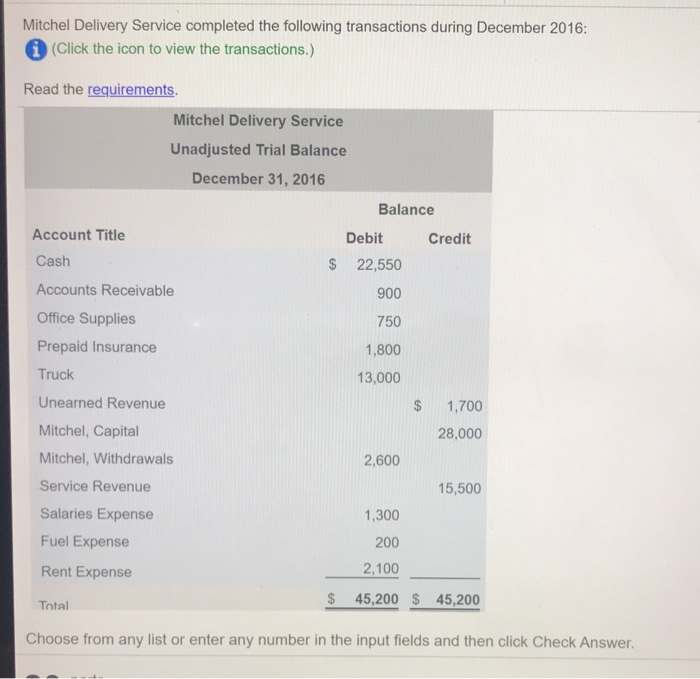

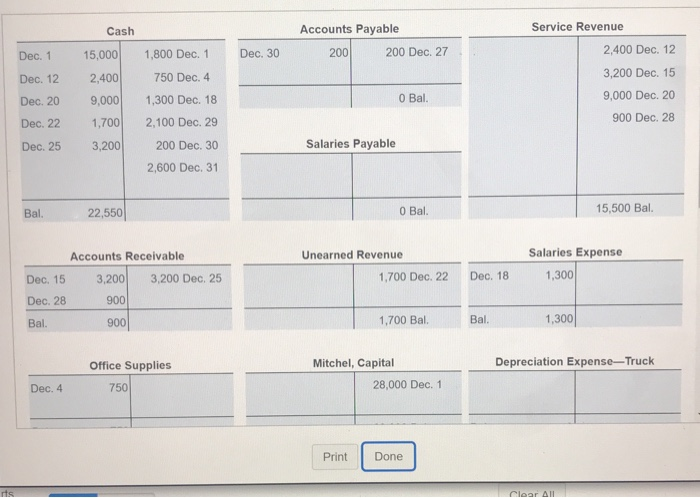

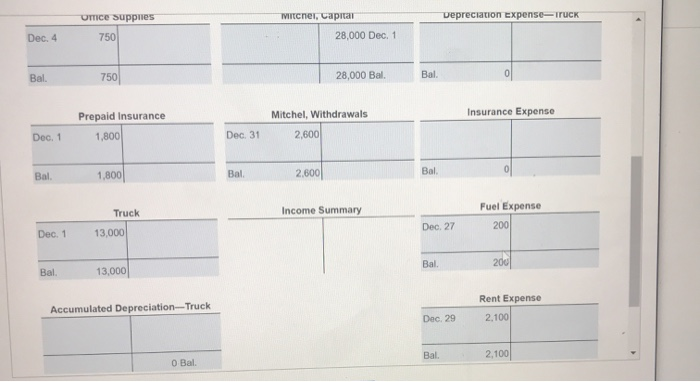

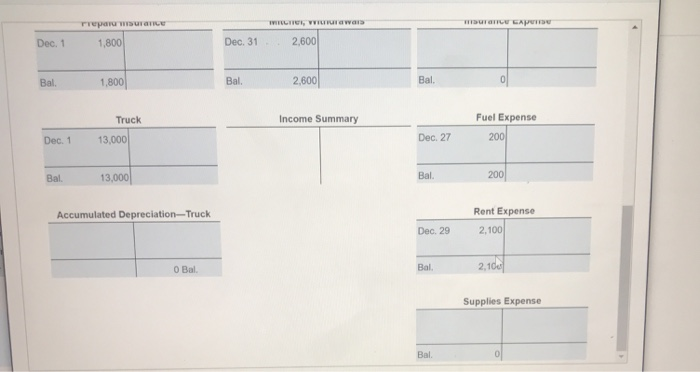

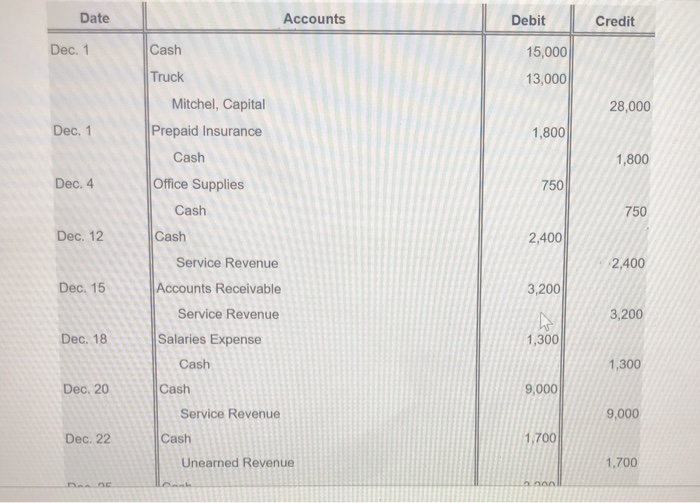

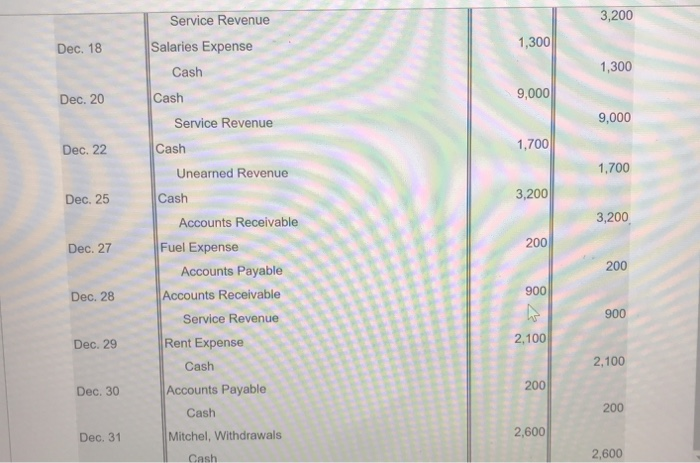

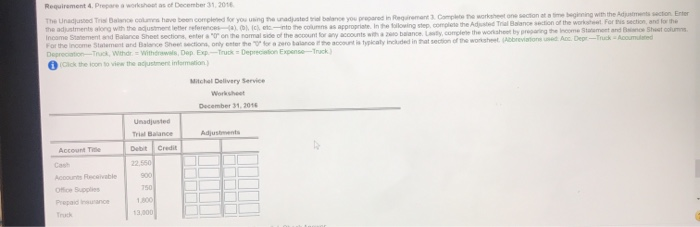

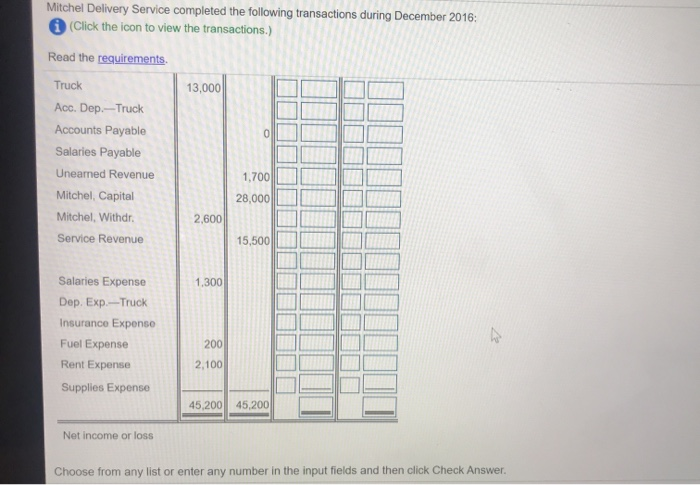

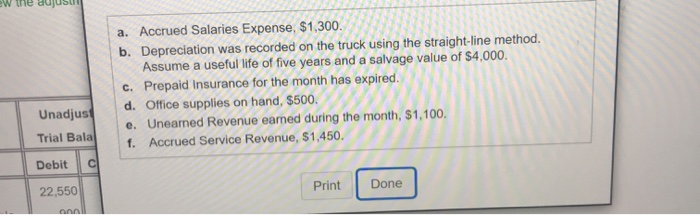

Mitchel Delivery Service completed the following transactions during December 2016: (Click the icon to view the transactions.) Read the requirements. Mitchel Delivery Service Unadjusted Trial Balance December 31, 2016 Balance Credit Account Title Cash Debit $ 22,550 900 750 1,800 13,000 $ Accounts Receivable Office Supplies Prepaid Insurance Truck Unearned Revenue Mitchel, Capital Mitchel, Withdrawals Service Revenue Salaries Expense Fuel Expense Rent Expense 1,700 28,000 2,600 15,500 1,300 200 2,100 $ 45,200 $ 45,200 Total Choose from any list or enter any number in the input fields and then click Check Answer. Cash Service Revenue Accounts Payable 200 200 Dec. 27 Dec. 1 1,800 Dec. 1 Dec. 30 15,000 2,400 9,000 Dec. 12 2,400 Dec. 12 3,200 Dec. 15 9,000 Dec. 20 750 Dec. 4 Dec. 20 O Bal. 1,300 Dec. 18 2,100 Dec. 29 900 Dec. 28 Dec. 22 1,700 Dec. 25 3,200 200 Dec. 30 Salaries Payable 2,600 Dec. 31 Bal. 22,550 O Bal. 15,500 Bal. Unearned Revenue Salaries Expense Accounts Receivable Dec. 15 3,200 3,200 Dec. 25 Dec. 28 900 1,700 Dec. 22 Dec. 18 1,300 Bal. 900 1,700 Bal. Bal. 1,300 Office Supplies Depreciation Expense-Truck Mitchel, Capital 28,000 Dec. 1 Dec. 4 750 Print Done rts. Clear All Depreciation Expense-Truck Unice Supplies 750 , 28,000 Dec. 1 Dec 4 Bal 750 28,000 Bal Bal. Insurance Expense Prepaid Insurance 1,800 Mitchel, Withdrawals 2,600 Dec. 1 Dec. 31 Bal 1,800 Bal Bal 2,600 Truck Income Summary Fuel Expense Dec. 27 200 Dec. 1 13,000 Bal 200 Bal 13,000 Rent Expense Accumulated Depreciation-Truck Dec. 29 2.100 Bal. 2,100 O Bal. Preparare muram EAT Dec. 1 1,800 Dec. 31 2,600 Bal 1.800 Bal 2,600 Bal. 0 Truck Income Summary Fuel Expense Dec. 1 13,000 Dec. 27 200 Bal 13,000 Bal. 200 Accumulated Depreciation-Truck Rent Expense 2.100 Dec. 29 O Bal Bal 2,106 Supplies Expense Bal Date Accounts Debit Credit Dec. 1 Cash 15,000 13,000 28,000 Dec. 1 1,800 1,800 Dec. 4 750 750 Dec. 12 Truck Mitchel, Capital Prepaid Insurance Cash Office Supplies Cash Cash Service Revenue Accounts Receivable Service Revenue Salaries Expense Cash Cash Service Revenue 2,400 2,400 Dec. 15 3,200 3,200 Dec, 18 1,300 1,300 Dec. 20 9,000 9,000 Dec. 22 Cash 1,700 Unearned Revenue 1,700 OR non 3,200 Dec. 18 1,300 1,300 Dec. 20 9,000 9,000 Dec. 22 1,700 1.700 Dec. 25 3,200 3,200 Service Revenue Salaries Expense Cash Cash Service Revenue Cash Unearned Revenue Cash Accounts Receivable Fuel Expense Accounts Payable Accounts Receivable Service Revenue Rent Expense Cash Accounts Payable Cash Mitchel, Withdrawals Dec. 27 200 200 900 Dec. 28 900 Dec. 29 2,100 2,100 200 Dec. 30 200 Dec. 2,600 Cash 2,600 Requirement 4. Prepare a worksheets of December 31, 2016 The Unded Trice chave been completed for you in the adjusted bance you reared in front Complete the worksheet one section time being with the Adjustment section Enter the adjustments along with the adusmenetter references into the columns as appropriate in the following te complete the Austria Balance section of the worst For section and for the Income Street and Balance Sheet sections, enterar on the normal side of the count for any accounts with a ban complete the worshot by preparing the income Statement and Shoot column For the income Statement and balance sheet sections only enter the former balance the costaty included in that section of the worst Abbreviation Act Depr ---Truck Accumulated Depreciation Truck Withdr = Withowels, DepExp. ---Truck Deprecation Expense--Truck) Click the boon to view the adjustment information Mitchel Delivery Service Worksheet December 31, 2016 Unadjusted Trial Balance Adjustment Account Tie Debit Credit 22.550 Accounts Receivable 900 Oto Solis 750 Presidence Truck Mitchel Delivery Service completed the following transactions during December 2016: (Click the icon to view the transactions.) Read the requirements Truck 13,000 Acc. Dep.---Truck Accounts Payable 0 Salaries Payable Uneamed Revenue 1,700 Mitchel, Capital 28,000 Mitchel, Withdr 2,600 Service Revenue 15,500 1.300 Salaries Expense Dep. Exp. --Truck Insurance Expense Fuel Expense Rent Expense Supplies Expense 200 2,100 45,200 45,200 Net income or loss Choose from any list or enter any number in the input fields and then click Check Answer. ew the a. Accrued Salaries Expense, $1,300. b. Depreciation was recorded on the truck using the straight-line method. Assume a useful life of five years and a salvage value of $4,000. c. Prepaid Insurance for the month has expired. d. Office supplies on hand, $500. e. Uneared Revenue earned during the month, $1,100. 1. Accrued Service Revenue, $1,450. Unadjust Trial Bala Debit C 22,550 Print Done