,000 Selling price per taco Variable cost per taco Expected sales (tacow) 5.00 The total fixed costs for the company are $115,000. Required: a. What is the anticipated level of profits for the expected sales volumes? b. Assuming that the product mix would be 42 percent chicken and 58 percent fish at the break-even point, compute the break-even volume using weighted-average contribution margin. c. If the product sales mix were to change to four chicken tacos for each fish taco, what would be the new break-even volume? Complete this question by entering your answers in the tabs below. Required A Required B Required C What is the anticipated level of profits for the expected sales volumes? Profit Required B> Mission Foods produces two flavors of tacos-chicken and fish with the following characteristics. Chicken Enh Selling price per taco S 3.10S 5.00 Variable cont per taco 1.55 2.50 Expected anles (tacoa) 193,000 304,000 The total fixed costs for the company are $115,000. Required: a. What is the anticipated level of profits for the expected sales volumes? b. Assuming that the product mix would be 42 percent chicken and 58 percent fish at the break-even point, compute the break-even volume using weighted-average contribution margin. c. If the product sales mix were to change to four chicken tacos for each fish taco, what would be the new break-even volume? Complete this question by entering your answers in the tabs below. Required A Required Required c Assuming that the product mix would be 42 percent chicken and 58 percent fish at the break-even point, compute the break- even volume using weighted average contribution margin. (in your computations, round up the total units to break-even to the nearest whole number and round other intermediate calculations to 2 decimal places. Round your final answers up to the nearest whole unit.) Show less Chicken Break-even Volume tacos tacos Fish Prey 1 of 5 DI! Next > Mission Foods produces two flavors of tacos-chicken and fish with the following characteristics. chicken $ 3.10 S Selling price per taco Variable cont per taco Expected sales (tacon) 1.55 193,000 5.00 2.50 304,000 The total fixed costs for the company are $115,000. Required: a. What is the anticipated level of profits for the expected sales volumes? b. Assuming that the product mix would be 42 percent chicken and 58 percent fish at the break-even point, compute the break-even volume using weighted-average contribution margin c. If the product sales mix were to change to four chicken tacos for each fish taco, what would be the new break-even volume? Complete this question by entering your answers in the tabs below. Required A Required B Regaired If the product sales mix were to change to four chicken tacos for each fish taco, what would be the new break-even volume? (In your computations, round up the total units to break-even to the nearest whole number and round other intermediate calculations to 2 decimal places. Round your final answers up to the nearest whole unit.) Break-even Volume Chicken Fish