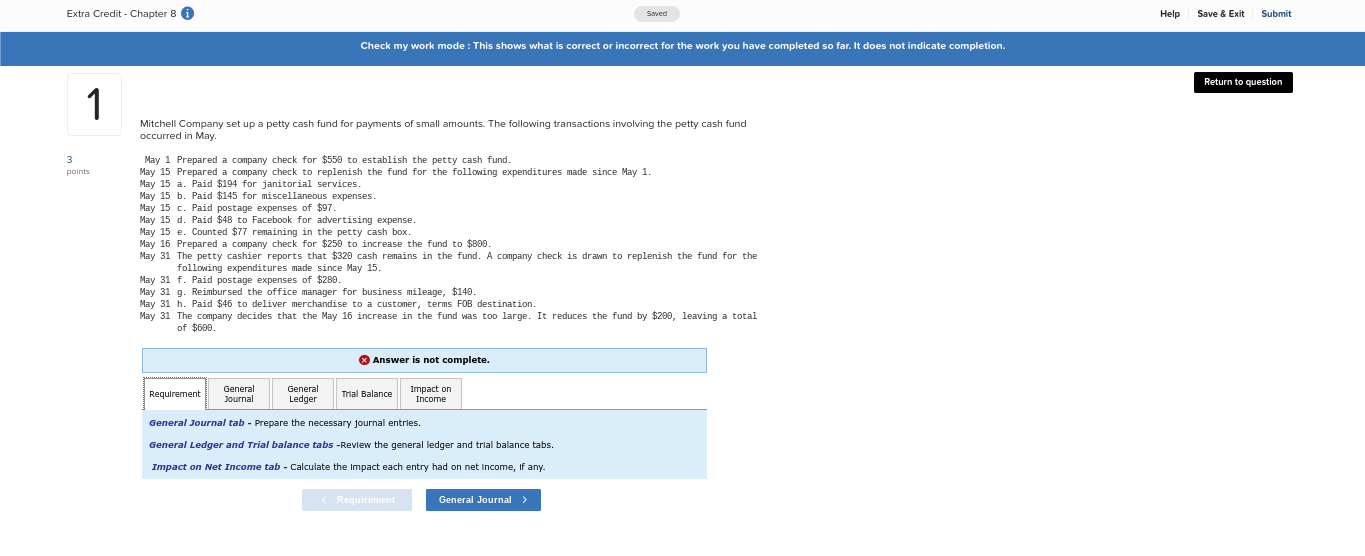

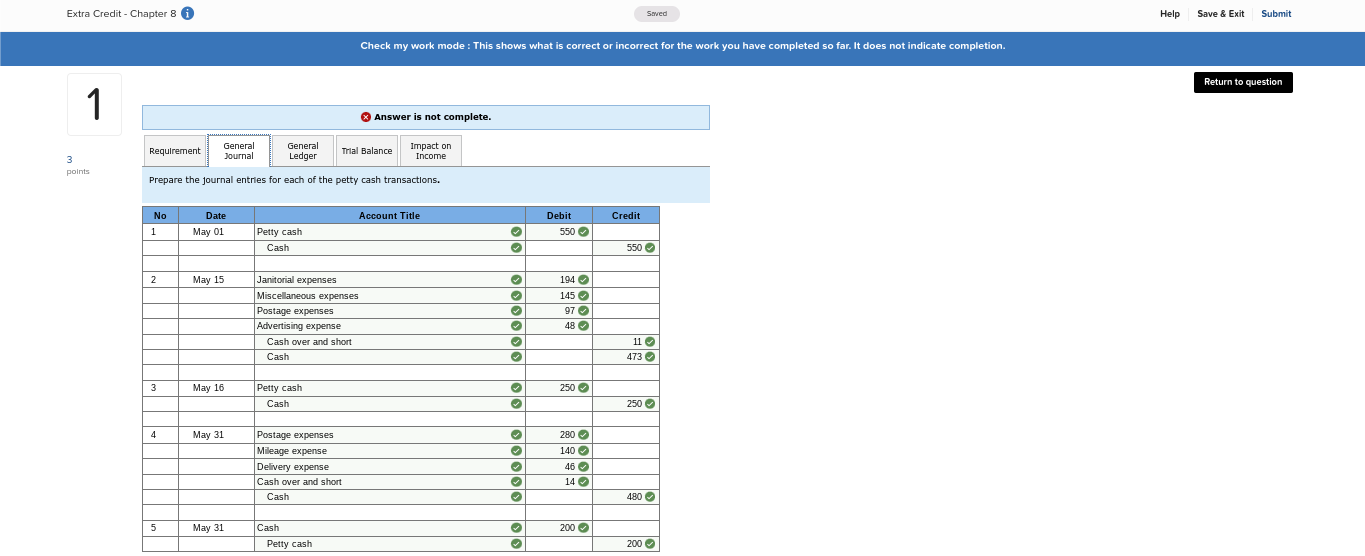

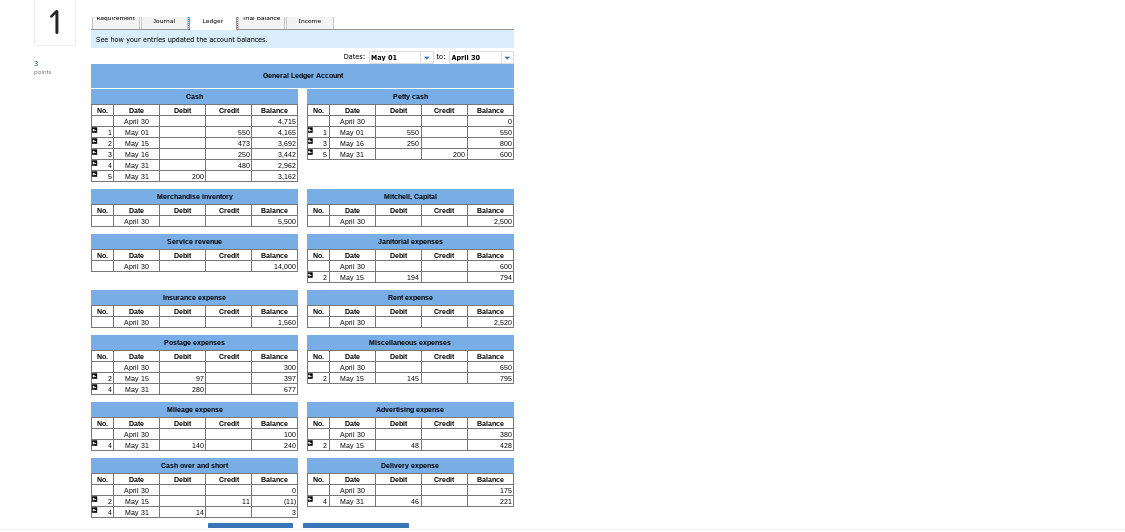

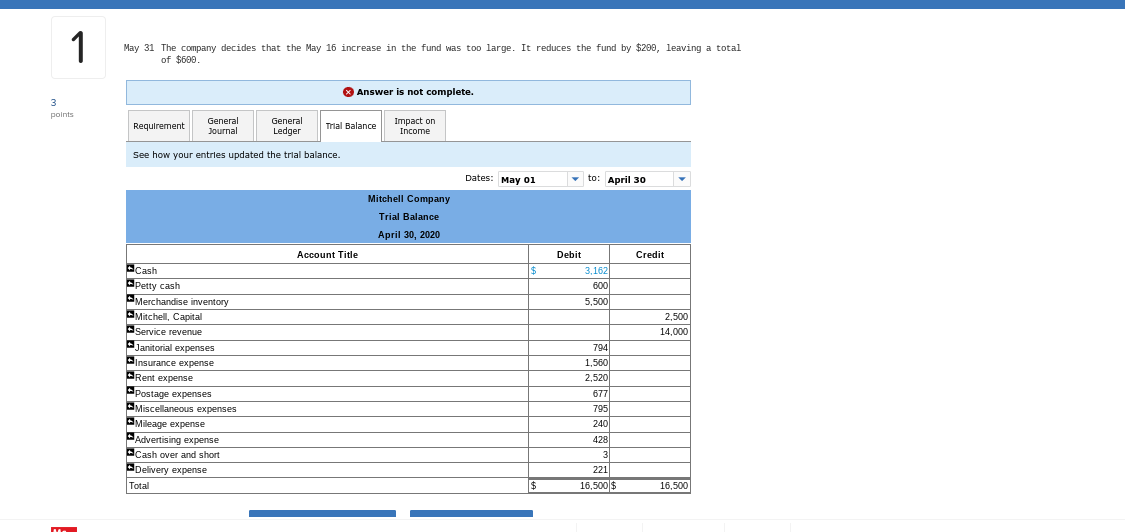

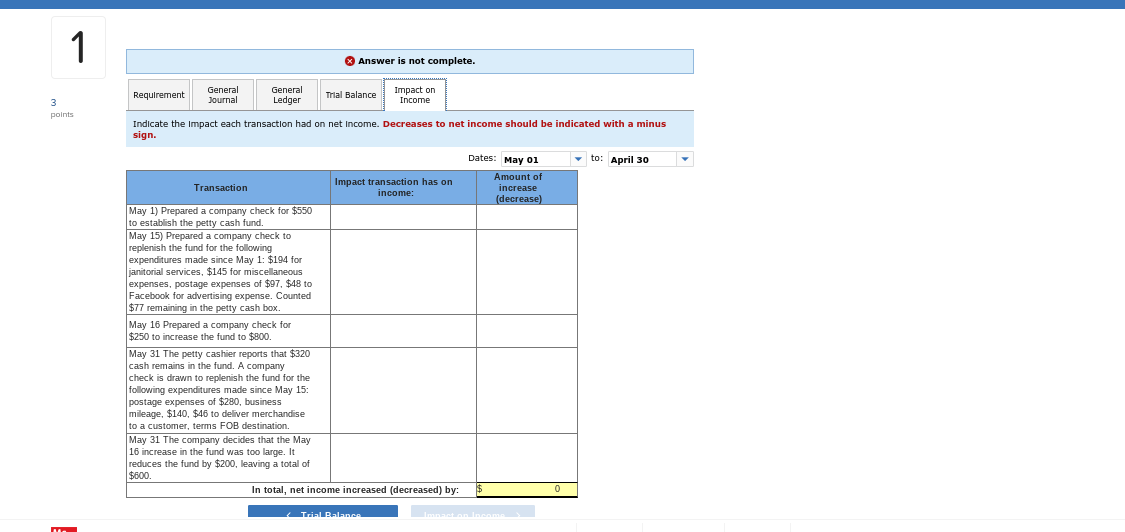

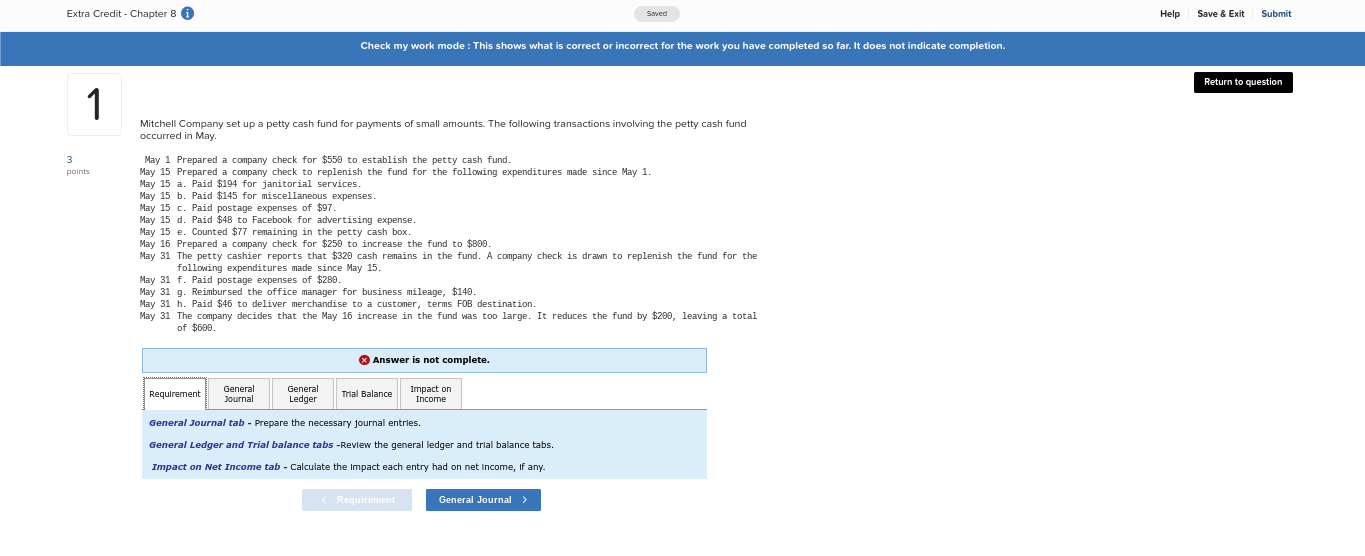

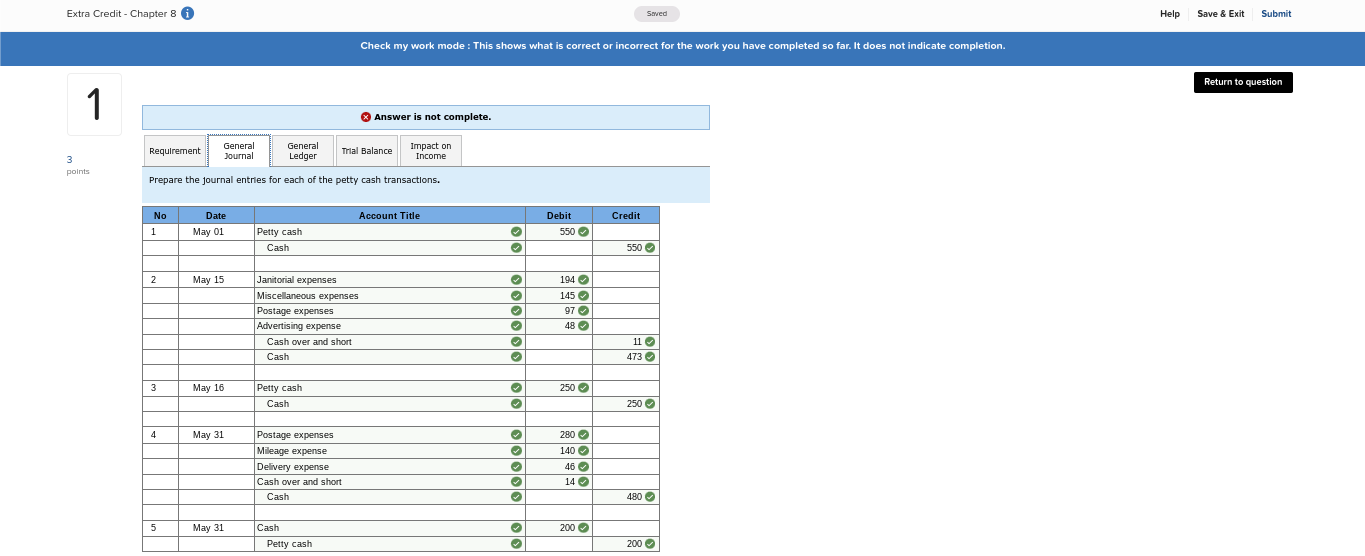

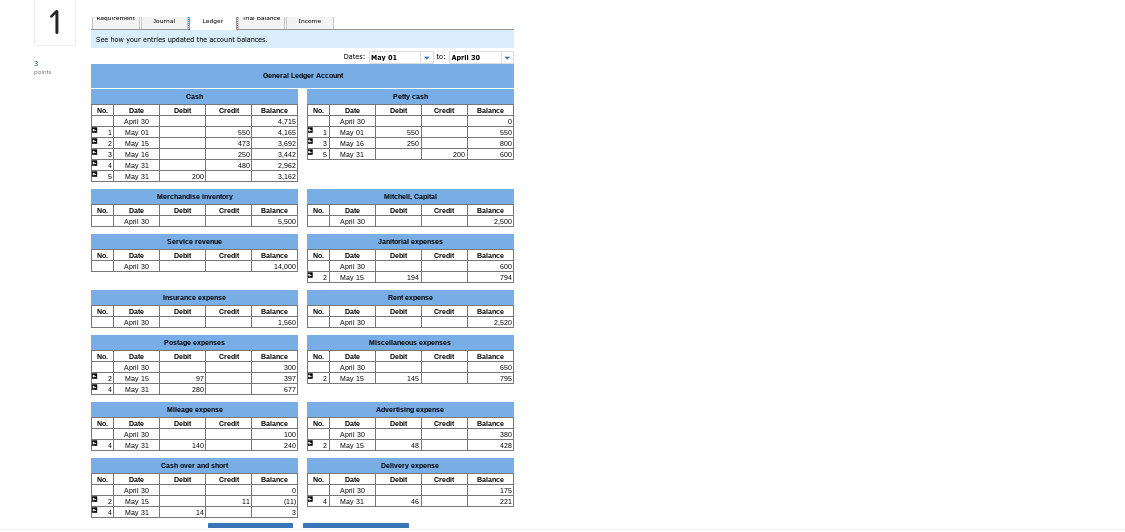

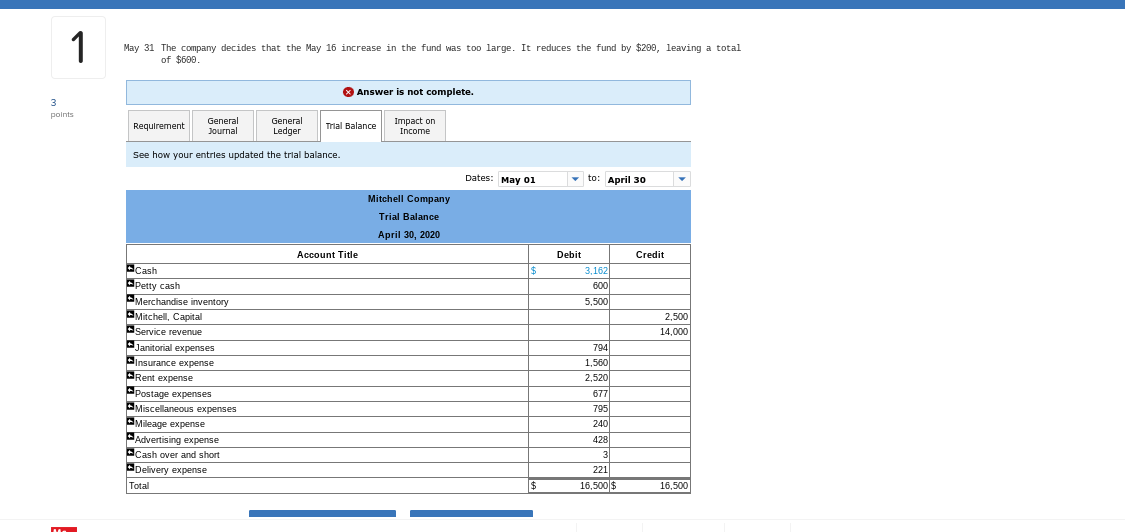

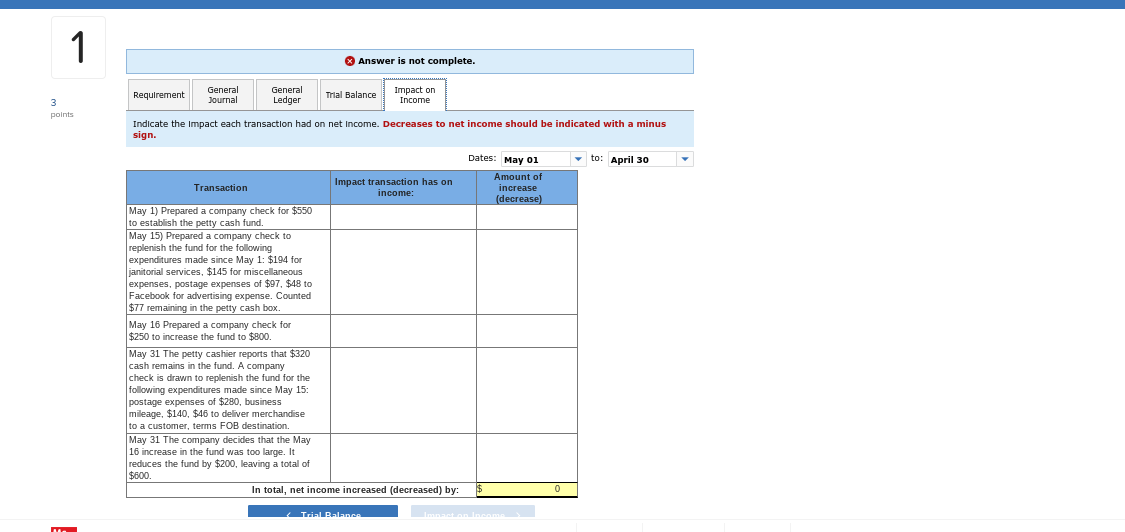

Mitchell Company set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May. May 1 Prepared a company check for $550 to establish the petty cash fund. May 15 Prepared a company check to replenish the fund for the following expenditures made since May 1. May 15 a. Paid $194 for janitorial services. May 15 b. Paid $145 for miscellaneds expenses. May 15 c. Paid postage expenses of $97. May 15 d. Paid $4B to Facebook for advertising expense. May 15 e. Counted $77 remaining in the petty cash box. May 16 Prepared a company check for $250 to increase the fund to $B. May 31 The petty cashier reports that $320 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15. May 31f. Paid postage expenses of $2BO. May 31 g. Reimbursed the office manager for business mileage, $140. May 31 h. Paid $46 to deliver merchandise to a customer, terms FOB destination. May 31 The company decides that the May 16 increase in the fund was too large. It reduces the fund by $200, leaving a total of $600. x) Answer is not complete. General Journal tab - Prepare the necessary journal entrles. General Ledger and Trial balance tabs -Review the general ledger and trial balance tabs. Impact on Net Income tab - Calculate the Impact each entry had on net Income, If any. Prepare the journal entries for each of the petty cash transactions. 1 May 31 The company decides that the May 16 increase in the fund was too large. It reduces the fund by $200, leaving a total of $60. Answer is not complete. See how your entrles updated the trial balance. x Answer is not complete. Indicate the Impact each transaction had on net Income. Decreases to net income should be indicated with a minus sign. Mitchell Company set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May. May 1 Prepared a company check for $550 to establish the petty cash fund. May 15 Prepared a company check to replenish the fund for the following expenditures made since May 1. May 15 a. Paid $194 for janitorial services. May 15 b. Paid $145 for miscellaneds expenses. May 15 c. Paid postage expenses of $97. May 15 d. Paid $4B to Facebook for advertising expense. May 15 e. Counted $77 remaining in the petty cash box. May 16 Prepared a company check for $250 to increase the fund to $B. May 31 The petty cashier reports that $320 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15. May 31f. Paid postage expenses of $2BO. May 31 g. Reimbursed the office manager for business mileage, $140. May 31 h. Paid $46 to deliver merchandise to a customer, terms FOB destination. May 31 The company decides that the May 16 increase in the fund was too large. It reduces the fund by $200, leaving a total of $600. x) Answer is not complete. General Journal tab - Prepare the necessary journal entrles. General Ledger and Trial balance tabs -Review the general ledger and trial balance tabs. Impact on Net Income tab - Calculate the Impact each entry had on net Income, If any. Prepare the journal entries for each of the petty cash transactions. 1 May 31 The company decides that the May 16 increase in the fund was too large. It reduces the fund by $200, leaving a total of $60. Answer is not complete. See how your entrles updated the trial balance. x Answer is not complete. Indicate the Impact each transaction had on net Income. Decreases to net income should be indicated with a minus sign