Answered step by step

Verified Expert Solution

Question

1 Approved Answer

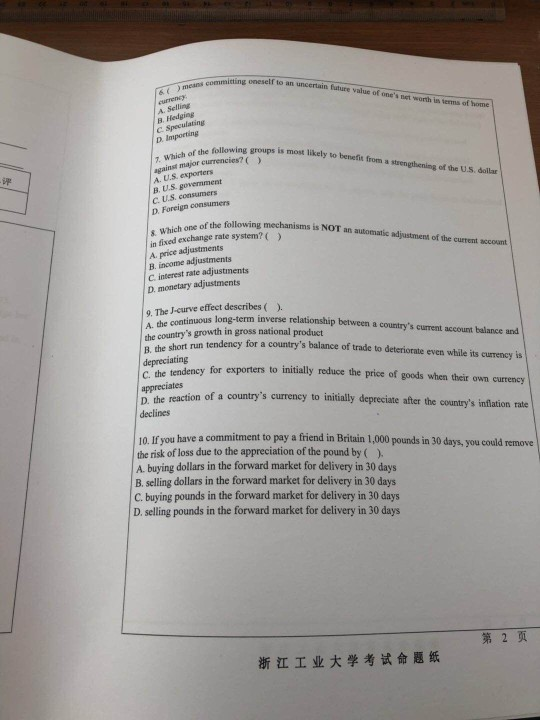

miting oneself to an uncertain fature value of one's out worth ia terms of horme A. Selling B. Hedging C Speculating D. ollowing groups is

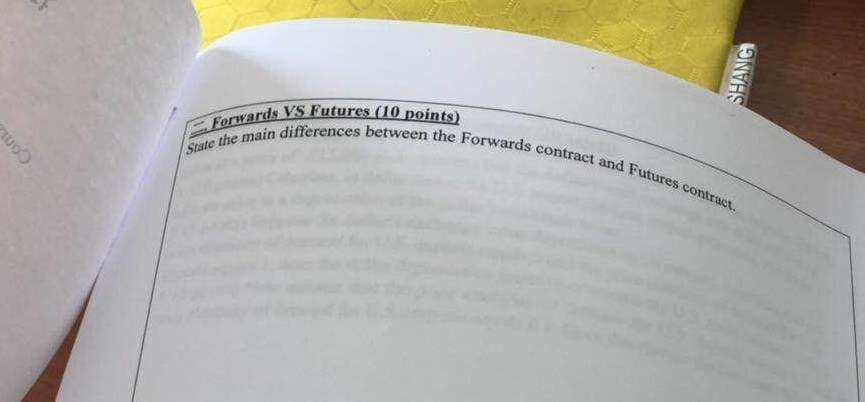

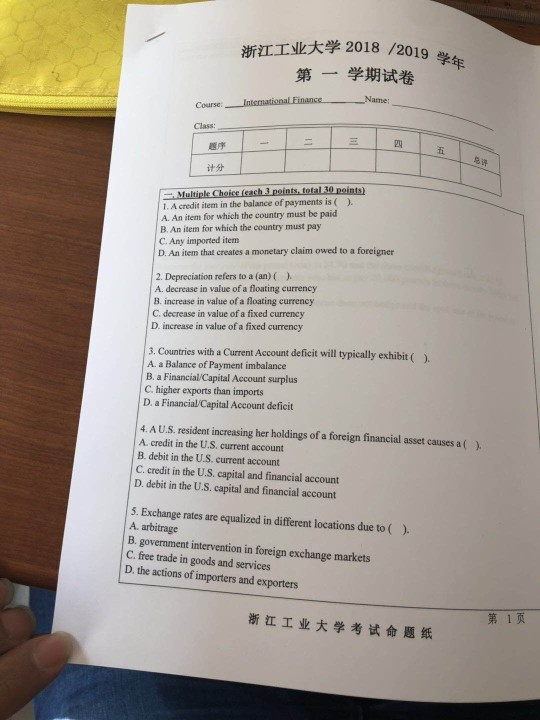

miting oneself to an uncertain fature value of one's out worth ia terms of horme A. Selling B. Hedging C Speculating D. ollowing groups is most likely to benefit from a 7. Which of the against major currencies? ( from a strengthening of the U.S. dollar A. U.S, exporters B. U.S. govermment C. U.S. consumers D. Foreign consumers f the following mechanisms is NOT an automatic adjutment of the current secount in fixed exchange rate system?( ) A. price adjustments B. inoome adjustments C. interest rate adjustments D. monetary adjustments 9. The J-curve effect describes () A. the continuous the country's growth in gross national product B, the shor depreciating C. the tendency appreciates long-term inverse relationship between a country's current account balance and t run tendency for a country's balance of trade to deteriorate even while its currency is for exporters to initially reduce the price of goods when their own currency the continuous D. the reaction of a country's currency to initially depreciate after the declines n rate 0 If you have a commitment to pay a friend in Britain 1,000 pounds in 30 days, you could remove the risk of loss due to the appreciation of the pound by () A. buying dollars in the forward market for delivery in 30 days B. selling dollars in the forward market for delivery in 30 days C. buying pounds in the forward market for delivery in 30 days D. selling pounds in the forward market for delivery in 30 days 2 0 Forwards VS Futures the Forwards contract and Fu ain differences between the Forwards 2018 /2013 Course: Class: its+ I. A credit item in the balance of payments is ( ). A. An item for which the country must be paid B. An item for which the country must pay C. Any imported item r oper 2. Depreciation refers to a (an) () A. decrease in value of a floating currency B. increase in value of a floating currency C. decrease in value of a fixed currency D. increase in value of a fixed currency 3. Countries with a Current Account deficit will typically exhibit () A. a Balance of Payment imbalance B. a Financial/Capital Account surplus C. higher exports than imports D. a Financial/Capital Account deficit 4, A U.S. resident increasing her holdings of a foreign financial asset causes a ( A. credit in the U.S. current account B. debit in the U.S. current account C. credit in the U.S. capital and financial account D. debit in the U.S. capital and financial account ). 5. Exchange rates are equalized in different locations due to () A. arbitrage B. government intervention in foreign exchange markets C. free trade in goods and services D, the actions of importers and exporters 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started